Neiman Marcus 2005 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2005 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

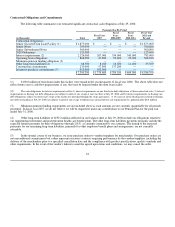

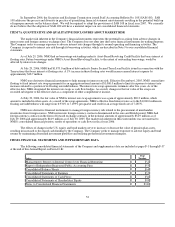

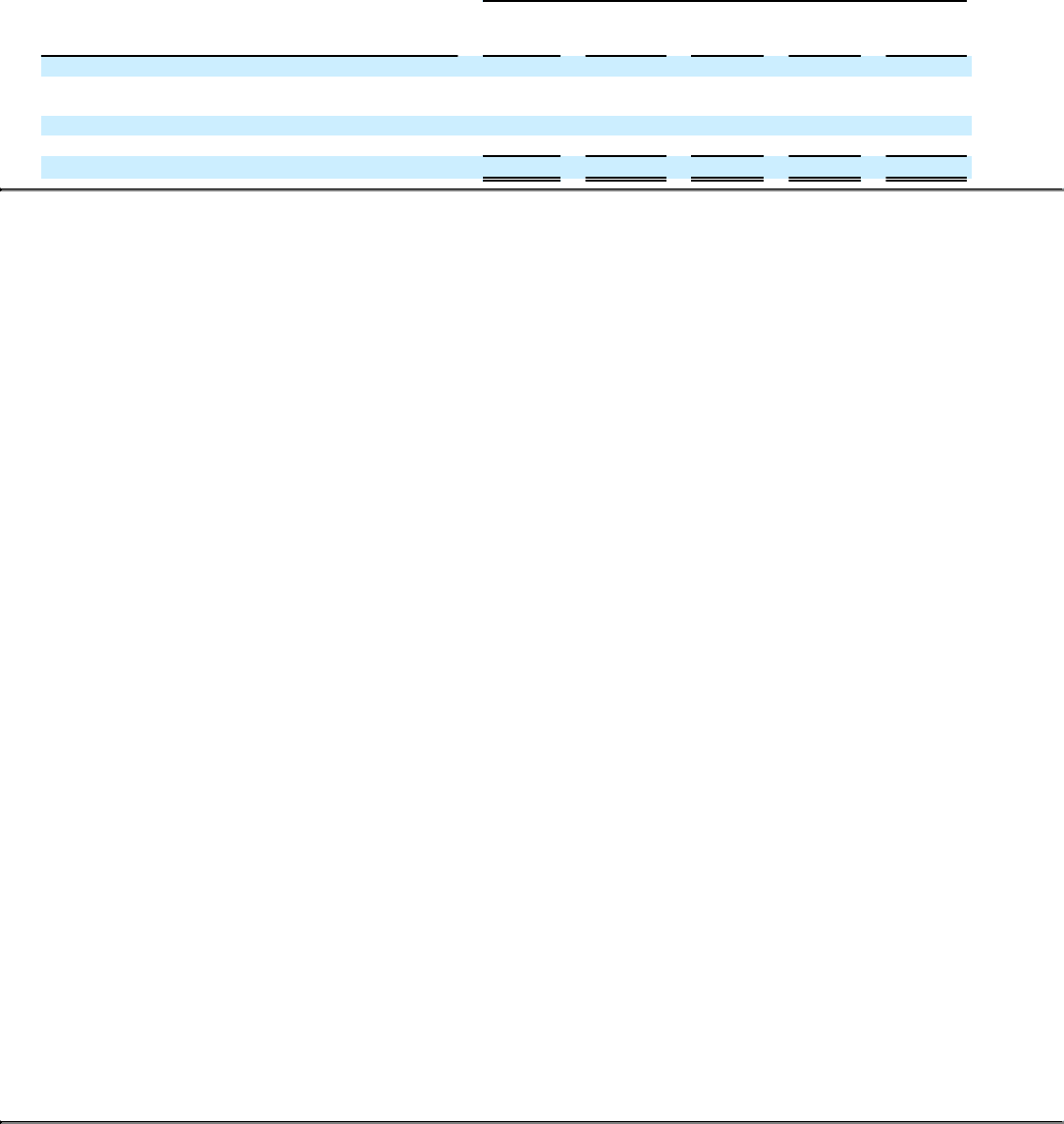

The following table summarizes the expiration of our significant commercial commitments outstanding at July 29, 2006:

