Neiman Marcus 2005 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2005 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

For the forty-three weeks ended July 29, 2006, we recognized non-cash stock compensation expense of $4.0 million, which is

included in selling, general and administrative expenses. The adoption of SFAS No. 123(R) had no impact on our cash flows from

operations or financing activities. At July 29, 2006, unearned non-cash stock-based compensation that we expect to recognize as expense

over the next 5 years aggregates approximately $23.8 million.

Predecessor

Cash dividend program. In the second quarter of 2005, the Predecessor Board of Directors increased the Predecessor quarterly

cash dividend from $0.13 per share to $0.15 per share. In fiscal year 2006, the Predecessor did not declare or pay any dividends. In 2005,

the Predecessor declared dividends aggregating $28.4 million, of which dividends payable of $7.3 million were included in accrued

liabilities in the accompanying consolidated balance sheet as of July 30, 2005 and were paid in August 2005.

Stock Repurchase Program. In prior years, the Predecessor Board of Directors authorized various stock repurchase programs

and increases in the number of shares subject to repurchase. The Predecessor repurchased 58,504 shares at an average price of $52.74 in

fiscal year 2005 and repurchased 175,600 shares at an average purchase price of $40.01 during the first quarter and 10,450 shares at an

average price of $50.48 during the fourth quarter of fiscal year 2004.

Common Stock Incentive Plans. The Predecessor had established common stock incentive plans allowing for the granting of

1) stock options, 2) stock appreciation rights, 3) restricted stock and stock units (restricted stock awards) and 4) other stock-based awards

to our employees. All outstanding Predecessor options and restricted shares as of October 5, 2005 were accelerated in connection with

Transactions resulting in a $19.0 million non-cash charge for stock compensation.

In fiscal years 2005 and 2004, the Predecessor made stock-based awards in the form of 1) restricted stock awards for which there

was no exercise price payable by the employee, 2) purchased restricted stock awards for which the exercise price was equal to 50% of the

fair value of our common stock on the date of grant and 3) matching restricted stock awards pursuant to which restricted stock awards

were granted equal to qualifying stock purchases by the employees. In fiscal year 2005, the Predecessor restricted stock and purchased

restricted stock awards aggregated 261,998 shares at a weighted-average exercise price of $23.82 as of the grant date. In fiscal year 2004,

the Predecessor restricted stock and purchased restricted stock awards aggregated 254,757 shares at a weighted-average exercise price of

$15.89 as of the grant date.

Compensation cost for Predecessor restricted stock and purchased restricted stock awards was recognized in an amount equal to

the difference between the exercise price of the award and fair value at the date of grant. The Predecessor recorded such expense on a

straight-line basis over the expected life of the award with the offsetting entry to additional paid-in capital. For performance accelerated

restricted stock, the expected life was determined based on the best estimate of the number of years from the grant date to the date at

which it was probable that the performance targets would be met (four or five years, depending on the grant). Compensation cost was

calculated as if all instruments granted that were subject only to a service requirement would vest. Compensation expense related to the

Predecessor restricted stock grants was $8.5 million in the nine-weeks ended October 1, 2005, $5.0 million in fiscal year 2005 and

$3.1 million in fiscal year 2004.

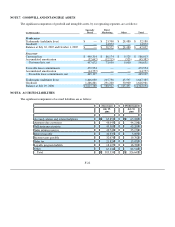

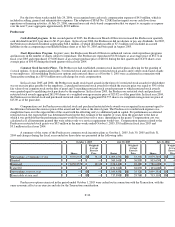

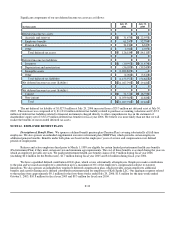

A summary of the status of the Predecessor common stock incentive plans as October 1, 2005, July 30, 2005 and July 31,

2004 and changes during the fiscal years ended on those dates are presented in the following table:

October 1, 2005 July 30, 2005 July 31, 2004

Shares

Weighted-

Average

Exercise

Price Shares

Weighted-

Average

Exercise

Price Shares

Weighted-

Average

Exercise

Price

Outstanding at beginning of year 3,050,855 $ 38.12 3,009,155 $ 33.35 3,079,705 $ 29.54

Granted — — 569,161 56.89 903,650 43.33

Exercised (3,050,855 ) 38.12 (376,140 ) 28.38 (780,600 ) 29.34

Canceled — — (151,321 )38.87 (193,600 )35.16

Outstanding at end of year — $ — 3,050,855 $ 38.12 3,009,155 $ 33.37

Exercisable at year end — $ — 717,890 $ 28.76 713,110 $ 28.68

Predecessor options exercised in the period ended October 1, 2005 were cashed out in connection with the Transaction, with the

same economic effect as an exercise and sale for the Transaction consideration.

F-30