Neiman Marcus 2005 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2005 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

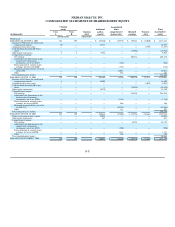

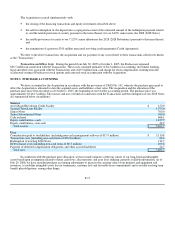

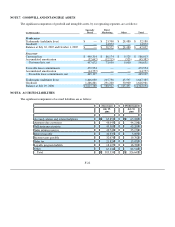

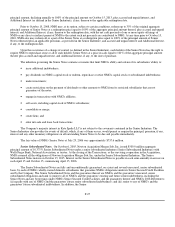

The purchase price has been allocated as follows (in millions):

Cash consideration:

Paid to shareholders $ 5,092.9

Transaction costs 63.5

5,156.4

Non-cash consideration 36.7

Total consideration 5,193.1

Net assets acquired at historical cost 1,638.2

Adjustments to state acquired assets at fair value:

1) Increase carrying value of property and equipment $ 137.8

2) Increase carrying value of inventory 38.1

3) Write-off historical goodwill and tradenames (71.5)

4) Record intangible assets acquired

Customer lists 586.0

Favorable lease commitments 480.0

Tradenames 1,667.4

5) Write-off other assets, primarily debt issue costs (3.7)

6) Adjustment to state 2008 Notes at redemption value (6.2)

7) Adjustment to state 2028 Debentures at fair value 4.5

8) Write-off deferred real estate credits 90.2

9) Increase in long-term benefit obligations, primarily pension obligations (57.6)

10) Tax impact of purchase accounting adjustments (1,049.3)

