Neiman Marcus 2005 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2005 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

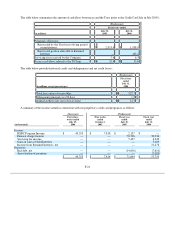

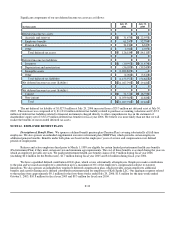

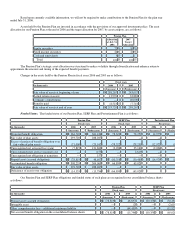

NOTE 11. INCOME TAXES

The significant components of income tax expense are as follows:

(Successor) (Predecessor)

(in thousands)

Forty-three

weeks ended

July 29,

2006

Nine weeks

ended

October 1,

2005

Fiscal year

ended

July 30,

2005

Fiscal year

ended

July 31,

2004

Current:

Federal $ 72,010 $ 30,200 $ 147,407 $ 93,536

State 8,447 2,437 13,229 3,319

Foreign 118 20 307 367

80,575 32,657 160,943 97,222

Deferred:

Federal (58,575 ) (6,148 ) (13,510 ) 20,903

State (7,364 ) (773 )(1,826 )2,066

(65,939 ) (6,921 )(15,336 )22,969

Income tax expense $ 14,636 $ 25,736 $ 145,607 $ 120,191

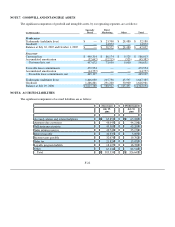

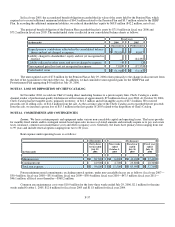

A reconciliation of income tax expense to the amount calculated based on the federal and state statutory rates is as follows:

(Successor) (Predecessor)

(in thousands)

Forty-three

weeks ended

July 29,

2006

Nine weeks

ended

October 1,

2005

Fiscal year

ended

July 30,

2005

Fiscal year

ended

July 31,

2004

Income tax expense at statutory rate $ 14,403 $ 24,461 $ 138,850 $ 114,566

State income taxes, net of federal income tax benefit 1,414 2,136 14,005 12,885

Tax benefit related to favorable tax settlements and other

reductions in tax liabilities (113 ) (222 ) (7,585 ) (7,500 )

Non-taxable income (1,378 ) (1,058 ) (2,121 ) (265 )

Non-deductible expenses 256 607 2,633 599

Other 54 (188 )(175 )(94 )

Total $ 14,636 $ 25,736 $ 145,607 $ 120,191

Our effective income tax rate was 35.6% for the forty-three weeks ended July 29, 2006 and 36.8% for the nine weeks ended

October 1, 2005. Our effective tax rate in the current year was favorably impacted by a higher level of tax-exempt interest income

earned. Our effective income tax rate was 36.7% for the fiscal year ended July 30, 2005 and was favorably impacted by tax-exempt

interest income, offset by non-deductible transaction costs. In the fourth fiscal quarter of fiscal year 2005, we recognized tax benefits

aggregating $7.6 million related to a favorable settlement associated with previous state tax filings and reductions in previously recorded

deferred tax liabilities. Excluding these benefits, our effective tax rate was 38.6% for fiscal year 2005. In the second quarter of fiscal year

2004, we also recognized a tax benefit of $7.5 million related to favorable settlements associated with previous state tax filings. Excluding

this benefit, our effective tax rate was 39.0% for 2004.

The Company's federal tax returns for fiscal years 2004 and 2003 are currently under examination by the Internal Revenue

Service (IRS). We believe our recorded tax liabilities as of July 29, 2006 are sufficient to cover any potential assessments to be made by

the IRS upon the completion of their examinations. We will continue to monitor the progress of the IRS examinations and review our

recorded tax liabilities for potential audit assessments. Adjustments to increase or decrease the recorded tax liabilities may be required in

the future as additional facts become known.

F-31