Neiman Marcus 2005 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2005 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

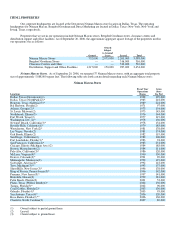

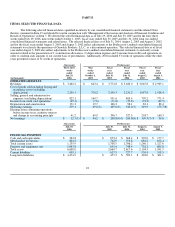

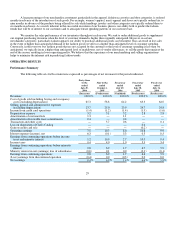

(Successor) (Predecessor)

Forty-three

weeks

ended

July 29,

2006

Nine

weeks

ended

October 1,

2005

Fiscal

year

ended

July 30,

2005

Fiscal

year

ended

July 31,

2004

Fiscal

year

ended

August 2,

2003

Fiscal

year

ended

August 3,

2002

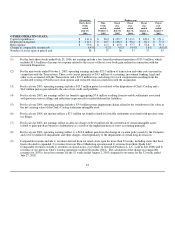

OTHER OPERATING DATA:

Capital expenditures $ 141.0 $ 26.2 $ 199.7 $ 119.1 $ 128.4 $ 171.1

Depreciation expense $ 111.1 $ 19.7 $ 106.3 $ 98.1 $ 82.1 $ 77.3

Rent expense $ 59.6 $ 11.5 $ 65.9 $ 57.7 $ 53.6 $ 53.3

Change in comparable revenues(9) 6.4% 9.2% 9.8% 14.4% 3.8% (4.8)%

Number of stores open at period end 38 37 36 37 37 35

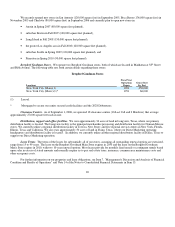

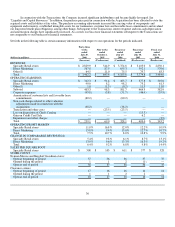

(1) For the forty-three weeks ended July 29, 2006, net earnings include a loss from discontinued operation of $13.9 million, which

includes $13.3 million of income tax expense related to the excess of the tax over book gain realized in connection with the

Gurwitch Disposition.

(2) For the nine weeks ended October 1, 2005, operating earnings includes $23.5 million of transaction and other costs incurred in

connection with the Transactions. These costs consist primarily of $4.5 million of accounting, investment banking, legal and

other costs associated with the Transactions and a $19.0 million non-cash charge for stock compensation resulting from the

accelerated vesting of Predecessor stock options and restricted stock in connection with the Acquisition.

(3) For fiscal year 2005, operating earnings include a $15.3 million pretax loss related to the disposition of Chef's Catalog and a

$6.2 million pretax gain related to the sale of our credit card portfolio.

(4) For fiscal year 2005, net earnings reflect tax benefits aggregating $7.6 million resulting from favorable settlements associated

with previous state tax filings and reductions in previously recorded deferred tax liabilities.

(5) For fiscal year 2004, operating earnings include a $3.9 million pretax impairment charge related to the writedown to fair value in

the net carrying value of the Chef's Catalog tradename intangible asset.

(6) For fiscal year 2004, net income reflects a $7.5 million tax benefit related to favorable settlements associated with previous state

tax filings.

(7) For fiscal year 2003, net earnings reflect an after-tax charge of $14.8 million for the writedown of certain intangible assets

related to prior purchase business combinations as a result of the implementation of a new accounting principle.

(8) For fiscal year 2002, operating earnings reflect 1) a $16.6 million gain from the change in vacation policy made by the Company

and 2) $13.2 million of impairment and other charges, related primarily to the impairment of certain long-lived assets.

(9) Comparable revenues include 1) revenues derived from our retail stores open for more than 52 weeks, including stores that have

been relocated or expanded, 2) revenues from our Direct Marketing operation and 3) revenues from Kate Spade LLC.

Comparable revenues exclude 1) revenues of closed stores, 2) revenues of Gurwitch Products, L.L.C. (sold in July 2006) and 3)

revenues of our previous Chef's Catalog operations (sold in November 2004). The calculation of the change in comparable

revenues for 2003 is based on revenues for the 52 weeks ended August 2, 2003 compared to revenues for the 52 weeks ended

July 27, 2002.

23