Neiman Marcus 2005 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2005 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

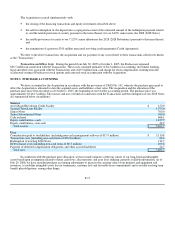

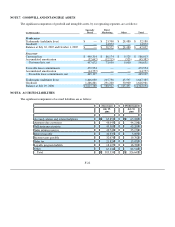

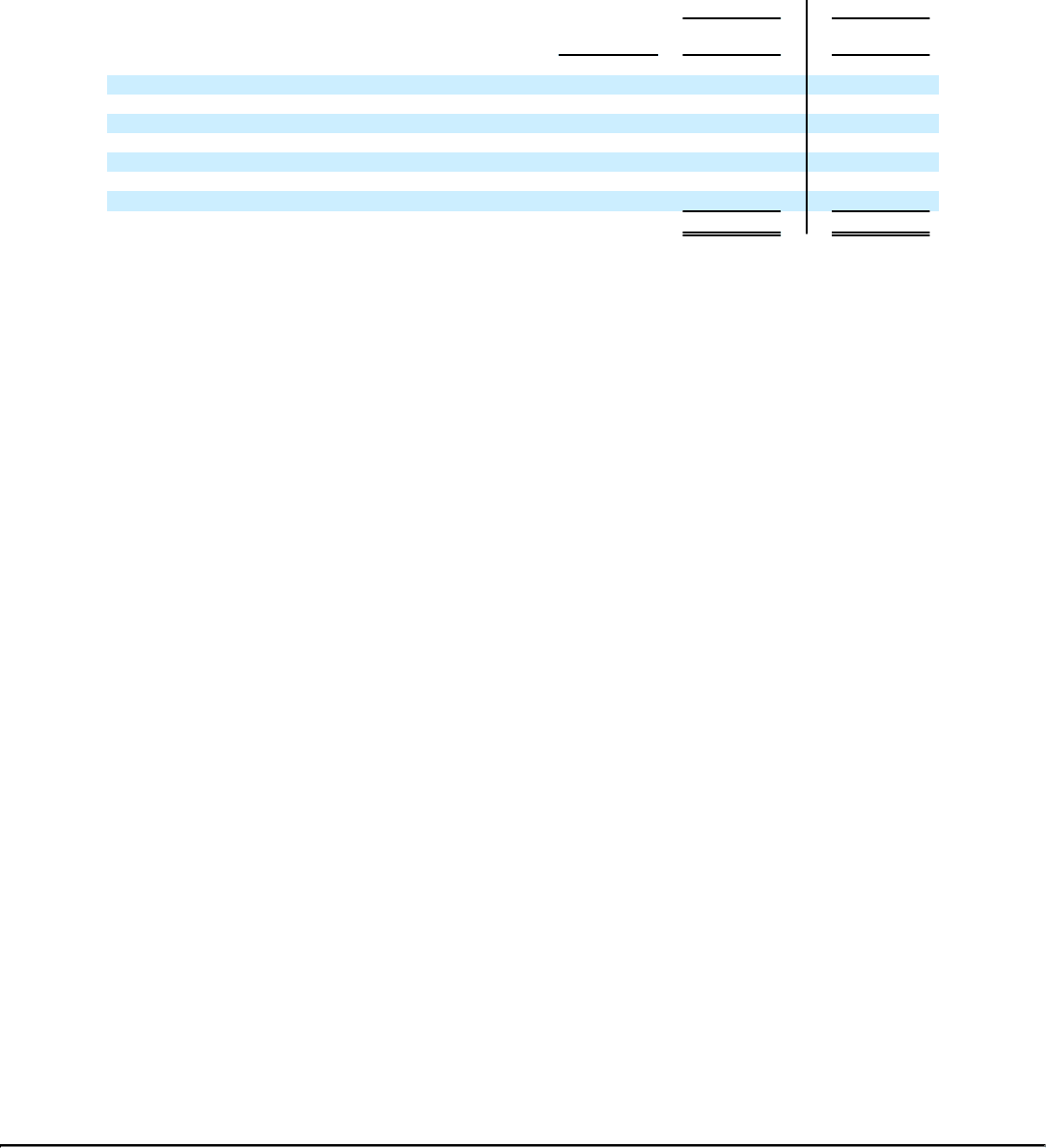

NOTE 9. LONG-TERM DEBT

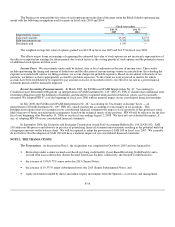

The significant components of our long-term debt are as follows:

