Neiman Marcus 2005 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2005 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

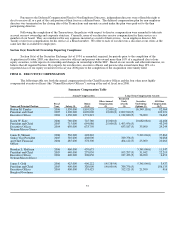

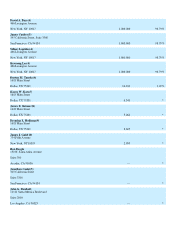

(8) Includes 1,157 shares not currently owned, but which are issuable upon the exercise of stock options that are currently

exercisable or that become exercisable within 60 days.

(9) Includes 1,157 shares not currently owned, but which are issuable upon the exercise of stock options that are currently

exercisable or that become exercisable within 60 days.

(10) Includes 1,157 shares not currently owned, but which are issuable upon the exercise of stock options that are currently

exercisable or that become exercisable within 60 days.

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Newton Holding, LLC Limited Liability Company Operating Agreement

The investment funds associated with or designated by a Sponsor (Sponsor Funds) and certain investors who agreed to co-

invest with the Sponsor Funds or through a vehicle jointly controlled by the Sponsors to provide equity financing for the Transactions

(Co-Investors), entered into a limited liability company operating agreement in respect of our parent company, Newton Holding, LLC

(the "LLC Agreement"). The LLC Agreement contains agreements among the parties with respect to the election of our directors and

the directors of our parent companies, restrictions on the issuance or transfer of interests in us, including tag-along rights and drag-

along rights, and other corporate governance provisions (including the right to approve various corporate actions).

Pursuant to the LLC Agreement, each of Texas Pacific Group and Warburg Pincus has the right, which is freely assignable to

other members or indirect members, to nominate four directors, and Texas Pacific Group and Warburg Pincus are entitled to jointly

nominate additional directors. The rights of Texas Pacific Group and Warburg Pincus to nominate directors are subject to their

ownership percentages in Newton Holding, LLC remaining above a specified percentage of their initial ownership percentage. Each

of the Sponsors has the right to have at least one of its directors sit on each committee of the Board of Directors, to the extent

permitted by applicable laws and regulations.

The Sponsors have assigned the right to appoint one of our directors to investment funds that are affiliates of Credit Suisse

Securities (USA) LLC and the right to appoint one of our directors to investment funds associated with Leonard Green Partners.

For purposes of any board action, each director nominated by Texas Pacific Group or Warburg Pincus has three votes and

each of the directors (including any jointly nominated directors and the directors nominated by investment funds that are affiliates of

Credit Suisse Securities (USA) LLC and Leonard Green Partners) has one vote. Certain major decisions of the board of directors of

Newton Holding, LLC require the approval of each of Texas Pacific Group and Warburg Pincus and certain other decisions of the

board of directors of Newton Holding, LLC require the approval of a specified number of directors designated by each of Texas

Pacific Group and Warburg Pincus, in each case subject to the requirement that their respective ownership percentage in Newton

Holding, LLC remains above a specified percentage of their initial ownership percentage.

Registration Rights Agreement

The Sponsor Funds and the Co-Investors entered into a registration rights agreement with us upon completion of the

Transactions. Pursuant to this agreement, the Sponsor Funds can cause us to register their interests in NMG under the Securities Act

and to maintain a shelf registration statement effective with respect to such interests. The Sponsor Funds and the Co-Investors are also

entitled to participate on a pro rata basis in any registration of our equity interests under the Securities Act that we may undertake.

Management Services Agreement

In connection with the Transactions, we entered into a management services agreement with affiliates of the Sponsors

pursuant to which affiliates of one of the Sponsors received on the closing date of the Acquisition a transaction fee of $25 million in

cash in connection with the Transactions. Affiliates of the other Sponsor waived any cash transaction fee in connection with the

Transactions. In addition, pursuant to such agreement, and in exchange for consulting and management advisory services that will be

provided to us by the Sponsors and their affiliates, affiliates of the Sponsors will receive an aggregate annual management fee equal to

the lesser of (i) 0.25% of consolidated annual revenue and (ii) $10 million. Also, affiliates of the Sponsors are entitled to receive

reimbursement for out-of-pocket expenses incurred by them or their affiliates

66