Neiman Marcus 2005 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2005 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ESTIMATES AND CRITICAL ACCOUNTING POLICIES

We make estimates and assumptions about future events in preparing our financial statements in conformity with generally

accepted accounting principles. These estimates and assumptions affect the amounts of assets, liabilities, revenues and expenses and the

disclosure of gain and loss contingencies at the date of the consolidated financial statements.

While we believe that our past estimates and assumptions have been materially accurate, the amounts currently estimated are

subject to change if we make different assumptions as to the outcome of future events. We evaluate our estimates and judgments on an

ongoing basis and predicate those estimates and judgments on historical experience and on various other factors that we believe to be

reasonable under the circumstances. We make adjustments to our assumptions and judgments when facts and circumstances dictate. Since

future events and their effects cannot be determined with absolute certainty, actual results may differ from the estimates used in preparing

the accompanying consolidated financial statements.

Purchase Accounting. We have accounted for the Acquisition in accordance with the provisions of Statement of Financial

Accounting Standards No. 141, "Business Combinations," (SFAS No. 141) whereby the purchase price paid to effect the Acquisition is

allocated to state the acquired assets and liabilities at fair value. The Acquisition and the allocation of the purchase price have been

recorded as of October 1, 2005, the beginning of our October 2005 accounting period. In connection with the purchase price allocation,

we have made estimates of the fair values of our long-lived and intangible assets based upon assumptions related to future cash flows,

discount rates and asset lives utilizing currently available information which resulted in increases in the carrying value of our property

and equipment and inventory, the recording of intangible assets for our tradenames, customer lists and favorable lease commitments and

the revaluation of our long-term benefit plan obligations, among other things.

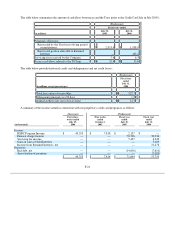

Cash and Cash Equivalents. Cash and cash equivalents primarily consist of cash on hand in the stores, deposits with banks and

overnight investments with banks and financial institutions. Cash equivalents are stated at cost, which approximates fair value. Our cash

management system provides for the reimbursement of all major bank disbursement accounts on a daily basis. Accounts payable includes

$66.5 million of outstanding checks not yet presented for payment at July 29, 2006 and $45.0 million at July 30, 2005.

Accounts Receivable. Accounts receivable primarily consist of credit card receivables.

Merchandise Inventories and Cost Of Goods Sold. We utilize the retail method of accounting for substantially all of our

merchandise inventories. Merchandise inventories are stated at the lower of cost or market. The retail inventory method is widely used in

the retail industry due to its practicality.

Under the retail inventory method, the valuation of inventories at cost and the resulting gross margins are determined by

applying a calculated cost-to-retail ratio, for various groupings of similar items, to the retail value of inventories. The cost of the inventory

reflected on the consolidated balance sheets is decreased by charges to cost of goods sold at the time the retail value of the inventory is

lowered through the use of markdowns. Earnings are negatively impacted when merchandise is marked down.

Our sales activities are conducted during two primary selling seasons—Fall and Spring. The Fall selling season is conducted

primarily in our first and second quarters and the Spring selling season is conducted primarily in the third and fourth quarters. During

each season, we record markdowns to reduce the retail value of our inventories. Factors considered in determining markdowns include

current and anticipated demand, customer preferences, age of merchandise and fashion trends. During the season, we record both

temporary and permanent markdowns. Temporary markdowns are recorded at the time of sale and reduce the retail value of only the

goods sold. Permanent markdowns are designated primarily for clearance activity and reduce the retail value of all goods subject to

markdown. At the end of each selling season, we record permanent markdowns for clearance goods remaining in ending inventory.

The areas requiring significant judgment related to the valuation of our inventories include 1) setting the original retail value for

the merchandise held for sale, 2) recognizing merchandise for which the customer's perception of value has declined and appropriately

marking the retail value of the merchandise down to the perceived value and 3) estimating the shrinkage that has occurred between

physical inventory counts. These judgments and estimates, coupled with the averaging processes within the retail method can, under

certain circumstances, produce varying financial results. Factors that can lead to different financial results include 1) determination of

original retail values for merchandise held for sale, 2) identification of declines in perceived value of inventories and processing the

appropriate retail value markdowns and 3) overly optimistic or conservative estimates of shrinkage. We believe appropriate merchandise

valuation and pricing controls minimize the risk that our inventory values would be materially misstated.

F-11