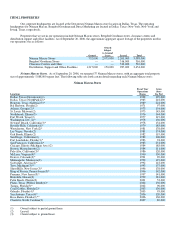

Neiman Marcus 2005 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2005 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

addition, we incur significant additional expenses in the period leading up to the months of November and December in anticipation of

higher sales volume in those periods, including for additional inventory, advertising and employees.

Our business is affected by foreign currency fluctuations.

We purchase a substantial portion of our inventory from foreign suppliers whose cost to us is affected by the fluctuation of their

local currency against the dollar or who price their merchandise in currencies other than the dollar. Accordingly, changes in the value of

the dollar relative to foreign currencies may increase our cost of goods sold and, if we are unable to pass such cost increases on to our

customers, decrease our gross margins and ultimately our earnings. Fluctuations in the Euro-dollar exchange rate affect us most

significantly; however, we source goods from numerous countries and thus are affected by changes in numerous currencies and,

generally, by fluctuations in the U.S. dollar relative to such currencies. Although we hedge some exposures to changes in foreign currency

exchange rates arising in the ordinary course of business, foreign currency fluctuations may have a material adverse effect on our

business, financial condition and results of operations.

Conditions in, and the United States' relationship with, the countries where we source our merchandise could affect our sales.

A substantial majority of our merchandise is manufactured overseas, mostly in Europe. As a result, political instability or other

events resulting in the disruption of trade from other countries or the imposition of additional regulations relating to or duties upon

imports could cause significant delays or interruptions in the supply of our merchandise or increase our costs, either of which could have

a material adverse effect on our business. If we are forced to source merchandise from other countries, those goods may be more

expensive or of a different or inferior quality from the ones we now sell. The importance to us of our existing designer relationships could

present additional difficulties, as it may not be possible to source merchandise from a given designer from alternative jurisdictions. If we

were unable to adequately replace the merchandise we currently source with merchandise produced elsewhere, our business could be

adversely affected.

Significant increases in costs associated with the production of catalogs and other promotional material may adversely affect our

operating income.

We advertise and promote in-store events, new merchandise and fashion trends through print catalogs and other promotional

materials mailed on a targeted basis to our customers. Significant increases in paper, printing and postage costs could affect the cost of

producing these materials and as a result, may adversely affect our operating income.

We are indirectly owned and controlled by the Sponsors, and their interests as equity holders may conflict with those of our

creditors.

We are indirectly owned and controlled by the Sponsors and certain other equity investors, and the Sponsors have the ability to

control our policies and operations. The interests of the Sponsors may not in all cases be aligned with those of our creditors. For example,

if we encounter financial difficulties or are unable to pay our debts as they mature, the interests of our equity holders might conflict with

our creditors' interests. In addition, our equity holders may have an interest in pursuing acquisitions, divestitures, financings or other

transactions that, in their judgment, could enhance their equity investments, even though such transactions might involve risks to holders

of our indebtedness. Furthermore, the Sponsors may in the future own businesses that directly or indirectly compete with us. One or more

of the Sponsors also may pursue acquisition opportunities that may be complementary to our business, and as a result, those acquisition

opportunities may not be available to us.

If we are unable to enforce our intellectual property rights, or if we are accused of infringing on a third party's intellectual

property rights, our net income may decline.

We and our subsidiaries currently own our trademarks and service marks, including the "Neiman Marcus," "Bergdorf Goodman"

and "Kate Spade" marks. Our trademarks and service marks are registered in the United States and in various foreign countries, primarily

in Europe. The laws of some foreign countries do not protect proprietary rights to the same extent as do the laws of the United States.

Moreover, we are unable to predict the effect that any future foreign or domestic intellectual property legislation or regulation may have

on our existing or future business. The loss or reduction of any of our significant proprietary rights could have an adverse effect on our

business.

Additionally, third parties may assert claims against us alleging infringement, misappropriation or other violations of their

trademark or other proprietary rights, whether or not the claims have merit. Claims like these may be time consuming and expensive to

defend and could result in our being required to cease using the trademark or other rights and selling the allegedly

17