Neiman Marcus 2005 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2005 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In September 2006, the Securities and Exchange Commission issued Staff Accounting Bulletin No. 108 (SAB 108). SAB

108 addresses the process and diversity in practice of quantifying financial statement misstatements resulting in the potential build up

of improper amounts on the balance sheet. We will be required to adopt the provisions of SAB 108 in fiscal year 2007. We currently

do not believe that the adoption of SAB 108 will have a material impact on our consolidated financial statements.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

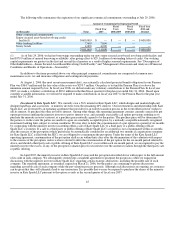

The market risk inherent in the Company's financial instruments represents the potential loss arising from adverse changes in

interest rates and foreign currency exchange rates. The Company does not enter into derivative financial instruments for trading purposes.

The Company seeks to manage exposure to adverse interest rate changes through its normal operating and financing activities. The

Company is exposed to interest rate risk through its borrowing activities, which are described in Note 9 to our consolidated financial

statements.

As of July 29, 2006, NMG had no borrowings outstanding under its Asset-Based Revolving Credit Facility that bears interest at

floating rates. Future borrowings under NMG's Asset-Based Revolving Facility, to the extent of outstanding borrowings, would be

affected by interest rate changes.

At July 29, 2006, NMG had $1,875.0 million of debt under its Senior Secured Term Loan Facility issued in connection with the

Transactions that bears interest at floating rates. A 1% increase in these floating rates would increase annual interest expense by

approximately $18.7 million.

NMG uses derivative financial instruments to help manage its interest rate risk. Effective December 6, 2005, NMG entered into

floating to fixed interest rate swap agreements for an aggregate notional amount of $1,000.0 million to limit its exposure to interest rate

increases related to a portion of its floating rate indebtedness. The interest rate swap agreements terminate after five years. As of the

effective date, NMG designated the interest rate swaps as cash flow hedges. As a result, changes in the fair value of the swaps are

recorded subsequent to the effective date as a component of other comprehensive income.

At July 29, 2006, the fair value of NMG's interest rate swap agreements was a gain of approximately $20.2 million, which

amount is included in other assets. As a result of the swap agreements, NMG's effective fixed interest rates as to the $1,000.0 million in

floating rate indebtedness will range from 6.931% to 7.499% per quarter and result in an average fixed rate of 7.285%.

NMG uses derivative financial instruments to manage foreign currency risk related to the procurement of merchandise

inventories from foreign sources. NMG enters into foreign currency contracts denominated in the euro and British pound. NMG had

foreign currency contracts in the form of forward exchange contracts in the notional amounts of approximately $54.9 million as of

July 29, 2006 and approximately $44.9 million as of July 30, 2005. The market risk inherent in these instruments was not material to

NMG's consolidated financial position, results of operations or cash flows in fiscal year 2006.

The effects of changes in the U.S. equity and bond markets serve to increase or decrease the value of pension plan assets,

resulting in increased or decreased cash funding by the Company. The Company seeks to manage exposure to adverse equity and bond

returns by maintaining diversified investment portfolios and utilizing professional investment managers.

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

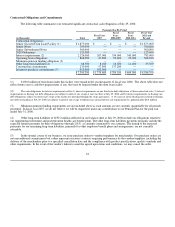

The following consolidated financial statements of the Company and supplementary data are included as pages F-1 through F-57

at the end of this Annual Report on Form 10-K:

Index

Page

Number

Management's Report on Internal Control over Financial Reporting F-2

Report of Independent Registered Public Accounting Firm F-3

Consolidated Balance Sheets F-4

Consolidated Statements of Earnings F-5

Consolidated Statements of Cash Flows F-6

Consolidated Statements of Shareholders' Equity F-8

Notes to Consolidated Financial Statements F-10

52