Neiman Marcus 2005 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2005 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

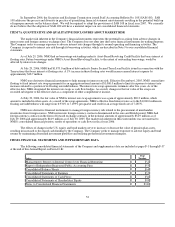

(1) Bonus payments are reported with respect to the year in which the related services were performed and consist of both bonus

payments made pursuant to our Key Executive Bonus Plan and discretionary bonus payments.

Discretionary bonus payments were made in fiscal year 2006 for $86,235 to Burton M. Tansky, $34,555 to Karen W. Katz,

$49,915 to James E. Skinner, $20,937 to Brendan L. Hoffman and $19,344 to James J. Gold.

(2) The amount shown for Mr. Tansky is for a car allowance.

(3) The amount shown for Karen Katz is for a clothing allowance.

(4) The amount shown for Jim Gold is for a cost of living adjustment due to his relocation from Texas to New York.

(5) Restricted stock and options awarded the Named Executive Officers in fiscal years 2005 and 2004 were awarded under The

Neiman Marcus Group, Inc. 1997 Incentive Plan (the "1997 Plan") which terminated on the closing date of the Transactions.

All outstanding awards were cashed out in accordance with the merger agreement or were rolled over into equity in the

Company. In particular, members of senior management rolled over or invested a mixture of cash and restricted stock equal

to an aggregate of $25.6 million into shares of the Company's stock.

(6) Options awarded the Named Executive Officers in fiscal year 2006 were awarded under the Neiman Marcus, Inc.

Management Equity Incentive Plan.

(7) The amounts reported include the cost of matching contributions under the Key Employee Deferred Compensation Plan,

which was terminated on the closing date of the Transactions and replaced by The Neiman Marcus Group, Inc. Key

Employee Compensation Plan effective January 1, 2006 ("Matching Contributions"), group life insurance premiums, and

financial counseling. For fiscal year 2006, such amounts for each of the Named Executive Officers were as follows:

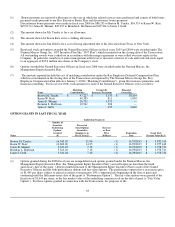

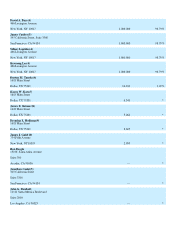

Matching Group Life Financial

Name Contributions Insurance Premiums Counseling

Burton M. Tansky $ 47,227 $ 5,133 $ 30,204

Karen W. Katz 40,585 811 1,090

James E. Skinner 26,791 1,072 —

Brendan L. Hoffman 10,961 386 —

James J. Gold — 437 3,000

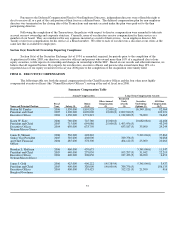

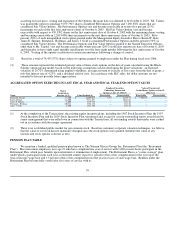

OPTION GRANTS IN LAST FISCAL YEAR

Individual Grants(1)

Name

Number of

Securities

Underlying

Options

Granted

(#)

Percent of

Total Options

Granted to

Employees in

Fiscal Year(2)

Exercise

or Base

Price

($/Share)

Expiration

Date

Grant Date

Present Value($)(3)

Burton M. Tansky 16,349.18 21.96 (1) 11/29/2015 $ 5,832,535

Karen W. Katz 10,682.08 14.35 (1) 11/29/2015 $ 3,957,442

James E. Skinner 5,341.04 7.18 (1) 11/29/2015 $ 1,978,721

Brendan L. Hoffman 5,341.04 7.18 (1) 11/29/2015 $ 1,978,721

James J. Gold 5,341.04 7.18 (1) 11/29/2015 $ 1,978,721

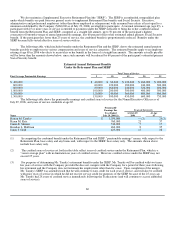

(1) Options granted during the 2006 fiscal year are nonqualified stock options granted under the Neiman Marcus, Inc.

Management Equity Incentive Plan (the "Management Equity Incentive Plan") and will expire no later than the tenth

anniversary date of the grant. Options granted pursuant to the Management Equity Incentive Plan to each of the Named

Executive Officers include both performance options and fair value options. The performance options have an exercise price

of $1,445 per share, subject to annual accretion at ten percent (10%) compound rate beginning on the date of grant and

continuing until the fifth anniversary date of the grant (a "Performance Option"). The fair value options were granted at the

fixed rate of $1,445 per share, or the fair market value of the underlying common stock on the date of grant (a "Fair Value

Option"). For those options granted in connection with the Transactions, for purposes of the

58