Neiman Marcus 2005 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2005 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Based upon currently available information, we will not be required to make contributions to the Pension Plan for the plan year

ended July 31, 2006.

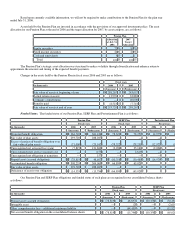

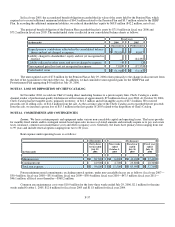

Assets held by the Pension Plan are invested in accordance with the provisions of our approved investment policy. The asset

allocation for our Pension Plan at the end of 2006 and the target allocation for 2007, by asset category, are as follows:

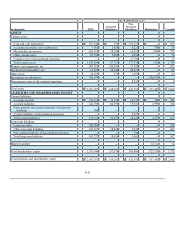

Pension Plan

Allocation

at July 31,

2006

2007

Target

Allocation

Equity securities 73 % 80 %

Fixed income securities 24 % 20 %

Cash and equivalents 3%—

Total 100 %100 %

The Pension Plan's strategic asset allocation was structured to reduce volatility through diversification and enhance return to

approximate the amounts and timing of the expected benefit payments.

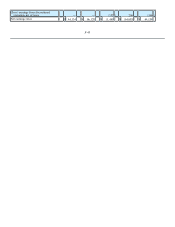

Changes in the assets held by the Pension Plan in fiscal years 2006 and 2005 are as follows:

Fiscal years

(in thousands) 2006 2005

(Successor) (Predecessor)

Fair value of assets at beginning of year $ 288,267 $ 243,097

Actual return on assets 13,976 32,888

Company contributions — 20,000

Benefits paid (8,523 ) (7,718 )

Fair value of assets at end of year $ 293,720 $ 288,267

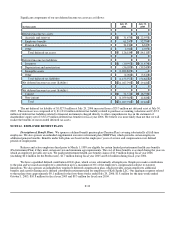

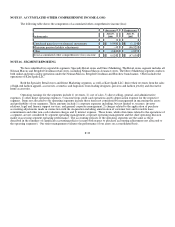

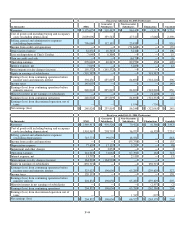

Funded Status. The funded status of our Pension Plan, SERP Plan and Postretirement Plan is as follows:

Pension Plan SERP Plan Postretirement Plan

Fiscal years Fiscal years Fiscal years

(in thousands) 2006 2005 2006 2005 2006 2005

(Successor) (Predecessor) (Successor) (Predecessor) (Successor) (Predecessor)

Projected benefit obligation $ 364,720 $ 361,434 $ 78,322 $ 78,259 $ 12,975 $ 15,755

Fair value of plan assets 293,720 288,267 — — —

Excess of projected benefit obligation over

fair value of plan assets (71,000 ) (73,167 ) (78,322 ) (78,259 ) (12,975 ) (15,755

Unrecognized net actuarial loss (gain) (7,819 ) 121,862 (2,036 ) 25,160 (2,004 ) (2,515

Unrecognized prior service (income) cost — (155 ) — 2,619 —

Unrecognized net obligation at transition — 157 — — —

Prepaid asset (accrued obligation) $ (78,819 )$ 48,697 $ (80,358 )$ (50,480 )$ (14,979 )$ (18,109

Accumulated benefit obligation $ 308,255 $ 304,063 $ 66,890 $ 65,028

Fair value of plan assets 293,720 288,267 — —

Deficiency of assets over obligation $ (14,535 )$ (15,796 )$ (66,890 )$ (65,028 )

