Neiman Marcus 2005 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2005 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

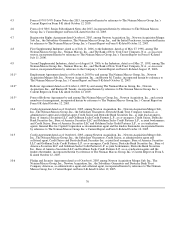

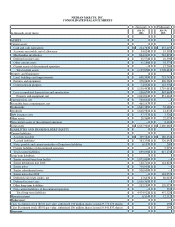

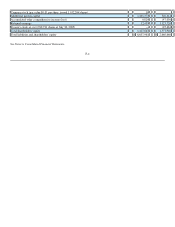

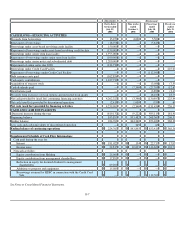

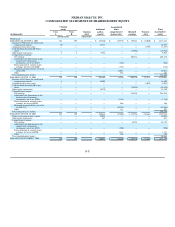

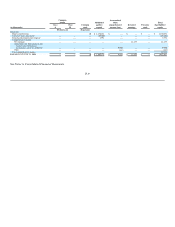

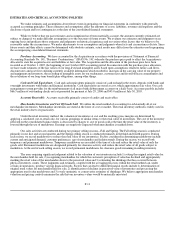

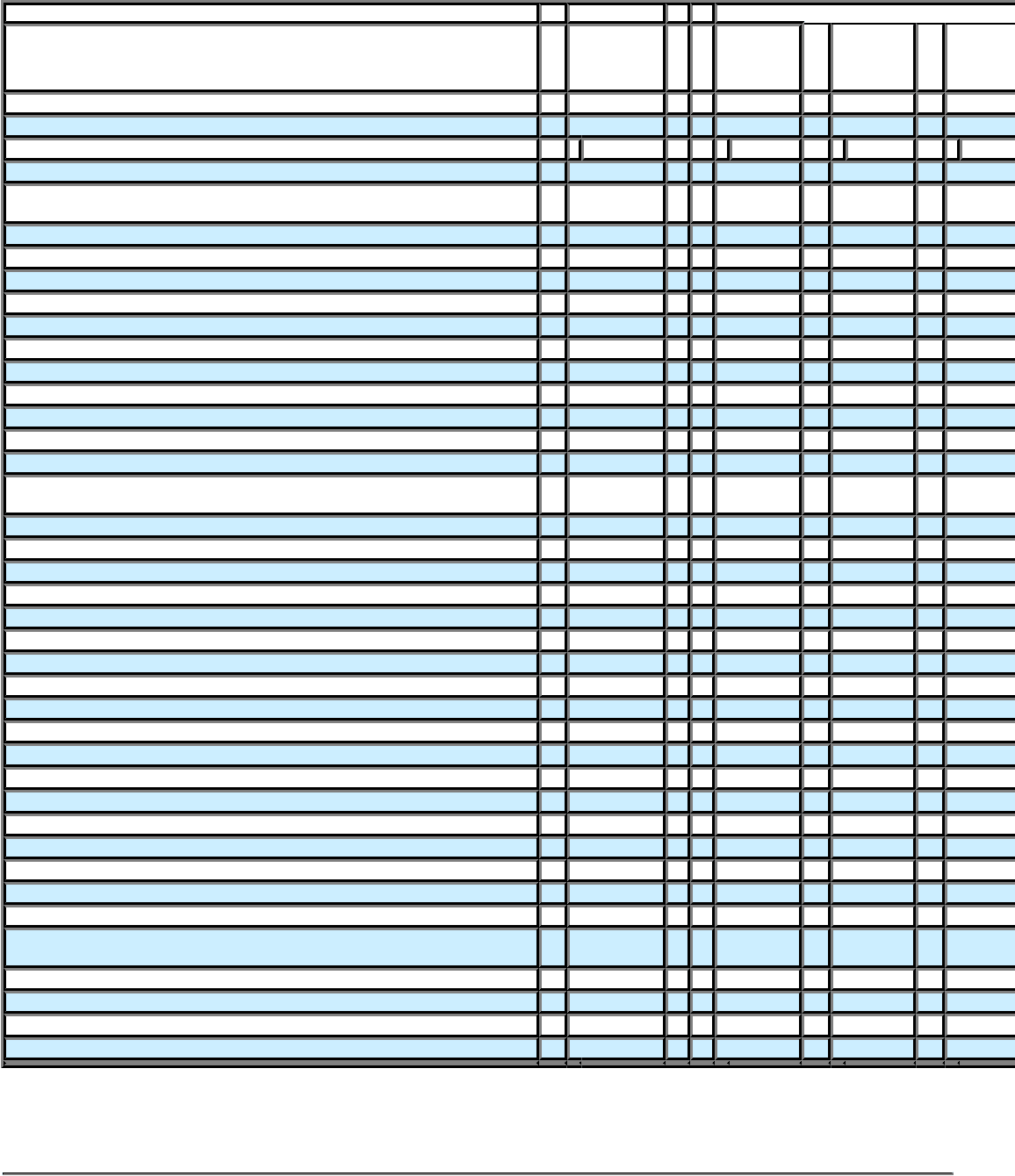

NEIMAN MARCUS, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Successor) (Predecessor)

(in thousands)

Forty-three

weeks ended

July 29,

2006

Nine weeks

ended

October 1,

2005

Fiscal year

ended

July 30,

2005

Fiscal year

ended

July 31,

2004

CASH FLOWS—OPERATING ACTIVITIES

Net earnings $ 12,455 $ 44,154 $ 248,824 $ 204,832

Loss (earnings) from discontinued operation 13,855 346 (824 ) (650

Adjustments to reconcile net earnings to net cash provided by operating

activities:

Depreciation 111,086 19,726 106,346 98,051

Amortization of debt issue costs 11,728 96 831 370

Amortization of customer lists and favorable lease commitments 60,165 — — —

Non-cash charges related to step-up in carrying value of inventory 38,067 — — —

Stock-based compensation charges 3,951 19,968 — —

Deferred income taxes (65,939 ) (6,921 ) (15,336 ) 22,969

Loss on disposition of Chef's Catalog — — 15,348 —

Gain on Credit Card Sale — — (6,170 ) —

Net cash received from Credit Card Sale — — 533,656 —

Impairment of intangible assets and other charges — — — 3,853

Minority interest 204 (347 ) 3,107 2,957

Other—primarily costs related to defined benefit pension and other

