Neiman Marcus 2005 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2005 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

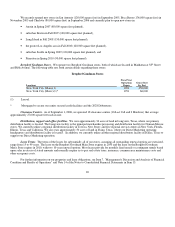

We recently opened new stores in San Antonio (120,000 square feet) in September 2005, Boca Raton (136,000 square feet) in

November 2005 and Charlotte (80,000 square feet) in September 2006 and currently plan to open new stores in:

• Austin in Spring 2007 (80,000 square feet planned),

• suburban Boston in Fall 2007 (100,000 square feet planned),

• Long Island in Fall 2008 (150,000 square feet planned),

• the greater Los Angeles area in Fall 2008 (120,000 square feet planned),

• suburban Seattle in Spring 2009 (120,000 square feet planned), and

• Princeton in Spring 2010 (90,000 square feet planned).

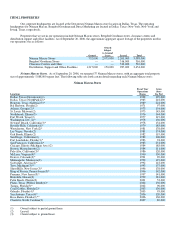

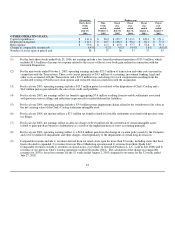

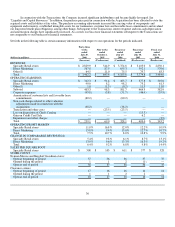

Bergdorf Goodman Stores. We operate two Bergdorf Goodman stores, both of which are located in Manhattan at 58th Street

and Fifth Avenue. The following table sets forth certain details regarding these stores:

Bergdorf Goodman Stores

Locations

Fiscal Year

Operations

Began

Gross Store

Sq. Feet

New York City (Main)(1) 1901 250,000

New York City (Men's)(1)* 1991 66,000

(1) Leased.

* Mortgaged to secure our senior secured credit facilities and the 2028 Debentures.

Clearance Centers. As of September 1, 2006, we operated 18 clearance centers (16 Last Call and 2 Horchow) that average

approximately 27,000 square feet each in size.

Distribution, support and office facilities. We own approximately 34 acres of land in Longview, Texas, where our primary

distribution facility is located. The Longview facility is the principal merchandise processing and distribution facility for Neiman Marcus

stores. We currently utilize a regional distribution facility in Totowa, New Jersey and five regional service centers in New York, Florida,

Illinois, Texas and California. We also own approximately 50 acres of land in Irving, Texas, where our Direct Marketing operating

headquarters and distribution facility is located. In addition, we currently utilize another regional distribution facility in Dallas, Texas to

support our Direct Marketing operation.

Lease Terms. The terms of the leases for substantially all of our stores, assuming all outstanding renewal options are exercised,

range from 15 to 99 years. The lease on the Bergdorf Goodman Main Store expires in 2050 and the lease on the Bergdorf Goodman

Men's Store expires in 2010, with two 10-year renewal options. Most leases provide for monthly fixed rentals or contingent rentals based

upon sales in excess of stated amounts and normally require us to pay real estate taxes, insurance, common area maintenance costs and

other occupancy costs.

For further information on our properties and lease obligations, see Item 7, "Management's Discussion and Analysis of Financial

Condition and Results of Operations" and Note 14 of the Notes to Consolidated Financial Statements in Item 15.

20