Neiman Marcus 2005 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2005 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

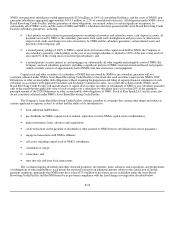

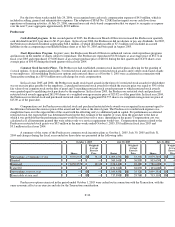

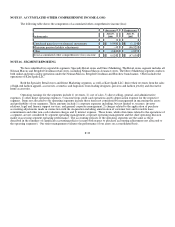

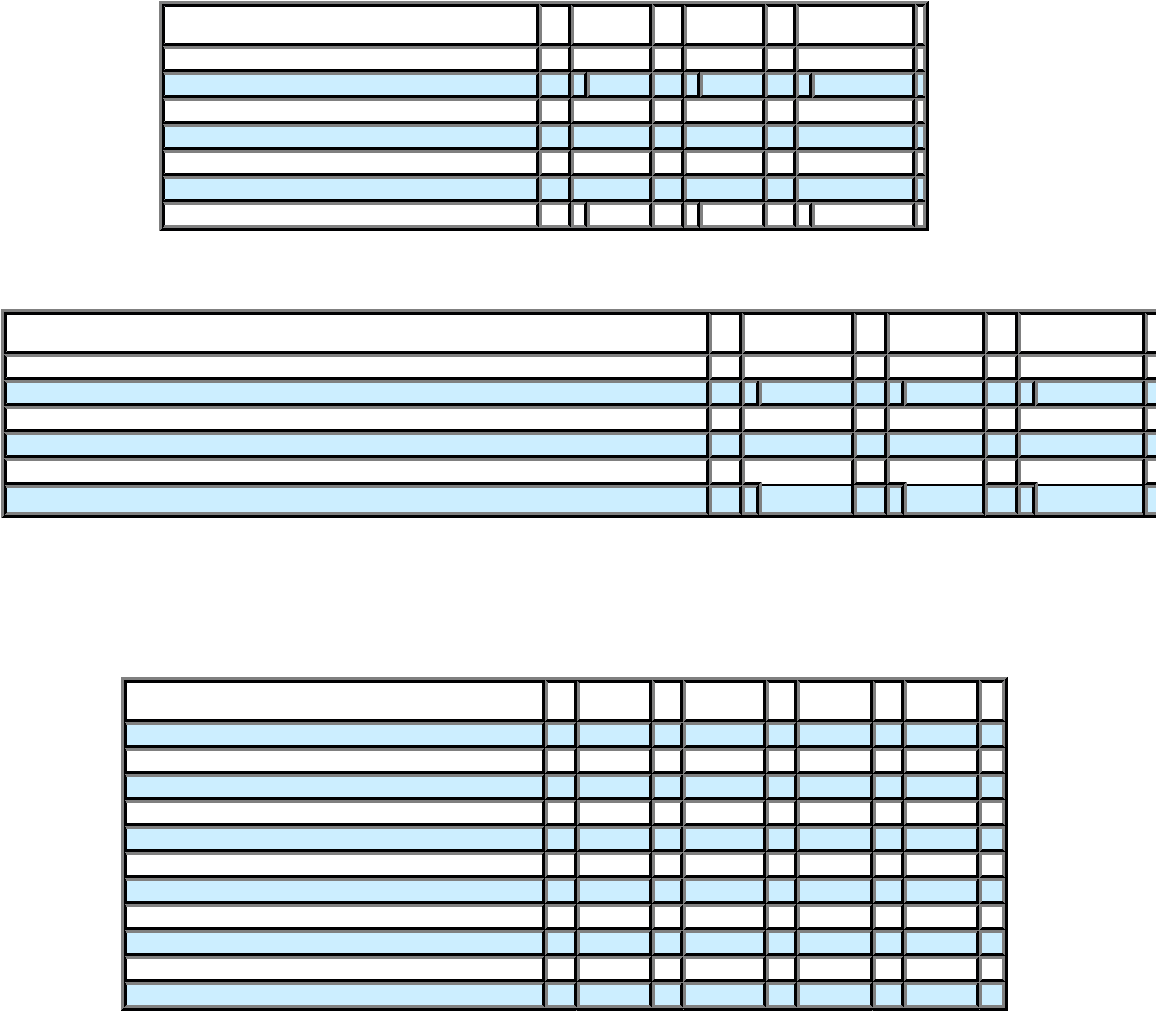

A summary of expected benefit payments related to our Pension Plan, SERP Plan and Postretirement Plan is as follows:

(in thousands)

