Neiman Marcus 2005 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2005 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Brendan L. Hoffman has been President and Chief Executive Officer of Neiman Marcus Direct since December 2002. Mr.

Hoffman served as Vice President of the Neiman Marcus Last Call Clearance Division from August 2000 to December 2002, and as a

Divisional Merchandise Manager of Bergdorf Goodman from October 1998 to August 2000.

James J. Gold has been President and Chief Executive Officer of Bergdorf Goodman since May 2004. Mr. Gold served as

Senior Vice President, General Merchandise Manager of Neiman Marcus Stores from December 2002 to May 2004, as Division

Merchandise Manager from June 2000 to December 2002 and as Vice President of the Neiman Marcus Last Call Clearance Division

from March 1997 to June 2000.

Code of Ethics

The Board has adopted The Neiman Marcus Group, Inc. Code of Ethics and Conduct which is applicable to all our directors,

officers and employees, as well as a separate Code of Ethics for Financial Professionals that applies to all financial employees

including the Chief Executive Officer, the Chief Financial Officer and the Principal Accounting Officer. Both the Code of Ethics and

Conduct and the Code of Ethics for Financial Professionals may be accessed through our website at www.neimanmarcusgroup.com

under the "Investor Information – Corporate Governance" section. Requests for printed copies may be made in writing to The Neiman

Marcus Group, Inc., Attn. Investor Relations, One Marcus Square, 1618 Main Street, Dallas, Texas 75201.

Board Committees

Our Board of Directors has established an audit committee, an executive committee and a compensation committee. The

members of our audit committee are David A. Barr, Carrie Wheeler, Ron Beegle and Sidney Lapidus. The audit committee

recommends the annual appointment of auditors with whom the audit committee reviews the scope of audit and non-audit assignments

and related fees, accounting principles we use in financial reporting, internal auditing procedures and the adequacy of our internal

control procedures. The members of our executive committee are Jonathan Coslet, Kewsong Lee, and Burton M. Tansky. The

executive committee manages the affairs of the Company as necessary between meetings of our Board of Directors and acts on

matters that must be dealt with prior to the next scheduled Board meeting. The members of our compensation committee are Jonathan

Coslet, Kewsong Lee, and John G. Danhakl. The compensation committee reviews and approves the compensation and benefits of

our employees, directors and consultants, administers our employee benefit plans, authorizes and ratifies stock option and/or restricted

stock grants and other incentive arrangements, and authorizes employment and related agreements.

Each of the Sponsors has the right to have at least one of its directors sit on each committee of the Board of Directors, to the

extent permitted by applicable laws and regulations.

Audit Committee Financial Expert

The Board of Directors has determined that David A. Barr, Chairman of the Audit Committee, meets the criteria set forth in

the rules and regulations of the SEC for an "audit committee financial expert."

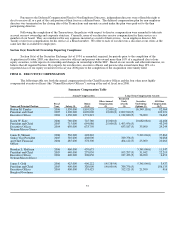

Director Compensation

In fiscal year 2006 prior to the completion of the Transactions, each independent director of NMG was paid an annual

retainer fee of $60,000. The chairman of the Audit Committee received an additional $20,000 per year, and other committee chairs

each received an additional $15,000 per year. Board members did not receive per-meeting fees. Upon the consummation of the

Transactions, each individual serving as a director prior to the Transactions became entitled to a lifetime discount at the Company's

stores on the same terms applicable to the individual immediately prior to the Transactions. Each independent director was also

entitled to receive additional compensation in the form of stock-based units in an amount equal to the value of the annual cash

retainer. The number of stock-based units was calculated quarterly by dividing $15,000 (the amount of the quarterly cash retainer) by

the trailing five-day average of the high and low price of the Class A Common Stock at the end of each fiscal quarter. Dividend

equivalents in the form of additional units representing Class A Common Stock were credited to each independent director's account

on each dividend payment date equal to (i) the per-share cash dividend divided by the average of the high and low price of our Class A

Common Stock on the dividend payment date, multiplied by (ii) the number of units reflected in the independent director's account on

the day before the dividend payment date. The value of each of the independent director's stock-based units was paid in cash on the

completion of the merger. The stock-based units were valued for payment by multiplying the applicable number of units by the

merger consideration. These stock-based units did not carry voting or dispositive rights.

56