long-term benefit plans 15,315 650 39,138 33,510

200,887 77,672 924,920 365,892

Changes in operating assets and liabilities:

Increase in accounts receivable (7,413 ) (7,213 ) (68,781 ) (528,658

Decrease in undivided interests — — — 242,565

Decrease (increase) in merchandise inventories 111,798 (173,118 ) (39,118 ) (31,520

Decrease (increase) in other current assets 10,829 6,264 (4,641 ) 12,170

Decrease (increase) in other assets 5,627 (2,274 ) 10,743 (4,454

Increase in accounts payable and accrued liabilities 56,845 114,417 23,950 39,312

Increase in deferred real estate credits 24,334 4,305 14,868 1,556

Payment of deferred compensation and stock-based awards (12,901 ) — — —

Funding of defined benefit pension plan — — (20,000 )(45,000

Net cash provided by continuing operating activities 390,006 20,053 841,941 51,863

Net cash (used for) provided by discontinued operation (9,241 ) (618 )3,459 709

Net cash provided by operating activities 380,765 19,435 845,400 52,572

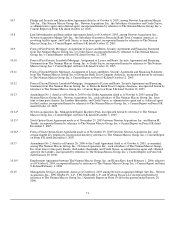

CASH FLOWS—INVESTING ACTIVITIES

Capital expenditures (140,990 ) (26,231 ) (199,698 ) (119,069

Acquisition of The Neiman Marcus Group, Inc. (5,156,423 ) — — —

Proceeds from sale of Gurwitch Products, L.L.C. 40,752 — — —

Net increase in cash restricted for repayment of borrowings under Credit

Card Facility — — (40,713 ) —

Proceeds from sale of Chef's Catalog and other assets — — 14,419 3,183

Net cash used for continuing investing activities (5,256,661 ) (26,231 ) (225,992 ) (115,886

Net cash used for discontinued operation (3,141 ) (80 )(2,837 )(1,404

Net cash used for investing activities (5,259,802 ) (26,311 )(228,829 )(117,290

F-6