Neiman Marcus 2005 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2005 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

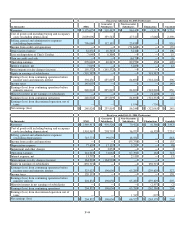

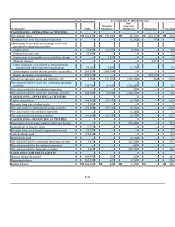

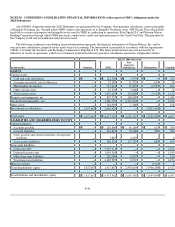

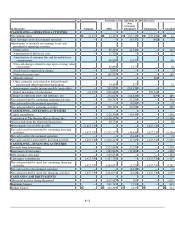

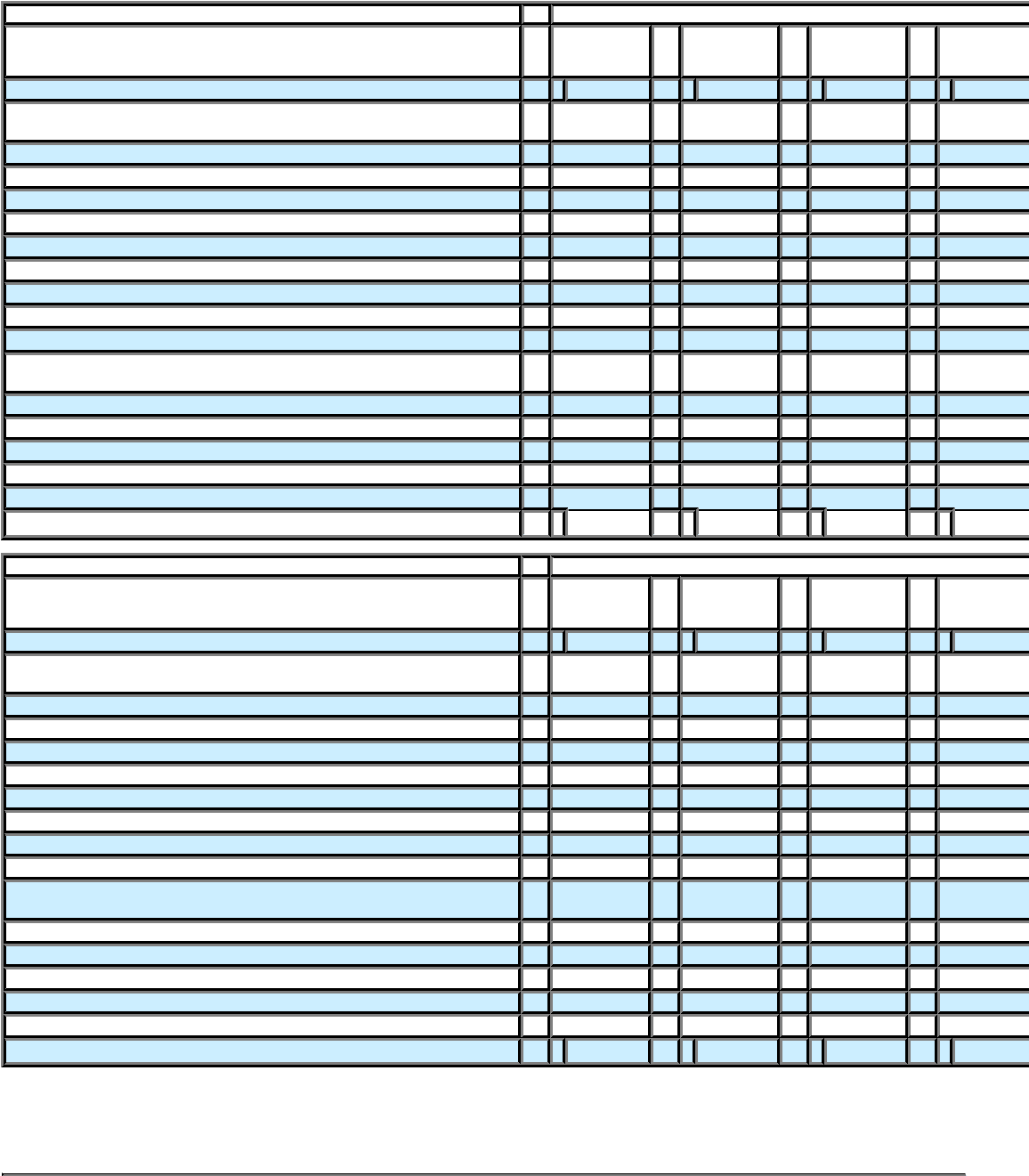

Year ended July 30, 2005 (Predecessor)

