MetLife 2001 Annual Report Download - page 8

Download and view the complete annual report

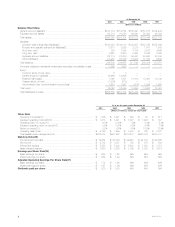

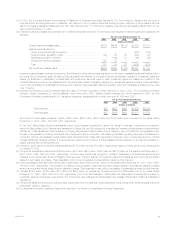

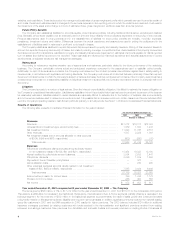

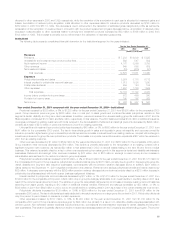

Please find page 8 of the 2001 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(13) Return on equity is defined as net income divided by average total equity, excluding accumulated other comprehensive income (loss).

(14) Includes MetLife’s general account and separate account assets and assets managed on behalf of third parties. Includes $21 billion of assets under

management managed by Conning at December 31, 2000, which was sold on July 2, 2001. Includes $133 billion, $135 billion, and $125 billion of

assets under management managed by Nvest at December 31, 1999, 1998 and 1997, respectively, which was sold on October 30, 2000.

(15) Metropolitan Life statutory data only.

The decrease in premiums and deposits from 2000 to 2001 is primarily attributable to a change in accounting required by the Codification, as

adopted by the Department. This change required $7.0 billion of deposits related to products without mortality or morbidity factors to be recorded as

policyholder liabilities beginning January 1, 2001.

A significant component of the increase in statutory net income is $1.8 billion of investment gains resulting from transactions including the sale of

Metropolitan Insurance and Annuity Company (‘‘MIAC’’) to MetLife, Inc. and the sale of certain real estate to MIAC from Metropolitan Life. On a GAAP

basis, the effects of these transactions are eliminated in consolidation. See Note 21 of Notes to Consolidated Financial Statements.

The decrease in policyholder surplus is primarily due to a special dividend payment of $3,064 million from Metropolitan Life to MetLife, Inc.

The increase in the asset valuation reserve is primarily attributable to the aforementioned investment gain.

(16) Based on earnings subsequent to the date of demutualization. For additional information regarding these items, see Note 19 of Notes to

Consolidated Financial Statements.

(17) Earnings per share amounts for 2000 are proforma and are presented as if the initial public offering had occurred on January 1, 2000.

MetLife, Inc. 5