Neiman Marcus 2005 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2005 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A large percentage of our merchandise assortment, particularly in the apparel, fashion accessories and shoe categories, is ordered

months in advance of the introduction of such goods. For example, women's apparel, men's apparel and shoes are typically ordered six to

nine months in advance of the products being offered for sale while handbags, jewelry and other categories are typically ordered three to

six months in advance. As a result, inherent in the successful execution of our business plans is our ability both to predict the fashion

trends that will be of interest to our customers and to anticipate future spending patterns of our customer base.

We monitor the sales performance of our inventories throughout each season. We seek to order additional goods to supplement

our original purchasing decisions when the level of customer demand is higher than originally anticipated. However, in certain

merchandise categories, particularly fashion apparel, our ability to purchase additional goods can be limited. This can result in lost sales

in the event of higher than anticipated demand of the fashion goods we offer or a higher than anticipated level of consumer spending.

Conversely, in the event we buy fashion goods that are not accepted by the customer or the level of consumer spending is less than we

anticipated, we typically incur a higher than anticipated level of markdowns, net of vendor allowances, to sell the goods that remain at the

end of the season, resulting in lower operating profits. We believe that the experience of our merchandising and selling organizations

helps to minimize the inherent risk in predicting fashion trends.

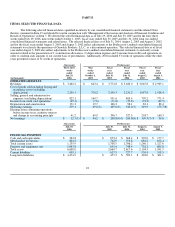

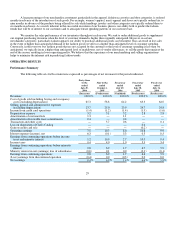

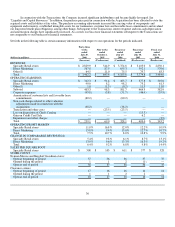

OPERATING RESULTS

Performance Summary

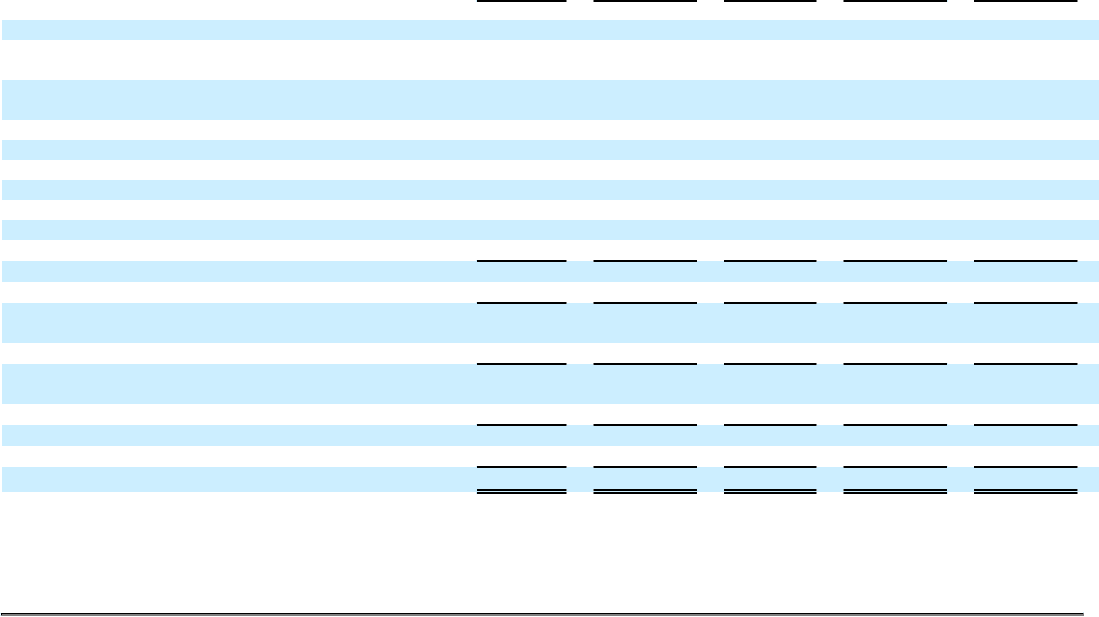

The following table sets forth certain items expressed as percentages of net revenues for the periods indicated.

Forty-three

weeks

ended

July 29,

2006

Nine weeks

ended

October 1,

2005

Fiscal year

ended

July 29,

2006

Fiscal year

ended

July 30,

2005

Fiscal year

ended

July 31,

2004

(Successor) (Predecessor) (Combined) (Predecessor) (Predecessor)

Revenues 100.0% 100.0% 100.0% 100.0% 100.0%

Cost of goods sold including buying and occupancy

costs (excluding depreciation) 65.3 58.8 64.2 63.3 64.0

Selling, general and administrative expenses

(excluding depreciation) 23.7 25.0 23.9 24.7 24.8

Income from credit card operations (1.4) (1.2) (1.4) (1.9) (1.6)

Depreciation expense 3.2 3.1 3.2 2.8 2.8

Amortization of customer lists 1.3 — 1.1 — —

Amortization of favorable lease commitments 0.4 — 0.4 — —

Transaction and other costs — 3.7 0.6 — 0.1

Loss on disposition of Chef's Catalog — — — 0.4 —

Gain on credit card sale — — — (0.2)—

Operating earnings 7.5 10.7 8.0 10.8 9.9

Interest expense (income), net 6.3 (0.1)5.3 0.3 0.5

Earnings from continuing operations before income

taxes and minority interest 1.2 10.9 2.7 10.5 9.4

Income taxes 0.4 4.0 1.0 3.9 3.4

Earnings from continuing operations before minority

interest 0.8 6.9 1.7 6.7 5.9

Minority interest in net (earnings) loss of subsidiaries (0.0)0.1 0.0 (0.1)(0.1)

Earnings from continuing operations 0.8 6.9 1.7 6.6 5.9

(Loss) earnings from discontinued operation (0.4)0.0 (0.3)0.0 0.0

Net earnings 0.4%6.9%1.4%6.6%5.9%

29