Neiman Marcus 2005 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2005 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

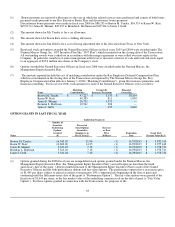

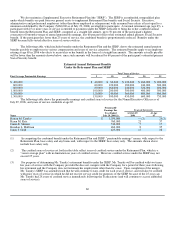

(1) Percentage of class beneficially owned is based on 1,012,264 common shares outstanding as of September 15, 2006,

together with the applicable options to purchase common shares for each shareholder exercisable on September 15, 2006 or

within 60 days thereafter. Shares issuable upon the exercise of options currently exercisable or exercisable 60 days after

September 15, 2006 are deemed outstanding for computing the percentage ownership of the person holding the options, but

are not deemed outstanding for computing the percentage of any other person. The amounts and percentages of common

stock beneficially owned are reported on the basis of regulations of the SEC governing the determination of beneficial

ownership of securities. Under the rules of the SEC, a person is deemed to be a "beneficial owner" of a security if that person

has or shares "voting power," which includes the power to vote or to direct the voting of such security, or "investment

power," which includes the power to dispose of or to direct the disposition of such security. A person is also deemed to be a

beneficial owner of any securities of which that person has a right to acquire beneficial ownership within 60 days. Under

these rules, more than one person may be deemed to be a beneficial owner of such securities as to which such person has

voting or investment power.

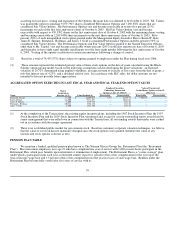

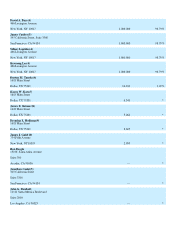

(2) Includes the 1,000,000 shares owned by Newton Holding, LLC over which TPG Partners IV, L.P., TPG Newton III, LLC

and TPG Newton Co-Invest I, LLC (the "TPG Entities") may be deemed, as a result of their ownership of 41.52% of Newton

Holding, LLC's total outstanding shares and certain provisions under the Newton Holding, LLC operating agreement, to have

shared voting or dispositive power. David Bonderman, James G. Coulter and William S. Price, III are directors, officers and

sole shareholders of each of i) TPG Advisors III, Inc., which is the general partner of TPG Partners III, which in turn is the

managing member of TPG Newton III, LLC; and ii) TPG Advisors IV, Inc., which is the general partner of TPG GenPar IC,

L.P., which in turn is a) the general partner of TPG Partners IV, L.P. and b) the managing member of TPG Newton Co-Invest

I, LLC. By virtue of their position in relation to the TPG Entities, Mr. Bonderman, Mr. Coulter and Mr. Price may be

deemed to have investment powers and beneficial ownership with respect to the securities described herein. Each of Mr.

Bonderman, Mr. Coulter and Mr. Price disclaims beneficial ownership of such securities. Neither Mr. Coslet nor Ms.

Wheeler has voting or dispositive power over any of the shares of common stock that may be deemed to be beneficially

owned by Texas Pacific Group.

(3) Includes the 1,000,000 shares owned by Newton Holding, LLC over which Warburg Pincus Private Equity VIII, L.P.,

Warburg Pincus Netherlands Private Equity VIII, C.V. I, Warburg Pincus Germany Private Equity VIII K. G. (collectively,

"WP VIII") and Warburg Pincus Private Equity IX, L.P. ("WP IX") may be deemed, as a result of their ownership of 43.25%

of Newton Holding, LLC's total outstanding shares and certain provisions under the Newton Holding, LLC operating

agreement, to have shared voting or dispositive power. Warburg Pincus Partners, LLC, a direct subsidiary of Warburg

Pincus & Co. ("WP"), is the general partner of WP VIII. Warburg Pincus IX, LLC, an indirect subsidiary of WP, is the

general partner of WP IX. Warburg Pincus LLC ("WP LLC") is the manager of each of WP VIII and WP IX. WP and WP

LLC may be deemed to beneficially own all of the shares of common stock owned by WP VIII and WP IX. Messrs. Barr,

Lapidus, and Lee disclaim beneficial ownership of all of the shares of common stock owned by the Warburg Pincus entities.

(4) Messrs. Bar, Lapidus and Lee, as partners of WP and managing directors and members of WP LLC, may be deemed to

beneficially own all of the shares of common stock beneficially owned by the Warburg Pincus entities. Messrs. Barr,

Lapidus and Lee disclaim any beneficial ownership of these shares of common stock.

(5) Mr. Coulter, as managing general partner of Texas Pacific Group, may be deemed to beneficially own all of the shares of

common stock owned by the TPG Entities. Mr. Coulter disclaims any beneficial ownership of these shares of common

stock. Neither Mr. Coslet nor Ms. Wheeler has voting or dispositive power over any of the shares of common stock that may

be deemed to be beneficially owned by Texas Pacific Group.

(6) Includes 10,012 shares not currently owned, but which are issuable upon the exercise of stock options that are currently

exercisable or that become exercisable within 60 days.

(7) Includes 2,314 shares not currently owned, but which are issuable upon the exercise of stock options that are currently

exercisable or that become exercisable within 60 days.

65