Pension

Plan

SERP

Plan

Postretirement

Plan

Fiscal year 2007 $ 10,583 $ 2,870 $ 1,547

Fiscal year 2008 11,561 2,899 1,639

Fiscal year 2009 12,646 3,323 1,697

Fiscal year 2010 13,766 3,765 1,728

Fiscal year 2011 14,939 4,050 1,774

Fiscal years 2012-2016 $ 99,509 $ 25,855 $ 9,681

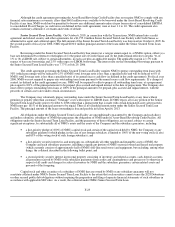

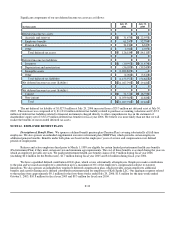

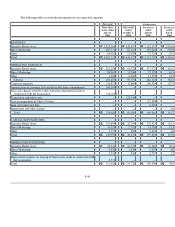

Purchase Accounting Adjustments. The obligations and assets related to our benefit plans were valued at fair value as of the

date of the Acquisition as follows:

(in thousands) Pension Plan SERP Plan

Postretirement

Plan

Benefit obligations at fair value (5.75% discount rate) $ 354,807 $ 76,806 $ 15,281

Assets held by defined benefit pension plan, at fair value 287,871 — —

Excess of benefit obligations over assets 66,936 76,806 15,281

Less: previously recorded benefit plan obligations recorded by Predecessor (19,655 )(63,540 )(18,205 )

Adjustment to increase (decrease) benefit plan obligations $ 47,281 $ 13,266 $ (2,924 )

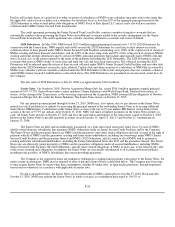

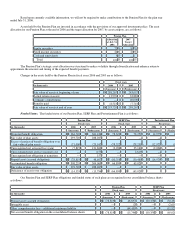

Actuarial Assumptions. Significant assumptions related to the calculation of our obligations pursuant to our employee benefit

plans include the discount rate used to calculate the actuarial present value of benefit obligations to be paid in the future, the expected

long-term rate of return on assets held by the Pension Plan, the average rate of compensation increase by Pension Plan and SERP Plan

participants and the health care cost trend rate for the Postretirement Plan. We review these actuarial assumptions annually based upon

currently available information. The assumptions we utilized in calculating the projected benefit obligations and periodic expense of our

Pension Plan, SERP Plan and Postretirement Plan are as follows:

August 1,

2006

October 1,

2005

August 1,

2005

August 1,

2004

Pension Plan:

Discount rate 6.25 % 5.75 % 5.50 % 6.25 %

Expected long-term rate of return on plan assets 8.00 % 8.00 % 8.00 % 8.00 %

Rate of future compensation increase 4.50 % 4.50 % 4.50 % 4.50 %

SERP Plan:

Discount rate 6.25 % 5.75 % 5.50 % 6.25 %

Rate of future compensation increase 4.50 % 4.50 % 4.50 % 4.50 %

Postretirement Plan:

Discount rate 6.25 % 5.75 % 5.50 % 6.25 %

Initial health care cost trend rate 8.00 % 8.00 % 9.00 % 10.00 %

Ultimate health care cost trend rate 5.00 % 5.00 % 5.00 % 5.00 %

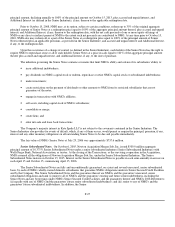

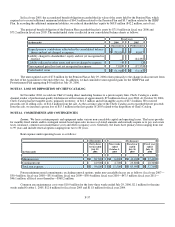

Discount rate. The assumed discount rate utilized is based, in part, upon the Moody's Aa corporate bond yield as of the

measurement date and the expected timing of cash outlays for plan benefits. The discount rate is utilized principally in calculating the

actuarial present value of our obligations and periodic expense pursuant to our employee benefit plans. At August 1, 2006, the discount

rate was 6.25%. As a result of the increase in the discount rate from 5.75% at the Acquisition date to 6.25% at August 1, 2006, the

projected benefit obligations related to our employee benefit plans decreased $37.4 million.

The estimated effect of a 0.25% decrease in the discount rate would increase the Pension Plan obligation by $15.7 million and

increase annual Pension Plan expense by $0.9 million. The estimated effect of a 0.25% decrease in the discount rate would increase the

SERP Plan obligation by $2.7 million and increase the SERP Plan annual expense by $0.1 million. The estimated effect of a 0.25%

decrease in the discount rate would increase the Postretirement Plan obligation by $0.3 million and increase the Postretirement Plan

annual expense by an immaterial amount.

F-34