Neiman Marcus 2005 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2005 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Pursuant to the Deferred Compensation Plan for Non-Employee Directors, independent directors were offered the right to

elect to receive all or a part of the cash portion of their fees on a deferred basis. The deferred compensation plan for non-employee

directors was terminated on the closing date of the Transactions and amounts accrued under the plan were paid out to the then

participating directors.

Following the completion of the Transactions, the policies with respect to director compensation were amended to take into

account our new ownership and corporate structure. Currently, none of our directors receive compensation for their service as a

member of our board. They are reimbursed for any expenses incurred as a result of their service. As an employee director, Mr.

Tansky receives no compensation for his service as a Board member. We offer to each of our directors a discount at our stores at the

same rate that is available to employees.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, required, for periods prior to the completion of the

Acquisition in October 2005, our directors, executive officers and persons who owned more than 10% of a registered class of our

equity securities, to file reports of ownership and changes in ownership with the SEC. Based on our records and other information, we

believe that all required Section 16(a) reports for our directors, executive officers and persons who owned more than 10% of a

registered class of our equity securities for fiscal year 2006 prior to the completion of the Acquisition were timely filed.

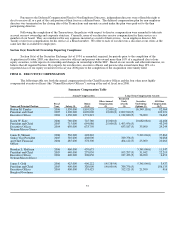

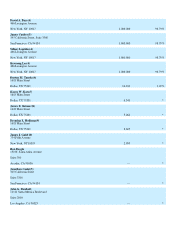

ITEM 11. EXECUTIVE COMPENSATION

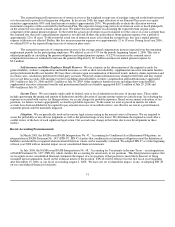

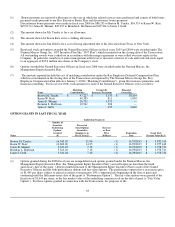

The following table sets forth the annual compensation for the Chief Executive Officer and the four other most highly

compensated executive officers (the "Named Executive Officers") serving at the end of fiscal year 2006.

Summary Compensation Table

Annual Compensation Long-Term Compensation Awards

Name and Principal Position

Fiscal

Year Salary ($)

Bonus

($)(1)

Other Annual

Compensation

($)

Restricted

Stock

Awards

($)

Securities

Underlying

Options (#)

All Other

Compensation

($)(7)

Burton M. Tansky 2006 1,350,000 1,810,928 12,000(2) 16,349.18(6) 82,564

President and Chief 2005 1,300,000 1,690,000 12,000(2) 2,699,940(5) 103,921

Executive Officer 2004 1,250,000 1,574,219 1,132,830(5) 76,000 76,665

Karen W. Katz 2006 760,000 725,760 25,000(3) 10,682.08(6) 42,486

President and Chief 2005 715,000 694,086 25,000(3) 1,403,956(5) 43,290

Executive Officer 2004 650,000 633,750 633,187(5) 35,000 29,249

Neiman Marcus Stores

James E. Skinner 2006 530,000 448,210 5,341.04(6) 27,863

Senior Vice President 2005 510,000 408,000 789,756(5) 32,088

and Chief Financial 2004 485,000 378,300 404,112(5) 25,000 23,061

Officer

Brendan L. Hoffman 2006 460,000 439,675 5,341.04(6) 11,347

President and Chief 2005 440,000 279,030 105,297(5) 31,042 22,219

Executive Officer 2004 400,000 306,650 187,423(5) 36,900 6,452

Neiman Marcus Direct

James J. Gold 2006 425,000 406,222 145,385(4) 5,341.04(6) 3,437

President and Chief 2005 400,000 320,000 140,000(4) 789,756(5) 186,135

Executive Officer 2004 400,000 174,425 312,121(5) 21,500 416

Bergdorf Goodman

57