(Successor) (Predecessor)

Interest Rate

July 29,

2006

July 30,

2005

Asset-Based Revolving Credit Facility variable $ — $ —

Senior Secured Term Loan Facility variable 1,875,000 —

2028 Debentures 7.125% 120,711 124,823

Senior Notes 9.0%/9.75% 700,000 —

Senior Subordinated Notes 10.375% 500,000 —

2008 Notes 6.65% — 124,957

Credit Card Facility variable — —

Long-term debt $ 3,195,711 $ 249,780

Senior Secured Asset-Based Revolving Credit Facility. On October 6, 2005, in connection with the Transactions, NMG

entered into a credit agreement and related security and other agreements for a senior secured Asset-Based Revolving Credit Facility with

Deutsche Bank Trust Company Americas as administrative agent and collateral agent. The Asset-Based Revolving Credit Facility

provides financing of up to $600.0 million, subject to a borrowing base equal to at any time the lesser of 80% of eligible inventory

(valued at the lower of cost or market value) and 85% of net orderly liquidation value of the eligible inventory, less certain reserves. The

Asset-Based Revolving Credit Facility includes borrowing capacity available for letters of credit and for borrowings on same-day notice.

At the closing of the Transactions, NMG utilized $150.0 million of the Asset-Based Revolving Credit Facility for loans and

approximately $16.5 million for letters of credit. In the second quarter of fiscal year 2006, NMG repaid all loans under the Asset-Based

Revolving Credit Facility. As of July 29, 2006, NMG had $570.9 million of unused borrowing availability under the Asset-Based

Revolving Credit Facility based on a borrowing base of over $600.0 million and after giving effect to $29.1 million used for letters of

credit.

The Asset-Based Revolving Credit Facility provides that NMG has the right at any time to request up to $200.0 million of

additional commitments, but the lenders are under no obligation to provide any such additional commitments, and any increase in

commitments will be subject to customary conditions precedent. If NMG were to request any such additional commitments and the

existing lenders or new lenders were to agree to provide such commitments, the Asset-Based Revolving Credit Facility size could be

increased to up to $800.0 million, but NMG's ability to borrow would still be limited by the amount of the borrowing base.

Borrowings under the Asset-Based Revolving Credit Facility bear interest at a rate per annum equal to, at NMG's option, either

(a) a base rate determined by reference to the higher of (1) the prime rate of Deutsche Bank Trust Company Americas and (2) the federal

funds effective rate plus 1¤2 of 1% or (b) a LIBOR rate, subject to certain adjustments, in each case plus an applicable margin. The initial

applicable margin is 0% with respect to base rate borrowings and 1.75% with respect to LIBOR borrowings. The applicable margin is

subject to adjustment based on the historical availability under the Asset-Based Revolving Credit Facility. In addition, NMG is required

to pay a commitment fee of 0.375% per annum in respect of the unutilized commitments. If the average revolving loan utilization is 50%

or more for any applicable period, the commitment fee will be reduced to 0.250% for such period. The Company must also pay

customary letter of credit fees and agency fees.

If at any time the aggregate amount of outstanding loans, unreimbursed letter of credit drawings and undrawn letters of credit

under the Asset-Based Revolving Credit Facility exceeds the lesser of (i) the commitment amount and (ii) the borrowing base, NMG will

be required to repay outstanding loans or cash collateralize letters of credit in an aggregate amount equal to such excess, with no reduction

of the commitment amount. If the amount available under the Asset-Based Revolving Credit Facility is less than $60 million or an event

of default has occurred, NMG will be required to repay outstanding loans and cash collateralize letters of credit with the cash NMG

would then be required to deposit daily in a collection account maintained with the agent under the Asset-Based Revolving Credit

Facility. The Company may voluntarily reduce the unutilized portion of the commitment amount and repay outstanding loans at any time

without premium or penalty other than customary "breakage" costs with respect to LIBOR loans. There is no scheduled amortization

under the Asset-Based Revolving Credit Facility; the principal amount of the loans outstanding is due and payable in full on October 6,

2010.

All obligations under the Asset-Based Revolving Credit Facility are guaranteed by the Company and certain of NMG's existing

and future domestic subsidiaries (excluding, among others, Kate Spade LLC). As of July 29, 2006, the liabilities of

F-23