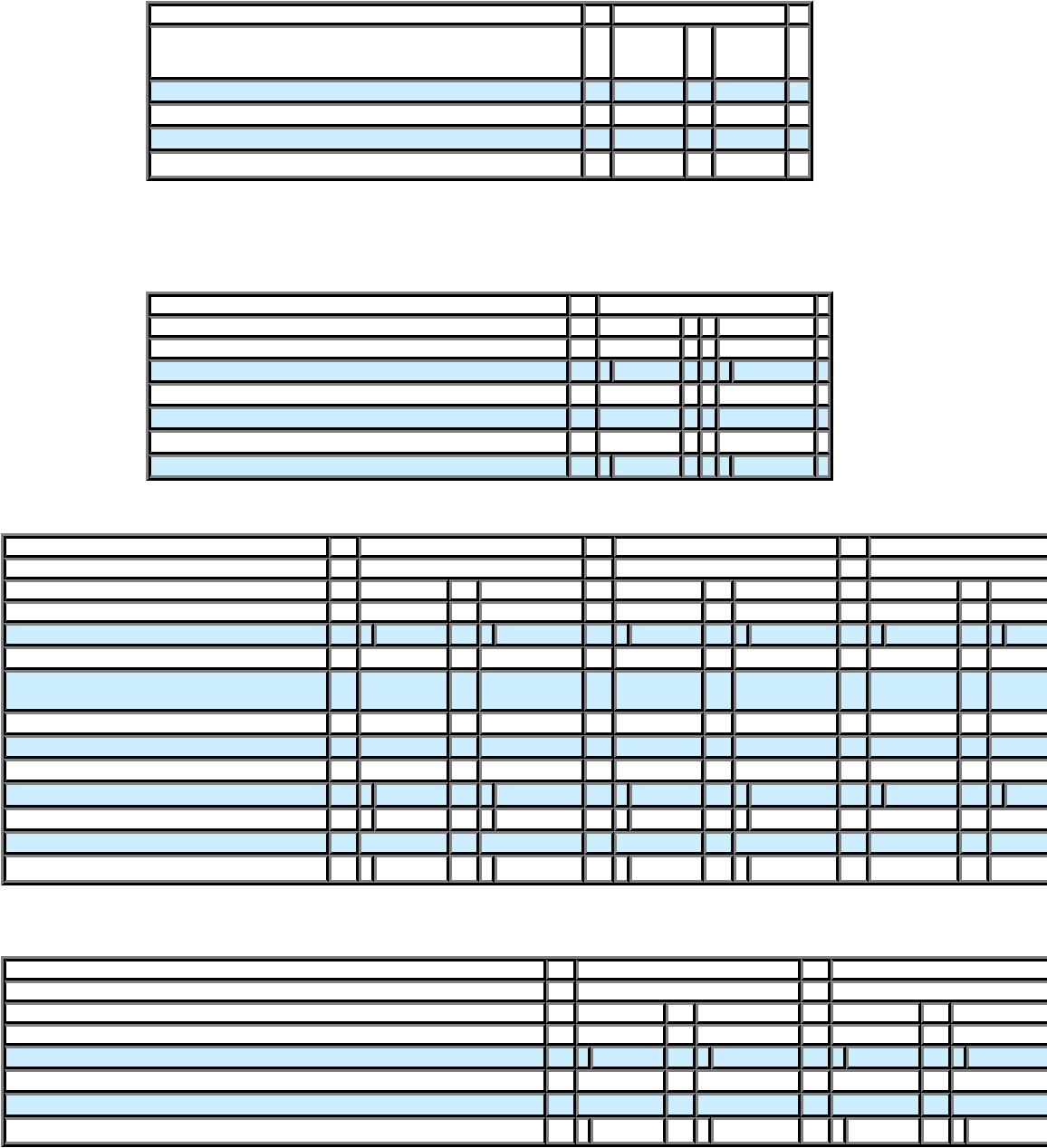

Our Pension Plan and SERP Plan obligations and funded status of such plans are recognized in our consolidated balance sheets

as follows:

Pension Plan SERP Plan

Fiscal years Fiscal years

(in thousands) 2006 2005 2006 2005

(Successor) (Predecessor) (Successor) (Predecessor)

Prepaid asset (accrued obligation) $ (78,819 ) $ 48,697 $ (80,358 ) $ (50,480

Intangible asset — (2 ) — (2,619

Other comprehensive loss—additional minimum liability — (64,491 )— (11,929

Net accrued benefit obligation in the consolidated balance sheets $ (78,819 )$ (15,796 )$ (80,358 )$ (65,028