(in thousands) NMG

Non-

Guarantor

Subsidiaries Eliminations Consolidated

Revenues $ 3,175,675 $ 604,635 $ (5,512 ) $ 3,774,798

Cost of goods sold including buying and occupancy costs (excluding

depreciation) 2,009,096 386,855 (5,668 ) 2,390,283

Selling, general and administrative expenses (excluding depreciation) 796,060 135,559 — 931,619

Income from credit card operations — (71,644 ) — (71,644

Depreciation expense 84,831 21,515 — 106,346

Loss on disposition of Chef's catalog 7,048 8,300 — 15,348

Gain on Credit Card Sale — (6,170 )— (6,170

Operating earnings 278,640 130,220 156 409,016

Interest expense, net 7,019 5,283 — 12,302

Intercompany royalty charges (income) 195,572 (195,572 ) — —

Equity in earnings of subsidiaries (318,382 )— 318,382 —

Earnings (loss) from continuing operations before income taxes and

minority interest 394,431 320,509 (318,226 ) 396,714

Income taxes 145,607 — — 145,607

Earnings (loss) from continuing operations before minority interest 248,824 320,509 (318,226 ) 251,107

Minority interest in net earnings of subsidiaries — — (3,107 )(3,107

Earnings (loss) from continuing operations 248,824 320,509 (321,333 ) 248,000

Earnings (loss) from discontinued operation, net of taxes — 1,554 (730 )824

Net earnings (loss) $ 248,824 $ 322,063 $ (322,063 )$ 248,824

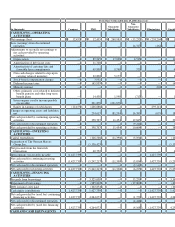

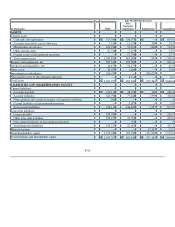

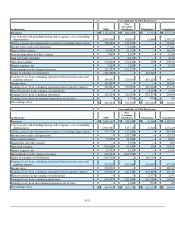

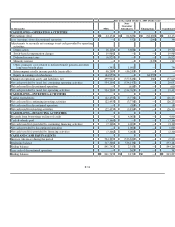

Year ended July 31, 2004 (Predecessor)

(in thousands) NMG

Non-

Guarantor

Subsidiaries Eliminations Consolidated

Revenues $ 2,969,417 $ 520,948 $ (6,366 ) $ 3,483,999

Cost of goods sold including buying and occupancy costs (excluding

depreciation) 1,901,967 335,770 (6,528 ) 2,231,209

Selling, general and administrative expenses (excluding depreciation) 745,773 117,630 — 863,403

Income from credit card operations — (55,750 ) — (55,750

Depreciation expense 77,659 20,392 — 98,051

Impairment and other charges — 3,853 — 3,853

Operating earnings 244,018 99,053 162 343,233

Interest expense, net 13,792 2,111 — 15,903

Intercompany royalty charges (income) 164,994 (164,994 ) — —

Equity in earnings of subsidiaries (259,791 )— 259,791 —

Earnings (loss) from continuing operations before income taxes and

minority interest 325,023 261,936 (259,629 ) 327,330

Income taxes 120,191 — — 120,191

Earnings (loss) from continuing operations before minority interest 204,832 261,936 (259,629 ) 207,139

Minority interest in net earnings of subsidiaries — — (2,957 )(2,957

Earnings (loss) from continuing operations 204,832 261,936 (262,586 ) 204,182

Earnings (loss) from discontinued operation, net of taxes — 1,242 (592 )650

Net earnings (loss) $ 204,832 $ 263,178 $ (263,178 )$ 204,832

F-52