Amount of Commitment by Expiration Period

(in thousands) Total

Fiscal Year

2007

Fiscal

Years

2008-2009

Fiscal

Years

2010-2011

Fiscal Year

2012 and

Beyond

Other commercial commitments:

Senior secured asset-based revolving credit

facility(1) $ 600,000 $ — $ — $ — $ 600,000

Other lending facilities 7,600 7,600 — — —

Surety bonds 4,000 4,000 — — —

$ 611,600 $ 11,600 $ — $ — $ 600,000

(1) As of July 29, 2006, we had no borrowings outstanding under our new senior secured asset-based revolving credit facility and

had $570.9 million of unused borrowing availability, after giving effect to $29.1 million of outstanding letters of credit. Our working

capital requirements are greatest in the first and second fiscal quarters as a result of higher seasonal requirements. See "Description of

Other Indebtedness—Senior Secured Asset-Based Revolving Credit Facility" and "Management's Discussion and Analysis of Financial

Conditions and Results of Operations—Seasonality."

In addition to the items presented above, our other principal commercial commitments are comprised of common area

maintenance costs, tax and insurance obligations and contingent rent payments.

At August 1, 2006 (the most recent measurement date), our actuarially calculated projected benefit obligation for our Pension

Plan was $364.7 million and the fair value of the assets was $293.7 million. Our policy is to fund the Pension Plan at or above the

minimum amount required by law. In fiscal year 2006, we did not make any voluntary contributions to the Pension Plan. In fiscal year

2005, we made a voluntary contribution of $20.0 million in the third fiscal quarter for the plan year ended July 31, 2004. Based upon

currently available information, we will not be required to make contributions in fiscal year 2007 to the Pension Plan for the plan year

ended July 31, 2006.

Investment in Kate Spade LLC. We currently own a 56% interest in Kate Spade LLC, which designs and markets high-end

designer handbags and accessories. A minority investor owns the remaining 44% interest. Our investment in and relationship with Kate

Spade LLC are governed by an operating agreement that provides for an orderly transition process in the event either investor wishes to

sell its interest, or purchase the other investor's interest. Among other things, this operating agreement contains currently exercisable put

option provisions entitling the minority investor to put its interest to us, and currently exercisable call option provisions entitling us to

purchase the minority investor's interest, at a purchase price mutually agreed to by the parties. The purchase price will be determined by

the parties or, in the event the parties are unable to agree on a mutually acceptable price, by a mutually acceptable nationally recognized

investment banking firm, subject to certain conditions. We may elect to defer the consummation of a put option for a period of six months

by cooperating with the minority investor in seeking either a sale of Kate Spade LLC to a third party or a public offering of Kate

Spade LLC's securities. If a sale to a third party or public offering of Kate Spade LLC's securities is not consummated within six months

after the exercise of the put option (which period may be automatically extended for an additional two months if a registration statement

for Kate Spade LLC is filed with the SEC), we are obligated to consummate the put option. Under the terms of the Kate Spade LLC

operating agreement, consummation of the put option shall occur within thirty days after the determination of the valuation with respect

to the exercise of the put option, unless we have elected to defer the consummation of the put option for the six-month period referred to

above, and should a third party sale or public offering of Kate Spade LLC occur within such six-month period, we are required to pay the

minority investor the excess, if any, of the put option valuation price for its interest over the amount it realizes through the third party sale

or public offering.

In April 2005, the minority investor in Kate Spade LLC exercised the put option described above with respect to the full amount

of its stake in such company. We subsequently entered into a standstill agreement to postpone the put process while we engaged in

discussions with the minority investor in Kate Spade LLC regarding certain strategic alternatives, including the possible sale of such

company. The standstill agreement, as extended, expired on March 21, 2006, but the parties are continuing to pursue discussions

regarding a possible sale of such company while the put valuation process proceeds. Although such discussions are ongoing, no assurance

can be given that they will ultimately lead to any transaction. It is possible that we may be required to purchase the shares of the minority

investor in Kate Spade LLC pursuant to the option as early as the second quarter of fiscal year 2007.

45