Neiman Marcus 2005 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2005 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

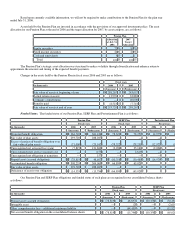

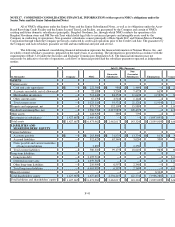

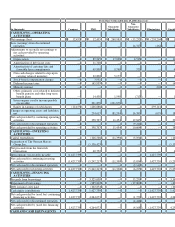

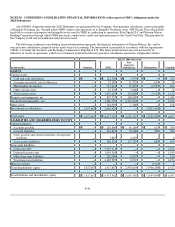

Forty-three weeks ended July 29, 2006 (Successor)

(in thousands) Company NMG

Guarantor

Subsidiaries

Non-

Guarantor

Subsidiaries Eliminations Consolidated

Revenues $ — $ 2,885,321 $ 512,007 $ 66,734 $ (1,843 ) $ 3,462,219

Cost of goods sold including buying and

occupancy costs (excluding depreciation) — 1,885,917 332,938 42,804 (2,522 ) 2,259,137

Selling, general and administrative expenses

(excluding depreciation) — 704,846 97,767 19,491 — 822,104

Income from credit card operations — (44,765 ) (4,588 ) — — (49,353

Depreciation expense — 89,545 17,028 4,513 — 111,086

Amortization of customer lists and favorable

lease commitments — 49,830 9,760 575 — 60,165

Operating earnings — 199,948 59,102 (649 ) 679 259,080

Interest expense, net — 217,664 — 266 — 217,930

Intercompany royalty charges (income) — 201,879 (201,879 ) — —

Equity in earnings of subsidiaries (12,455 )(246,686 )— — 259,141

Earnings (loss) from continuing operations

before income taxes and minority interest 12,455 27,091 260,981 (915 ) (258,462 ) 41,150

Income taxes — 14,636 — — — 14,636

Earnings (loss) from continuing operations

before minority interest 12,455 12,455 260,981 (915 ) (258,462 ) 26,514

Minority interest in net earnings of

subsidiaries — — — — (204 )

Earnings (loss) from continuing operations 12,455 12,455 260,981 (915 ) (258,666 ) 26,310

(Loss) earnings from discontinued operation,

net of taxes — — — (14,317 )462 (13,855

Net earnings (loss) $ 12,455 $ 12,455 $ 260,981 $ (15,232 )$ (258,204 )$ 12,455

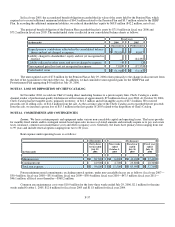

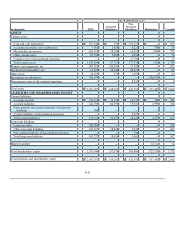

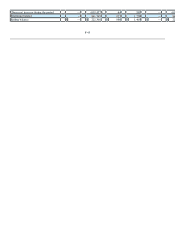

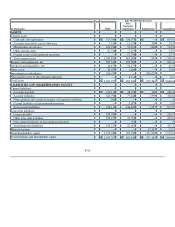

Nine weeks ended October 1, 2005 (Predecessor)

(in thousands) NMG

Guarantor

Subsidiaries

Non-

Guarantor

Subsidiaries Eliminations Consolidated

Revenues $ 530,666 $ 101,556 $ 12,283 $ (1,128 ) $ 643,377

Cost of goods sold including buying and

occupancy costs (excluding

depreciation) 312,454 58,986 7,644 (842 ) 378,242

Selling, general and administrative

expenses (excluding depreciation) 135,278 20,491 4,914 — 160,683

Income from credit card operations (6,994 ) (824 ) — — (7,818 )

Depreciation expense 16,118 3,015 593 — 19,726

Transaction and other costs 23,544 — — — 23,544

Operating earnings 50,266 19,888 (868 ) (286 ) 69,000

Interest (income) expense, net (909 ) — 20 — (889 )

Intercompany royalty charges (income) 46,240 (46,240 ) — — —

Equity in earnings of subsidiaries (64,955 )— — 64,955 —

Earnings (loss) from continuing

operations before income taxes and

minority interest 69,890 66,128 (888 ) (65,241 ) 69,889

Income taxes 25,736 — — — 25,736

Earnings (loss) from continuing

operations before minority interest 44,154 66,128 (888 ) (65,241 ) 44,153

Minority interest in net loss of

subsidiaries — — — 347 347

Earnings (loss) from continuing

operations 44,154 66,128 (888 ) (64,894 ) 44,500