Neiman Marcus 2005 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2005 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

hedges. As a result, changes in the fair value of NMG's swaps are recorded primarily subsequent to the effective date as a component of

other comprehensive income. For the forty-three weeks ended July 29, 2006, we recorded $10.6 million of unrecognized gains in other comprehensive

income.

At July 29, 2006, the fair value of NMG's interest rate swap agreements was a gain of approximately $20.2 million, which

amount is included in other assets. As a result of the swap agreements, NMG's effective fixed interest rates as to the $1,000.0 million in

floating rate indebtedness will range from 6.931% to 7.499% per quarter and result in an average fixed rate of 7.285%.

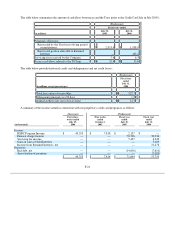

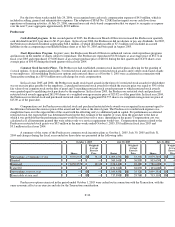

Interest expense. The significant components of interest expense are as follows:

(Successor) (Predecessor)

(in thousands)

Forty-three

weeks ended

July 29,

2006

Nine weeks

ended

October 1,

2005

Fiscal year

ended

July 30,

2005

Fiscal year

ended

July 31,

2004

Asset-Based Revolving Credit Facility $ 1,332 $ — $ — $ —

Senior Secured Term Loan Facility 111,662 — — —

2028 Debentures 7,266 1,542 8,904 8,904

Senior Notes 51,421 — — —

Senior Subordinated Notes 42,339 — — —

Credit Agreement — — 5,803 2,200

2008 Notes 638 1,439 8,308 8,308

Amortization of debt issue costs and other 12,275 322 1,193 1,659

Total interest expense 226,933 3,303 24,208 21,071

Less:

Interest income 5,557 3,046 6,556 2,132

Capitalized interest 3,446 1,146 5,350 3,036

Interest expense, net $ 217,930 $ (889)$ 12,302 $ 15,903

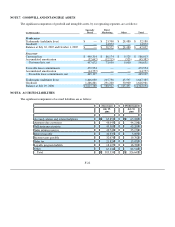

NOTE 10. COMMON SHAREHOLDERS' EQUITY

Successor

Carryover Basis Adjustment for Management Shareholders. Executive management participants held certain equity interests,

including stock options, in the Predecessor prior to the Transactions and continue to hold equity interests in the Company, representing

indirect equity interests in the Successor after the Transactions. In accordance with the provisions of Emerging Issues Task Force

No. 88-16, "Basis in Leveraged Buyout Transactions," the basis of executive management's indirect interests in the Successor after the

Transactions is carried over at the basis of their interests in the Predecessor prior to the Transactions. The carryover basis of such interests

less the net cash received by the management participants represents a deemed dividend of $69.2 million to the management participants

and has been recognized as a reduction to shareholders' equity.

Successor Stock-Based Compensation Accounting. In connection with the Transactions, the Company authorized new equity-

based management arrangements which authorize equity awards to be granted for up to 87,992.0 shares of the common stock of the

Company, of which options for 81,716.3 shares were issued to certain management employees. All options are outstanding at July 29,

2006. Substantially all options have an exercise price of $1,445 per share, with the exercise price with respect to approximately 50% of

such options escalating at a 10% compound rate per year until the earlier to occur of (i) exercise, (ii) the fifth anniversary of the date of

grant or (iii) the occurrence of a change in control; provided that in the event the Sponsors cause the sale of shares of the Company to an

unaffiliated entity, the exercise price will cease to accrete at the time of the sale with respect to a pro rata portion of the accreting options.

Using the Black-Scholes option-pricing model, the per share fair value of these options was approximately $494 for the fixed price

options and $247 for the options with escalating exercise prices. In estimating the fair value of our options, we made the following

assumptions: expected term to exercise of five years; expected volatility of 30%; risk-free interest rate of 4.23%; and no dividend yield.

Expected volatility is based on a combination of the Predecessor's historical volatility adjusted for our new leverage and estimates of

implied volatility of our peer group. Options generally vest over four to five years and expire 10 years from the date of grant. At July 29,

2006, options for 7,283.2 shares were vested.

F-29