Neiman Marcus 2005 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2005 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In fiscal year 2007, we anticipate capital expenditures for planned new stores in Charlotte, Austin, suburban Boston, Long

Island, the greater Los Angeles area and suburban Seattle and for renovations of our Atlanta store and San Diego stores, as well as the

main Bergdorf Goodman store. We also expect to make technology related expenditures to enhance existing systems and reporting

capabilities in a number of areas, including our warehousing systems at Direct Marketing.

We receive allowances from developers related to the construction of our stores thereby reducing our cash investment in these

stores. We record these allowances as deferred real estate credits which are recognized as a reduction of rent expense on a straight-line

basis over the lease term. We received construction allowances aggregating $32.0 million in fiscal year 2006 and $25.6 million in fiscal

year 2005.

Competition

The specialty retail industry is highly competitive and fragmented. We compete for customers with specialty retailers, traditional

and high-end department stores, national apparel chains, vendor-owned proprietary boutiques, individual specialty apparel stores and

direct marketing firms. We compete for customers principally on the basis of quality and fashion, customer service, value, assortment and

presentation of merchandise, marketing and customer loyalty programs and, in the case of Neiman Marcus and Bergdorf Goodman, store

ambiance. Retailers that compete with us for distribution of luxury fashion brands include Saks Fifth Avenue, Nordstrom, Barney's New

York and other national, regional and local retailers. Many of these competitors have greater resources than we do. In addition, following

consummation of the Transactions many of those competitors are significantly less leveraged than we are, and therefore may have greater

flexibility to respond to changes in our industry.

We believe we are differentiated from other national retailers by our distinctive merchandise assortment, which we believe is

more upscale than other high-end department stores, excellent customer service, prime real estate locations and elegant shopping

environment. We believe we differentiate ourselves from regional and local high-end luxury retailers through our diverse product

selection, strong national brand, loyalty programs, customer service, prime shopping locations and strong vendor relationships that allow

us to offer the top merchandise from each vendor. Vendor-owned proprietary boutiques and specialty stores carry a much smaller

selection of brands and merchandise, lack the overall shopping experience we provide and have a limited number of retail locations.

Employees

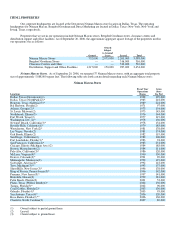

As of September 1, 2006, we had approximately 17,200 employees. Neiman Marcus stores had approximately 14,200

employees, Bergdorf Goodman stores had approximately 1,200 employees, Direct Marketing had approximately 1,700 employees and

Neiman Marcus Group had approximately 90 employees. Our staffing requirements fluctuate during the year as a result of the seasonality

of the retail industry. We hire additional temporary associates and increase the hours of part-time employees during seasonal peak selling

periods. None of our employees is subject to a collective bargaining agreement, except for approximately 14% of the Bergdorf Goodman

employees. We believe that our relations with our employees are good.

Seasonality

Our business, like that of most retailers, is affected by seasonal fluctuations in customer demand, product offerings and working

capital expenditures. For additional information on seasonality, see Item 7, "Management's Discussion and Analysis of Financial

Condition and Results of Operations—Executive Overview—Seasonality."

10