Neiman Marcus 2005 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2005 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

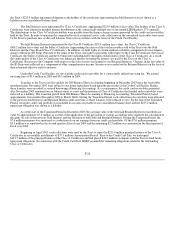

the Trust's $225.0 million repayment obligation to the holders of the certificates representing the Sold Interests was not shown as a

liability on our consolidated balance sheet.

The Sold Interests were represented by Class A Certificates, aggregating $225.0 million at face value. The holders of the Class A

Certificates were entitled to monthly interest distributions at the contractually-defined rate of one month LIBOR plus 0.27% annually.

The distributions to the Class A Certificate holders were payable from the finance charge income generated by the credit card receivables

held by the Trust. In order to maintain the committed level of securitized assets, cash collections on the securitized receivables were used

by the Trust to purchase new credit card balances from us in accordance with the terms of the Credit Card Facility.

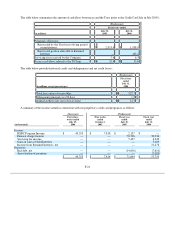

We held Retained Interests represented by the Class B Certificate ($23.8 million face value), the Class C Certificate

($68.2 million face value) and the Seller's Certificate (representing the excess of the total receivables sold to the Trust over the Sold

Interests and the Class B and Class C Certificates). In addition, we held rights to certain residual cash flows comprised of excess finance

charge collections (IO Strip). Pursuant to the terms of the Trust, our rights to payments with respect to the Class B Certificate, the Class C

Certificate, the Seller's Certificate and the IO Strip were subordinated to the rights of the holders of the Class A Certificates. As a result,

the credit quality of the Class A Certificates was enhanced, thereby lowering the interest cost paid by the Trust on the Class A

Certificates. Recourse to the Company with respect to the sale of assets was limited to our Retained Interests. Changes in the fair value of

the IO Strip were reflected as a component of other comprehensive income. Income was recorded on the Retained Interests on the basis of

their estimated effective yield to maturity.

Under the Credit Card Facility, we serviced the credit card receivables for a contractually defined servicing fee. We earned

servicing fees of $5.4 million in 2005 and $6.3 million in 2004.

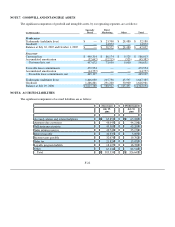

Transfers to the Trust ceased to qualify for Off-Balance Sheet Accounting beginning in December 2003 since the receivables

transferred after November 2003 were subject to our future repurchase based upon the provisions of the Credit Card Facility. Rather,

these transfers were recorded as secured borrowings (Financing Accounting). As a consequence, the credit card receivables generated

after November 2003 remained on our balance sheet as assets and the portions of Class A Certificates that funded such receivables were

reflected as a liability. The transition period from Off-Balance Sheet Accounting to Financing Accounting (Transition Period) lasted

approximately four months (December 2003 to March 2004). During the Transition Period, cash collections of receivables were allocated

to the previous Sold Interests and Retained Interests until such time as those balances were reduced to zero. By the end of the Transition

Period, our entire credit card portfolio was included in accounts receivable in our consolidated balance sheet and the $225.0 million

repayment obligation was shown as a liability.

As of the start of the Transition Period in December 2003, the carrying value of the Sold and Retained Interests exceeded face

value by approximately $7.6 million as a result of the application of the provisions of current accounting rules related to the calculation of

the gains on sale of the previous Sold Interests and the valuation of both Sold and Retained Interests. During the Transition Period, the

$7.6 million premium was amortized as a reduction of our net earnings from our credit card portfolio. Of the $7.6 million premium,

$5.3 million was amortized in the second quarter of fiscal year 2004 and the remaining $2.3 million was amortized in the third quarter of

fiscal year 2004.

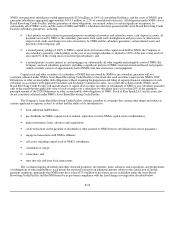

Beginning in April 2005, cash collections were used by the Trust to repay the $225.0 million principal balance of the Class A

Certificates in six monthly installments of $37.5 million (Amortization Period). Prior to the Credit Card Sale, we had repaid

$112.5 million of the principal balance of the Class A Certificates and had placed $40.7 million on deposit with the Trust to fund future

repayment obligations. In connection with the Credit Card Sale, HSBC assumed the remaining obligations related to the outstanding

Class A Certificates.

F-20