Neiman Marcus 2005 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2005 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

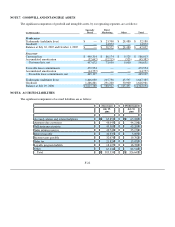

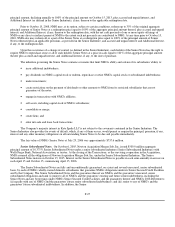

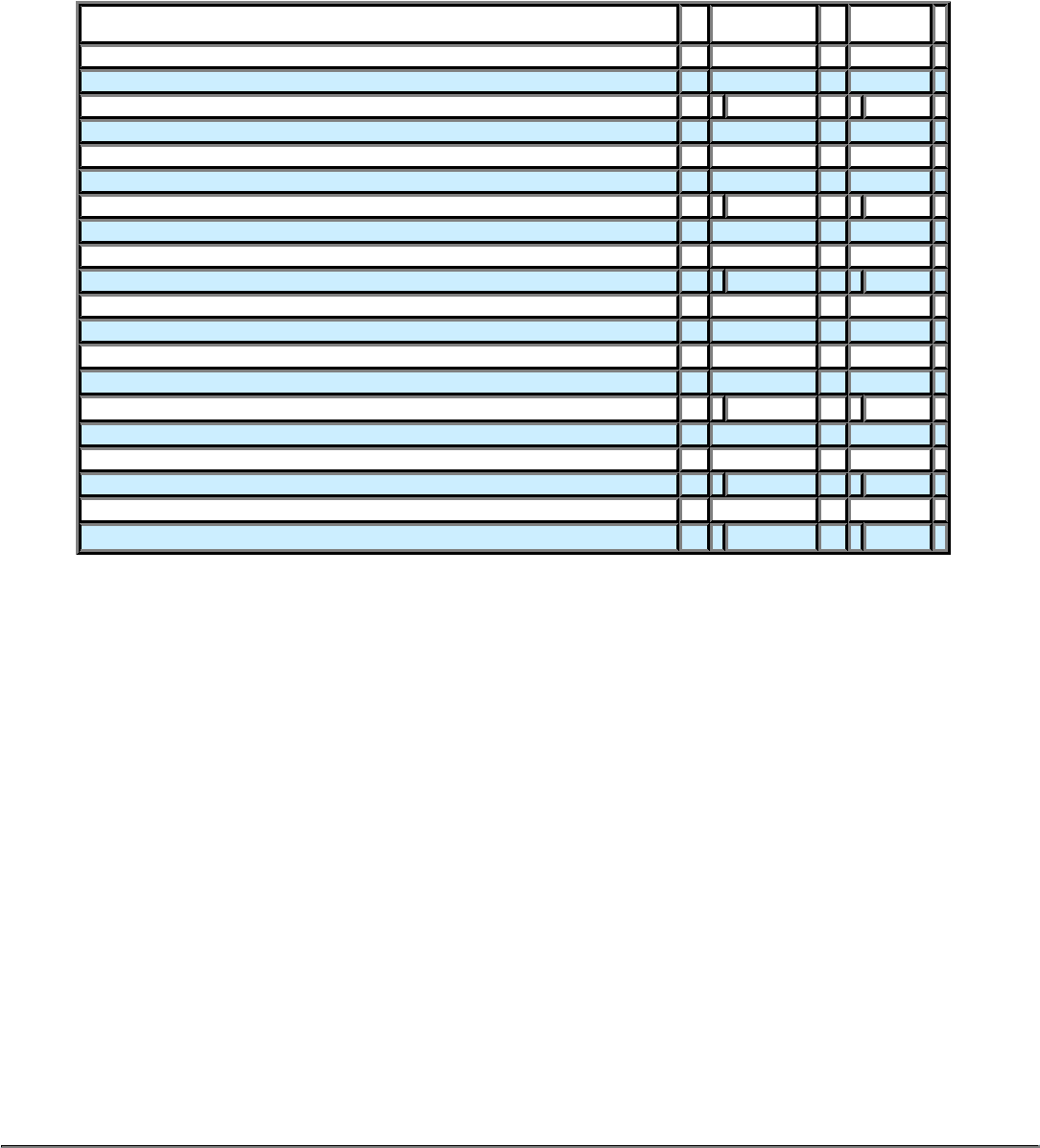

Significant components of our net deferred income tax asset are as follows:

(in thousands)

July 29,

2006

July 30,

2005

Deferred income tax assets:

Accruals and reserves $ 31,679 $ 22,955

Employee benefits 61,247 52,794

Pension obligation 31,214 6,327

Other 2,044 2,035

Total deferred tax assets $ 126,184 $ 84,111

Deferred income tax liabilities:

Inventory $ (10,993 ) $ (11,674 )

Depreciation and amortization (56,053 ) (39,343 )

Intangible assets (1,082,867 ) —

Other (4,064 )(3,610 )

Total deferred tax liabilities (1,153,977 )(54,627 )

Net deferred income tax asset (liability) $ (1,027,793 )$ 29,484

Net deferred income tax asset (liability):

Current $ 31,572 $ 16,598

Non-current (1,059,365 )12,886

Total $ (1,027,793 )$ 29,484

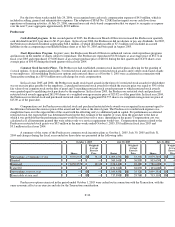

The net deferred tax liability of $1,027.8 million at July 29, 2006 increased from a $29.5 million net deferred asset at July 30,

2005. This increase was comprised of 1) $1,123.0 million deferred tax liability related to purchase accounting valuations and 2) $7.2

million of deferred tax liabilities related to financial instruments charged directly to other comprehensive loss in the statement of

shareholders' equity net of 3) $72.9 million deferred tax benefit for fiscal year 2006. We believe it is more likely than not that we will

realize the benefits of our recorded deferred tax assets.

NOTE 12. EMPLOYEE BENEFIT PLANS

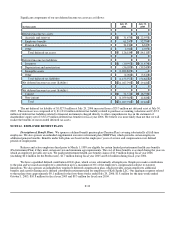

Description of Benefit Plans. We sponsor a defined benefit pension plan (Pension Plan) covering substantially all full-time

employees. We also sponsor an unfunded supplemental executive retirement plan (SERP Plan) which provides certain employees

additional pension benefits. Benefits under both plans are based on the employees' years of service and compensation over defined

periods of employment.

Retirees and active employees hired prior to March 1, 1989 are eligible for certain limited postretirement health care benefits

(Postretirement Plan) if they meet certain service and minimum age requirements. The cost of these benefits is accrued during the years in

which an employee provides services. We paid postretirement health care benefit claims of $1.9 million during fiscal year 2006

(including $0.4 million for the Predecessor), $1.7 million during fiscal year 2005 and $1.8 million during fiscal year 2004.

We have a qualified defined contribution 401(k) plan, which covers substantially all employees. Employees make contributions

to the plan and we match an employee's contribution up to a maximum of 6% of the employee's compensation subject to statutory

limitations. We also sponsor an unfunded key employee deferred compensation plan, which provides certain employees additional

benefits and a profit sharing and a defined contribution retirement plan for employees of Kate Spade LLC. Our aggregate expense related

to these plans were approximately $9.1 million for the forty-three weeks ended July 29, 2006, $1.8 million for the nine weeks ended

October 1, 2005, $10.8 million for fiscal year 2005 and $9.5 million for fiscal year 2004.

F-32