11) Increase carrying values of assets of Gurwitch Products, L.L.C. 41.0

Deemed dividend to management shareholders 69.2 1,925.9

Net assets acquired at fair value 3,564.1

Goodwill at Acquisition date $ 1,629.0

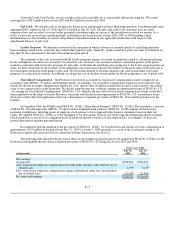

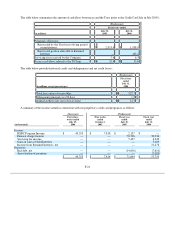

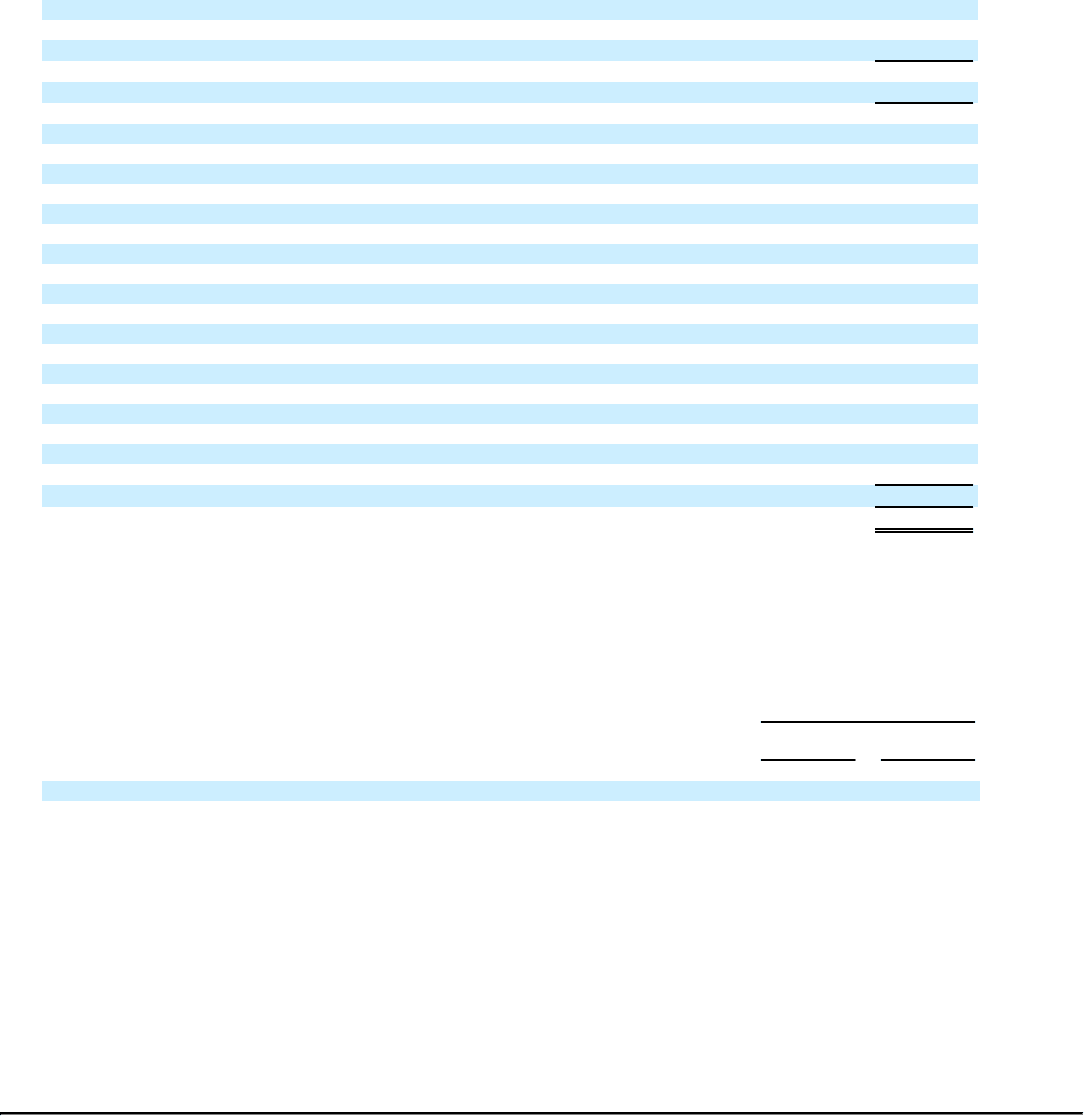

Pro Forma Financial Information. The following unaudited pro forma results of operations assume that the Transactions

occurred on August 1, 2004. The following unaudited pro forma results reflect Gurwitch Products, L.L.C. as a discontinued operation and

do not give effect to the sale of our credit card receivables, which was completed on July 7, 2005, or the disposition of Chef's Catalog,

which was completed on November 8, 2004. This unaudited pro forma information should not be relied upon as necessarily being

indicative of the historical results that would have been obtained if the Transactions had actually occurred on that date, nor the results that

may be obtained in the future.

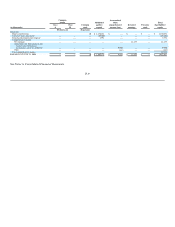

Fiscal years ended

July 29,

2006

July 30,

2005

Revenues $ 4,105,596 $ 3,774,798

Net income $ 44,692 $ 35,517

Pro forma adjustments for fiscal year 2006 consist primarily of adjustments for the nine-week Predecessor period prior to the

Acquisition for 1) depreciation and amortization charges of $13.4 million and 2) interest expense of $44.4 million offset by 3) the reversal

of the historical non-cash charges of $39.6 million to cost of goods sold recorded subsequent to the Acquisition related to the step-up in

the carrying value of our inventories as of the Acquisition date.

Pro forma adjustments for fiscal year 2005 consist primarily of 1) non-cash charges of $39.6 million to cost of goods sold related

to the step-up in the carrying value of our inventories as of the Acquisition date, 2) depreciation and amortization charges aggregating

$77.5 million and 3) interest expense of $225.0 million.

F-18