Neiman Marcus 2005 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2005 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

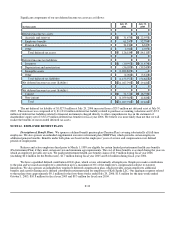

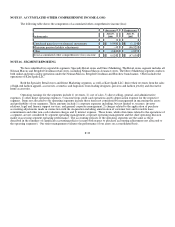

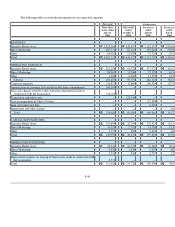

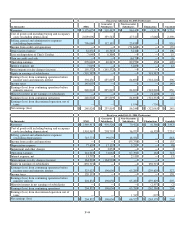

NOTE 15. ACCUMULATED OTHER COMPREHENSIVE INCOME (LOSS)

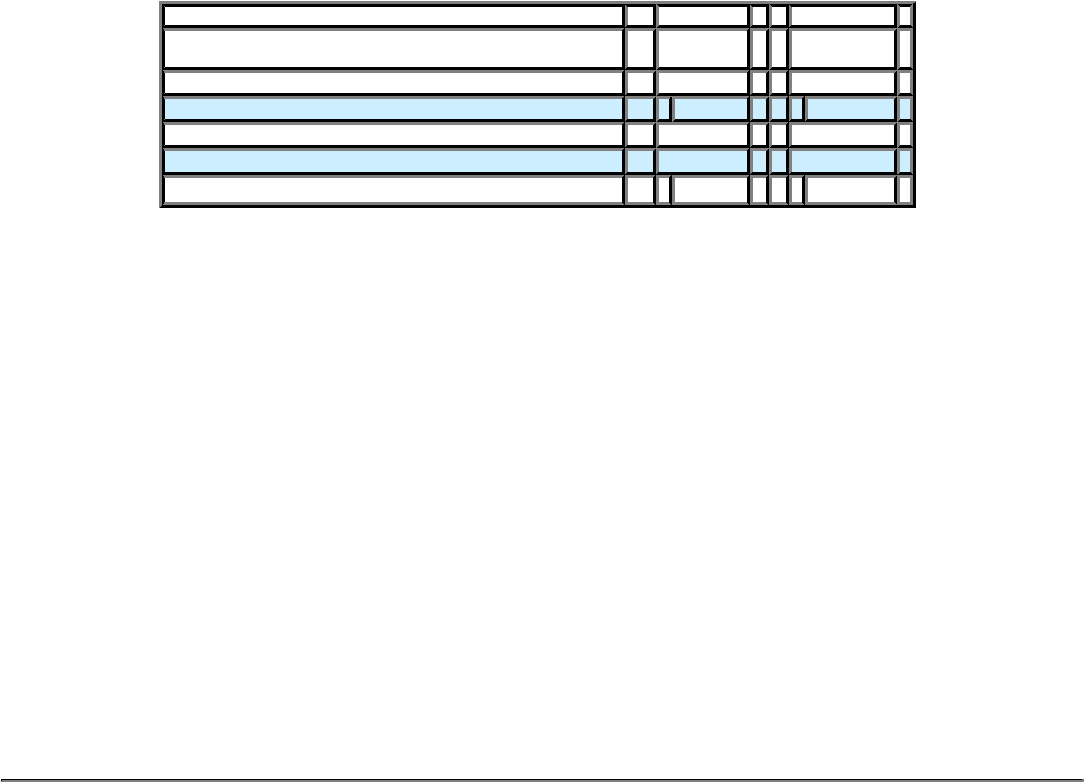

The following table shows the components of accumulated other comprehensive income (loss):

(Successor) (Predecessor)

(in thousands)

July 29,

2006

July 30,

2005

Unrealized gain (loss) on financial instruments $ 9,990 $ (1,114 )

Minimum pension liability adjustments — (46,921 )

Other (161 ) 1,005

Total accumulated other comprehensive (loss) income $ 9,829 $ (47,030 )

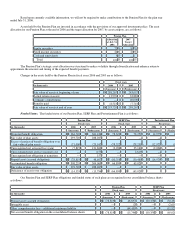

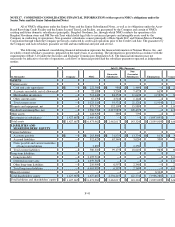

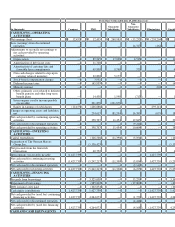

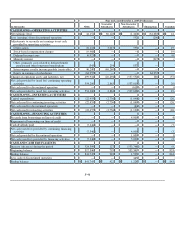

NOTE 16. SEGMENT REPORTING

We have identified two reportable segments: Specialty Retail stores and Direct Marketing. The Retail stores segment includes all

Neiman Marcus and Bergdorf Goodman retail stores, including Neiman Marcus clearance stores. The Direct Marketing segment conducts

both online and print catalog operations under the Neiman Marcus, Bergdorf Goodman and Horchow brand names. Other includes the

operations of Kate Spade LLC.

Both the Specialty Retail stores and Direct Marketing segments, as well as Kate Spade LLC, derive their revenues from the sales

of high-end fashion apparel, accessories, cosmetics and fragrances from leading designers, precious and fashion jewelry and decorative

home accessories.

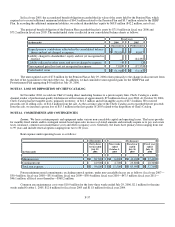

Operating earnings for the segments include 1) revenues, 2) cost of sales, 3) direct selling, general, and administrative

expenses, 4) other direct operating expenses, 5) income from credit card operations and 6) depreciation expense for the respective

segment. Items not allocated to our operating segments include those items not considered by management in measuring the assets

and profitability of our segments. These amounts include 1) corporate expenses including, but not limited to, treasury, investor

relations, legal and finance support services, and general corporate management, 2) charges related to the application of purchase

accounting adjustments made in connection with the Acquisition including amortization of customer lists and favorable lease

commitments and other non-cash valuation charges and 3) interest expense. These items, while often times related to the operations of

a segment, are not considered by segment operating management, corporate operating management and the chief operating decision

maker in assessing segment operating performance. The accounting policies of the operating segments are the same as those

described in the summary of significant accounting policies (except with respect to purchase accounting adjustments not allocated to

the operating segments). Our senior management evaluates the performance of our assets on a consolidated basis.

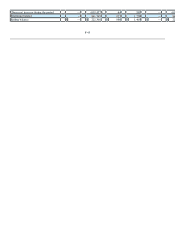

F-39