Neiman Marcus 2005 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2005 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

principal amount, declining annually to 100% of the principal amount on October 15, 2013, plus accrued and unpaid interest, and

Additional Interest (as defined in the Senior Indenture), if any, thereon to the applicable redemption date.

Prior to October 15, 2008, NMG may, at its option, subject to certain conditions, redeem up to 35% of the original aggregate

principal amount of Senior Notes at a redemption price equal to 109% of the aggregate principal amount thereof, plus accrued and unpaid

interest, and Additional Interest, if any, thereon to the redemption date, with the net cash proceeds of one or more equity offerings of

NMG or any direct or indirect parent of NMG to the extent such net proceeds are contributed to NMG. At any time prior to October 15,

2010, NMG also may redeem all or a part of the Senior Notes at a redemption price equal to 100% of the principal amount of Senior

Notes redeemed plus an applicable premium, as provided in the Senior Indenture, as of, and accrued and unpaid interest and Additional

Interest, if any, to the redemption date.

Upon the occurrence of a change of control (as defined in the Senior Indenture), each holder of the Senior Notes has the right to

require NMG to repurchase some or all of such holder's Senior Notes at a price in cash equal to 101% of the aggregate principal amount

thereof plus accrued and unpaid interest, and Additional Interest, if any, to the date of purchase.

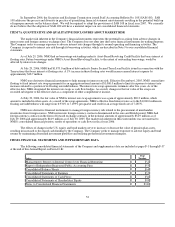

The indenture governing the Senior Notes contains covenants that limit NMG's ability and certain of its subsidiaries' ability to:

• incur additional indebtedness;

• pay dividends on NMG's capital stock or redeem, repurchase or retire NMG's capital stock or subordinated indebtedness;

• make investments;

• create restrictions on the payment of dividends or other amounts to NMG from its restricted subsidiaries that are not

guarantors of the notes;

• engage in transactions with NMG's affiliates;

• sell assets, including capital stock of NMG's subsidiaries;

• consolidate or merge;

• create liens; and

• enter into sale and lease back transactions.

NMG's majority interest in Kate Spade LLC is not subject to the covenants contained in the Senior Indenture. The Senior

Indenture also provides for events of default, which, if any of them occurs, would permit or require the principal, premium, if any, interest

and any other monetary obligations on all outstanding Senior Notes to be due and payable immediately.

Senior Subordinated Notes. On October 6, 2005, Newton Acquisition Merger Sub, Inc. issued $500.0 million aggregate

principal amount of 10.375% Senior Subordinated Notes under a senior subordinated indenture (Senior Subordinated Indenture) with

Wells Fargo Bank, National Association, as trustee. At the closing of the Transactions, as the surviving corporation in the Acquisition,

NMG assumed all the obligations of Newton Acquisition Merger Sub, Inc. under the Senior Subordinated Indenture. The Senior

Subordinated Notes mature on October 15, 2015. Interest on the Senior Subordinated Notes is payable in cash semi-annually in arrears on

each April 15 and October 15, commencing April 15, 2006.

The Senior Subordinated Notes are fully and unconditionally guaranteed, on a joint and several unsecured, senior subordinated

basis, by each of NMG's wholly-owned domestic subsidiaries that guarantee NMG's obligations under its Senior Secured Credit Facilities

and by the Company. The Senior Subordinated Notes and the guarantees thereof are NMG's and the guarantors' unsecured, senior

subordinated obligations and rank (i) junior to all of NMG's and the guarantors' existing and future senior indebtedness, including the

Senior Notes and any borrowings under NMG's Senior Secured Credit Facilities, and the guarantees thereof and NMG's 2028 Debentures;

(ii) equally with any of NMG's and the guarantors' future senior subordinated indebtedness; and (iii) senior to any of NMG's and the

guarantors' future subordinated indebtedness. In addition, the Senior Subordinated Notes are structurally subordinated to all existing and

future liabilities, including trade payables, of NMG's subsidiaries that are not providing guarantees.

42