Neiman Marcus 2005 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2005 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

accreting exercise price, vesting and expiration of the Options, the grant date was deemed to be October 6, 2005. Mr. Tansky

was granted the option to purchase 9,079.7947 shares considered Performance Options and 7,269.3851 shares that are

considered Fair Value Options. His Performance Options vest and become exercisable in twenty-five percent (25%)

increments on each of the first four anniversary dates of October 6, 2005. His Fair Value Options vest and become

exercisable with respect to 459.5392 shares on the first anniversary date of October 6, 2005 with the remaining shares vesting

and becoming exercisable in 2,269.9486 share increments on the next three anniversary dates of October 6, 2005. Fifty-

percent (50%) of each nonqualified stock option granted under the Management Equity Incentive Plan to Karen W. Katz,

James E. Skinner, Brendan L. Hoffman, and James J. Gold is considered Performance Options and fifty-percent (50%) is

considered Fair Value Options. The Performance Options and Fair Value Options granted to the Named Executive Officers,

other than to Mr. Tansky, vest and become exercisable twenty-percent (20%) on the first anniversary date of October 6, 2005

and thereafter in forty-eight equal monthly installments over the forty-eight months following the first anniversary of October

6, 2005. Vesting of the options accelerates in certain circumstances following a change of control.

(2) Based on a total of 74,433.0770 shares subject to options granted to employees under the Plan during fiscal year 2006.

(3) These amounts represent the estimated present value of these stock options on the date of grant calculated using the Black-

Scholes option pricing model, based on the following assumptions used in developing the grant valuations: an expected

volatility of 29.72% determined using implied volatilities; an expected term to exercise of five years from the date of grant; a

risk-free interest rate of 4.23%; and a dividend yield of zero. In accordance with SEC rules, the dollar amounts are not

intended to forecast possible future appreciation.

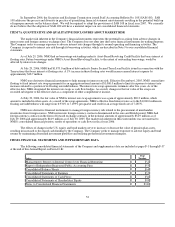

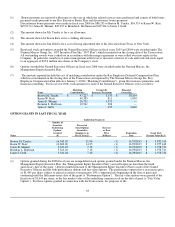

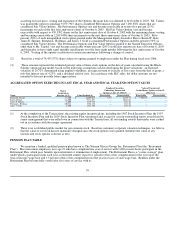

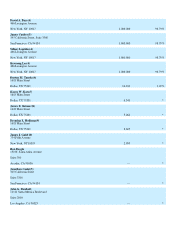

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR AND FISCAL YEAR-END OPTION VALUES

Number of Securities Value of Unexercised

Name

Shares

Acquired on

Exercise (#)(1) Value Realized ($)

Underlying Unexercised In-the-Money Options at July 29,

Options at July 29, 2006 (#) 2006 ($)(2)

Exercisable Unexercisable Exercisable Unexercisable

Burton M. Tansky 371,200 $ 26,069,025 7,283 16,349.18 $ 7,908,125 —

Karen M. Katz 146,500 9,571,693 — 10,682.08 — —

James E. Skinner 81,000 5,369,270 — 5,341.04 — —

Brendan L. Hoffman 100,542 5,568,470 — 5,341.04 — —

James J. Gold 28,600 1,634,580 — 5,341.04 — —

(1) At the completion of the Transactions, the existing equity incentive plans, including the 1987 Stock Incentive Plan, the 1997

Stock Incentive Plan and the 2005 Stock Incentive Plan, terminated and, except for certain outstanding equity awards held by

senior management that were rolled over in connection with the Transactions, all outstanding awards thereunder were cashed

out in accordance with the merger agreement.

(2) There is no established public market for our common stock. Based on customary corporate valuation techniques, we believe

that the value of our stock has not materially changed since the stock options were granted, therefore the value of any

unexercised stock options is shown as zero.

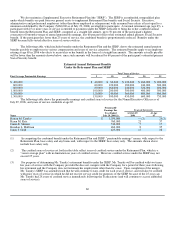

PENSION PLAN TABLE

We maintain a funded, qualified pension plan known as The Neiman Marcus Group, Inc. Retirement Plan (the "Retirement

Plan"). Most non-union employees over age 21 who have completed one year of service with 1,000 or more hours participate in the

Retirement Plan, which pays benefits upon retirement or termination of employment. The Retirement Plan is a "career-average" plan,

under which a participant earns each year a retirement annuity equal to 1 percent of his or her compensation for the year up to the

Social Security wage base and 1.5 percent of his or her compensation for the year in excess of such wage base. Benefits under the

Retirement Plan become fully vested after five years of service with us.

59