Neiman Marcus 2005 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2005 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

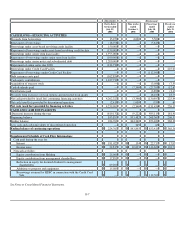

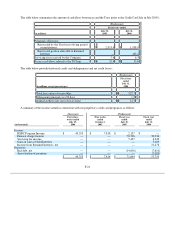

The Predecessor estimated the fair value of each option grant on the date of the grant using the Black-Scholes option pricing

model with the following assumptions used for grants in fiscal years 2005 and 2004:

Fiscal years ended

July 30,

2005

July 31,

2004

Expected life (years) 5 5

Expected volatility 25.0% 32.7%

Risk-free interest rate 3.3% 3.1%

Dividend yield 1.0% —

The weighted-average fair value of options granted was $14.38 in fiscal year 2005 and $14.79 in fiscal year 2004.

The effects on pro forma net earnings of expensing the estimated fair value of stock options are not necessarily representative of

the effects on reported net earnings for future periods due to such factors as the vesting periods of stock options and the potential issuance

of additional stock options in future years.

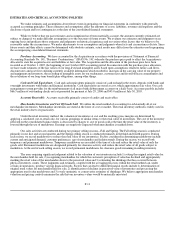

Income Taxes. We are routinely under audit by federal, state or local authorities in the area of income taxes. These audits

include questioning the timing and amount of deductions and the allocation of income among various tax jurisdictions. In evaluating the

exposure associated with various tax filing positions, we accrue charges for probable exposures. Based on our annual evaluations of tax

positions, we believe we have appropriately accrued for probable exposures. To the extent we were to prevail in matters for which

accruals have been established or be required to pay amounts in excess of recorded reserves, our effective tax rate in a given financial

statement period could be materially impacted.

Recent Accounting Pronouncements. In March 2005, the FASB issued FASB Interpretation No. 47, "Accounting for

Conditional Asset Retirement Obligations, an interpretation of FASB Statement No. 143" (FIN 47). FIN 47 clarifies that conditional asset

retirement obligations meet the definition of liabilities and should be recognized when incurred if their fair values can be reasonably

estimated. We adopted FIN 47 as of the beginning of fiscal year 2006 with no material impact on our consolidated financial statements.

In July 2006, the FASB issued FASB Interpretation No. 48, "Accounting for Uncertainty in Income Taxes — an

interpretation of FASB Statement No. 109" (FIN 48), which clarifies the accounting for uncertainty in tax positions. This

Interpretation requires that we recognize in our consolidated financial statements the impact of a tax position, if that position is more

likely than not of being sustained upon examination, based on the technical merits of the position. FIN 48 will be effective for the first

fiscal year beginning after December 15, 2006, or our fiscal year ending August 2, 2008. We have not yet evaluated the impact, if

any, of adopting FIN 48 on our consolidated financial statements.

In September 2006, the Securities and Exchange Commission issued Staff Accounting Bulletin No. 108 (SAB 108). SAB

108 addresses the process and diversity in practice of quantifying financial statement misstatements resulting in the potential build up

of improper amounts on the balance sheet. We will be required to adopt the provisions of SAB 108 in fiscal year 2007. We currently

do not believe that the adoption of SAB 108 will have a material impact on our consolidated financial statements.

NOTE 2. THE TRANSACTIONS

The Transactions. As discussed in Note 1, the Acquisition was completed on October 6, 2005 and was financed by:

• Borrowings under a senior secured asset-based revolving credit facility (Asset-Based Revolving Credit Facility) and a

secured term loan credit facility (Senior Secured Term Loan Facility) (collectively, the Secured Credit Facilities);

• the issuance of 9.0%/9.75% senior notes due 2015 (Senior Notes);

• the issuance of 10.375% senior subordinated notes due 2015 (Senior Subordinated Notes); and

• equity investments funded by direct and indirect equity investments from the Sponsors, co-investors and management.

F-16