Neiman Marcus 2005 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2005 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

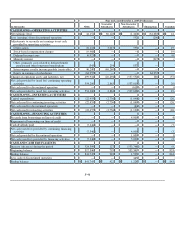

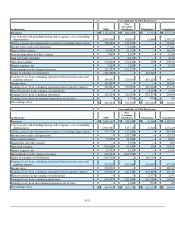

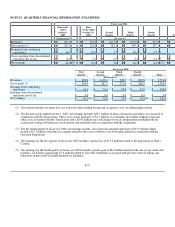

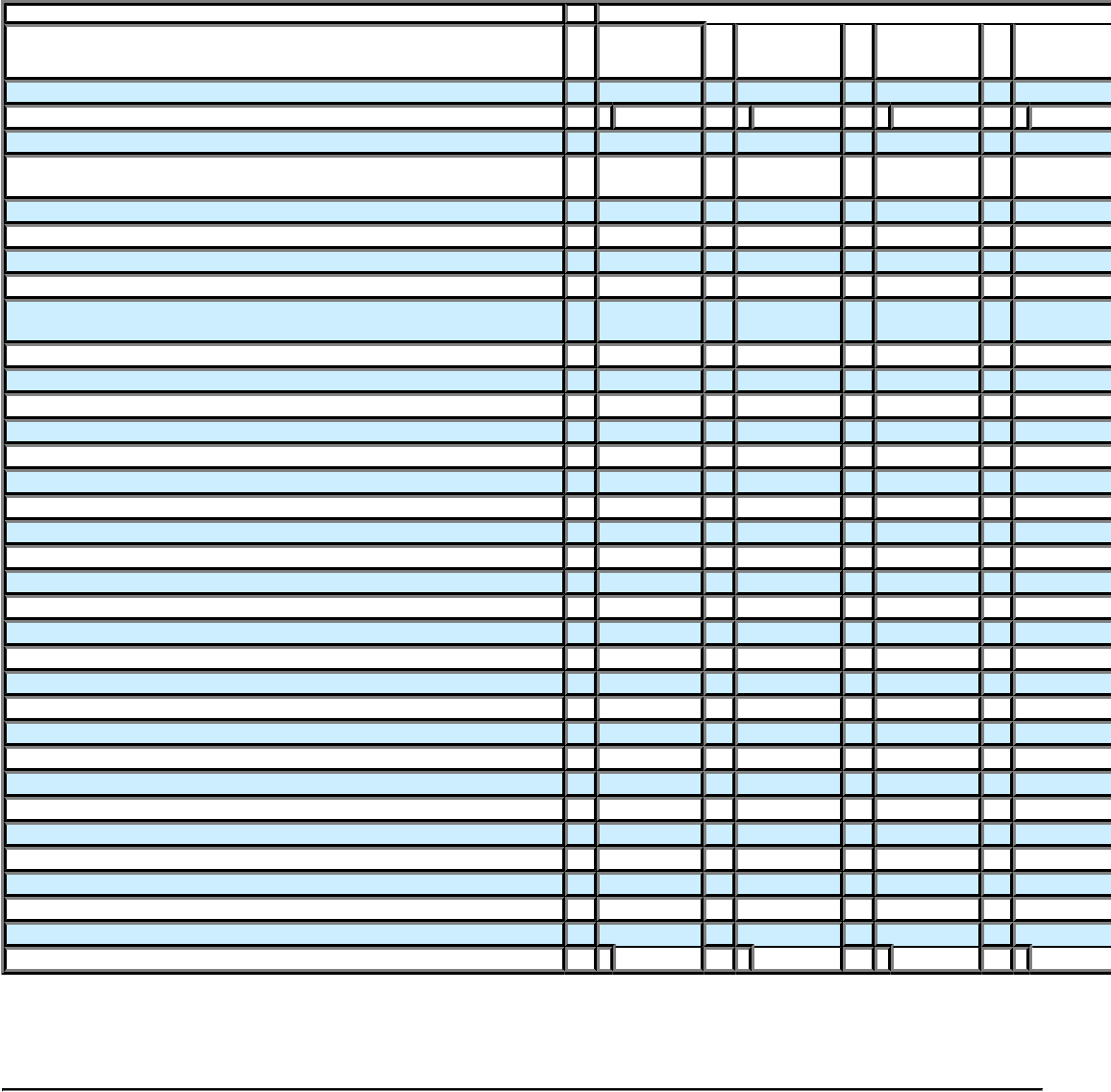

Year ended July 31, 2004 (Predecessor)

(in thousands) NMG

Non-

Guarantor

Subsidiaries Eliminations Consolidated

CASH FLOWS—OPERATING ACTIVITIES

Net earnings (loss) $ 204,832 $ 263,178 $ (263,178 ) $ 204,832

(Earnings) loss from discontinued operation — (1,242 ) 592 (650

Adjustments to reconcile net earnings to net cash provided by operating

activities:

Depreciation 77,659 20,392 — 98,051

Deferred income taxes 22,969 — — 22,969

Impairment of intangible assets and other charges — 3,853 — 3,853

Minority Interest — — 2,957 2,957

Other, primarily costs related to defined benefit pension and other

long-term benefit plans 34,562 (682 ) — 33,880

Intercompany royalty income payable (receivable) 164,994 (164,994 ) — —

Equity in earnings of subsidiaries (259,791 ) — 259,791 —

Changes in operating assets and liabilities, net 3,564 (317,431 )(162 )(314,029

Net cash provided by (used for) continuing operating activities 248,789 (196,926 ) — 51,863

Net cash provided by discontinued operation — 709 — 709

Net cash provided by (used for) operating activities 248,789 (196,217 )— 52,572

CASH FLOWS—INVESTING ACTIVITIES

Capital expenditures (94,591 ) (24,478 ) — (119,069

Proceeds from sale of other assets 3,183 — — 3,183

Net cash used for continuing investing activities (91,408 ) (24,478 ) — (115,886

Net cash used for discontinued operation — (1,404 )— (1,404

Net cash used for investing activities (91,408 )(25,882 )— (117,290

CASH FLOWS—FINANCING ACTIVITIES

Repayment of borrowings under Credit Card Facility — 225,000 — 225,000

Acquisitions of treasury stock (7,553 ) — — (7,553

Proceeds from stock-based compensation awards 23,797 — — 23,797

Cash dividends paid (12,632 ) — — (12,632

Distributions paid — (3,172 )— (3,172

Net cash provided by continuing financing activities 3,612 221,828 — 225,440

Net cash provided by discontinued operation — 695 — 695

Net cash provided by financing activities 3,612 222,523 — 226,135

CASH AND CASH EQUIVALENTS

Increase during the period 160,993 424 — 161,417

Beginning balance 202,070 4,880 — 206,950

Ending balance $ 363,063 $ 5,304 $ — $ 368,367

F-56