Neiman Marcus 2005 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2005 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Instruments. We use derivative financial instruments to help manage our interest rate risks. At July 29, 2006, we

have outstanding floating and fixed interest rate swap agreements for an aggregate notional amount of $1,000.0 million. These

interest rate swap agreements have been designated as cash flow hedges and are recorded at fair value on the consolidated balance

sheets.

At July 29, 2006, the fair value of NMG's interest rate swap agreements was a gain of approximately $20.2 million, which

amount is included in other assets.

Advertising and Catalog Costs. We incur costs to advertise and promote the merchandise assortment offered by both Specialty

Retail stores and Direct Marketing. Advertising costs incurred by our Specialty Retail stores consist primarily of print media costs related

to promotional materials mailed to our customers. These costs are expensed at the time of mailing to the customer. Advertising costs

incurred by Direct Marketing relate to the production, printing and distribution of our print catalogs and the production of the

photographic content on our websites. We amortize the costs of print catalogs during the periods we expect to generate revenues from

such catalogs, generally three to six months. We expense the costs incurred to produce the photographic content on our websites at the

time the images are first loaded onto the website. We expense website design costs as incurred.

Gift Cards. We sell gift cards at our Specialty Retail stores and through Direct Marketing. Unredeemed gift cards aggregated

$30.1 million at July 29, 2006, $25.6 million at July 30, 2005 and $21.8 million at July 31, 2004. The gift cards sold to our customers

have no stated expiration dates and are subject to actual and /or potential escheatment rights in various of the jurisdictions in which we

operate. As a result, we have not reversed any unredeemed gift card balances into income in fiscal years 2006, 2005 or 2004 pending a

final determination as to the invalidity of current and potential escheatment claims in any applicable jurisdictions with respect to the

unredeemed balances of gift cards.

Loyalty Programs. We maintain customer loyalty programs in which customers accumulate points for qualifying purchases.

Upon reaching certain levels, customers may redeem their points for gifts. Generally, points earned in a given year must be redeemed no

later than ninety days subsequent to the end of the annual program period.

The estimates of the costs associated with the loyalty programs require us to make assumptions related to customer purchasing

levels, redemption rates and costs of awards to be chosen by our customers. Our customers redeem a substantial portion of the points

earned in connection with our loyalty programs for gift cards. At the time the qualifying sales giving rise to the loyalty program points are

made, we defer the portion of the revenues on the qualifying sales transactions equal to the estimate of the retail value of the gift cards to

be issued upon conversion of the points to gift cards. We record the deferral of revenues related to gift card awards under our loyalty

programs as a reduction of revenues. In addition, we charge the cost of all other awards under our loyalty programs to cost of goods sold.

We deferred revenues related to anticipated gift card awards of $28.5 million in fiscal year 2006, $23.8 million in fiscal year 2005 and

$20.8 million in fiscal year 2004 and charged costs of goods sold for the anticipated costs of all other awards of $3.7 million in fiscal year

2006, $4.9 million in fiscal year 2005 and $6.1 million in fiscal year 2004.

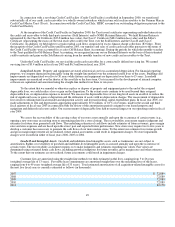

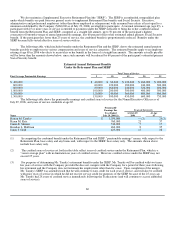

Pension Plan. We sponsor a noncontributory defined benefit pension plan covering substantially all full-time employees. In

calculating our pension obligations and related pension expense, we make various assumptions and estimates after consulting with outside

actuaries and advisors. The annual determination of pension expense involves calculating the estimated total benefits ultimately payable

to plan participants and allocating this cost to the periods in which services are expected to be rendered. We use the projected unit credit

method in recognizing pension liabilities. The Pension Plan is valued annually as of the beginning of each fiscal year.

Significant assumptions related to the calculation of our pension obligation include the discount rate used to calculate the

actuarial present value of benefit obligations to be paid in the future, the expected long-term rate of return on assets held by the Pension

Plan and the average rate of compensation increase by plan participants. We review these actuarial assumptions annually based upon

currently available information.

The assumed discount rate utilized is based on a broad sample of Moody's high quality corporate bond yields as of the

measurement date. The projected benefit payments are matched with the yields on these bonds to determine an appropriate discount rate

for the plan. The discount rate is utilized principally in calculating the actuarial present value of our pension obligation and net pension

expense. At July 29, 2006, the discount rate was 6.25%. To the extent the discount rate increases or decreases, our pension obligation is

decreased or increased, accordingly. The estimated effect of a 0.25% decrease in the discount rate would increase the pension obligation

by $15.7 million and increase annual pension expense by $0.9 million.

50