Neiman Marcus 2005 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2005 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ITEM 14. PRINCIPAL ACCOUNTING FEES AND SERVICES

The Audit Committee has adopted policies and procedures for pre-approving all audit and permissible non-audit services

performed by Deloitte & Touche LLP. Under these policies, the Audit Committee pre-approves the use of audit and audit-related services

following approval of the independent registered public accounting firm's audit plan. All services detailed in the audit plan are considered

pre-approved. If, during the course of the audit, the independent registered public accounting firm expects fees to exceed the approved fee

estimate between 10 percent and 15 percent, those fees must be pre-approved in advance by the Audit Committee Chairman. If fees are

expected to exceed the approved estimate by more than 15 percent, those fees must be approved in advance by the Audit Committee.

Other non-audit services of less than $50,000 that are not restricted services may be pre-approved by both the chief financial

officer and the controller, provided those services will not impair the independence of the independent auditor. These services will be

considered approved by the Audit Committee, provided those projects are discussed with the Audit Committee at its next scheduled

meeting. Services between $50,000 and $100,000 in estimated fees must be pre-approved by the Chairman of the Audit Committee,

acting on behalf of the entire Audit Committee. Services of greater than $100,000 in estimated fees must be pre-approved by the Audit

Committee. All fee overruns will be discussed with the Audit Committee at the next scheduled meeting.

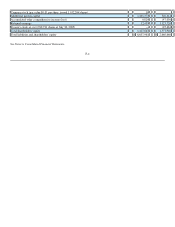

Principal Accounting Fees and Services

For the fiscal years ended July 29, 2006 and July 30, 2005, professional services were performed by Deloitte & Touche LLP, the

member firms of Deloitte Touche Tohmatsu, and their respective affiliates, which includes Deloitte consulting (collectively, "Deloitte &

Touche").

Audit Fees. The aggregate fees billed for the audits of the Company's annual financial statements for the fiscal years ended

July 29, 2006 and July 30, 2005 and for the reviews of the financial statements included in our Quarterly Reports on Form 10-Q were

$1,957,000 and $1,346,000, respectively.

Audit-Related Fees. The aggregate fees billed for audit-related services for the fiscal years ended July 29, 2006 and July 30,

2005 were $1,008,000 and $534,000, respectively. These fees related to accounting research and consultation and attestation services for

certain subsidiary companies for the fiscal years ended July 29, 2006 and July 30, 2005.

Tax Fees. The aggregate fees billed for tax services for the fiscal years ended July 29, 2006 and July 30, 2005 were $83,000

and $47,000, respectively. These fees related to tax compliance and planning for the fiscal years ended July 29, 2006 and July 30, 2005.

The Audit Committee has considered and concluded that the provision of permissible non-audit services is compatible with

maintaining Deloitte & Touche's independence.

68