MetLife 2001 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2001 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

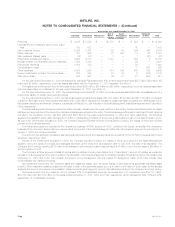

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

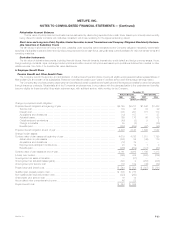

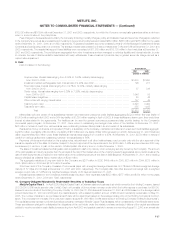

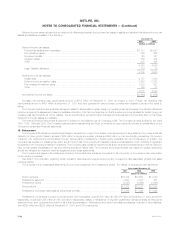

13. Business Realignment Initiatives

During the fourth quarter of 2001, the Company implemented several business realignment initiatives, which resulted from a strategic review of

operations and an ongoing commitment to reduce expenses. The impact of these actions on a segment basis are as follows:

For the year ended

December 31, 2001

Net of

income

Amount tax

(Dollars in millions)

Institutional********************************************************************************************* $399 $267

Individual ********************************************************************************************** 97 61

Auto & Home ****************************************************************************************** 32

Total ****************************************************************************************** $499 $330

The charges, net of income tax, reduced earnings per share for the year ended December 31, 2001 by $0.43, on a diluted basis.

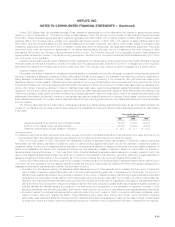

Institutional. The charges to this segment include costs associated with exiting a business, including the write-off of goodwill, severance,

severance-related expenses, and facility consolidation costs. These expenses are the result of the discontinuance of certain 401(k) recordkeeping

services and externally-managed guaranteed index separate accounts. These initiatives will result in the elimination of approximately 450 positions. These

actions resulted in charges to policyholder benefits and claims and other expenses of $215 million and $184 million, respectively.

Individual. The charges to this segment include facility consolidation costs, severance and severance-related expenses, which predominately stem

from the elimination of approximately 560 non-sales positions and 190 operations and technology positions supporting this segment. The costs were

recorded in other expenses.

Auto & Home. The charges to this segment include severance and severance-related costs associated with the elimination of approximately 200

positions. The costs were recorded in other expenses.

Although many of the underlying business initiatives were completed in 2001, a portion of the activity will continue into 2002. The liability as of

December 31, 2001 was $295 million.

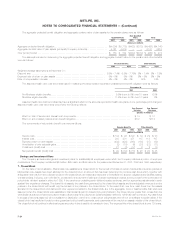

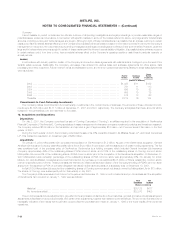

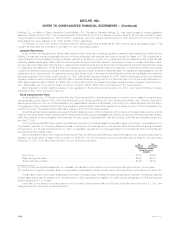

14. Income Taxes

The provision for income taxes was as follows:

Years ended December 31,

2001 2000 1999

(Dollars in millions)

Current:

Federal************************************************************************************ $ (44) $(153) $608

State and local ***************************************************************************** (4) 34 24

Foreign************************************************************************************ 15 5 4

(33) (114) 636

Deferred:

Federal************************************************************************************ 286 563 (78)

State and local ***************************************************************************** 12 8 2

Foreign************************************************************************************ 1 6 (2)

299 577 (78)

Provision for income taxes********************************************************************** $266 $ 463 $558

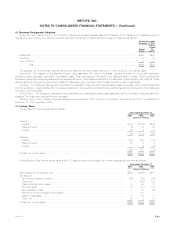

Reconciliations of the income tax provision at the U.S. statutory rate to the provision for income taxes as reported were as follows:

Years ended December 31,

2001 2000 1999

(Dollars in millions)

Tax provision at U.S. statutory rate*************************************************************** $259 $ 496 $411

Tax effect of:

Tax exempt investment income**************************************************************** (82) (52) (39)

Surplus tax ******************************************************************************** — (145) 125

State and local income taxes ***************************************************************** 93018

Prior year taxes***************************************************************************** 38 (37) (31)

Demutualization costs *********************************************************************** —2156

Payment to former Canadian policyholders ****************************************************** — 114 —

Sales of businesses************************************************************************* 531—

Other, net ********************************************************************************* 37 5 18

Provision for income taxes********************************************************************** $266 $ 463 $558

MetLife, Inc. F-33