MetLife 2001 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2001 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.necessary to maintain the capital and surplus of General American at a level not less than 180% of the NAIC Risk Based Capitalization Model. The capital

and surplus of General American at December 31, 2001 was in excess of the required amount.

Metropolitan Life has also entered into arrangements with some of its other subsidiaries and affiliates to assist such subsidiaries and affiliates in

meeting various jurisdictions’ regulatory requirements regarding capital and surplus. In addition, Metropolitan Life has entered into a support arrangement

with respect to reinsurance obligations of Metropolitan Insurance and Annuity Company (‘‘MIAC’’). Management does not anticipate that these

arrangements will place any significant demands upon the Company’s liquidity resources.

The Holding Company has agreed to make capital contributions, in any event not to exceed $120 million, to MIAC in the aggregate amount of the

excess of (i) the debt service payments required to be made, and the capital expenditure payments required to be made or reserved for, under the

borrowings made by MIAC subsidiaries to fund the purchase of certain real estate properties from Metropolitan Life during the two year period following

the date of borrowings, over (ii) the cash flows generated by these properties.

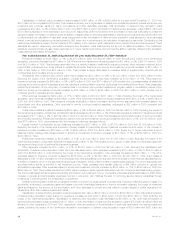

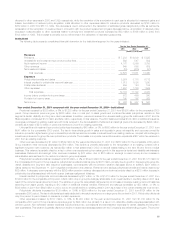

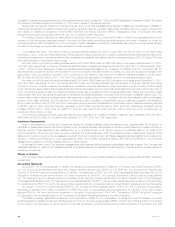

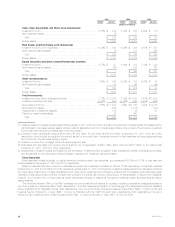

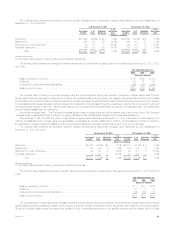

Consolidated cash flows. Net cash provided by operating activities was $4,799 million, $1,299 million and $3,883 million for the years ended

December 31, 2001, 2000, and 1999, respectively. The fluctuations in cash provided by the Company’s operations between periods are primarily due to

the timing in the settlement of security trades and other receivables and payables. Net cash provided by operating activities in 2001, 2000 and 1999 was

more than adequate to meet liquidity requirements.

Net cash (used in) provided by investing activities was $(3,663) million, $309 million and $(2,389) million for the years ended December 31, 2001,

2000 and 1999, respectively. Purchases of investments exceeded sales, maturities and repayments by $3,289 million, $7,101 million and $461 million

in 2001, 2000 and 1999, respectively. These net purchases were primarily attributable to the investment of collateral received in connection with the

securities lending program. In addition, the reinvestment of the proceeds from the sale of Nvest on October 30, 2000 and the planned increase in the

cash position within the investment portfolio in 2001 contributed to the variance. Cash flows from investment activities increased by $360 million,

$5,840 million and $2,692 million in 2001, 2000 and 1999, respectively, as a result of increased volume in the securities lending program.

Net cash provided by (used in) financing activities was $2,903 million, $(963) million and $(2,006) million for the years ended December 31, 2001,

2000 and 1999, respectively. In 2001, the primary sources of cash from financing activities were the issuance of long-term debt by the Holding

Company in the form of senior notes and the issuance of mandatorily convertible securities by RGA in connection with the formation of RGA Capital

Trust I. The primary uses of cash in financing activities include stock repurchases, common stock cash dividends and the pay-down of short-term debt. In

2000, the primary sources of cash from financing activities include cash proceeds from the Company’s initial public offering and concurrent private

placements in April 2000, as well as the issuance of mandatorily convertible securities in connection with the formation of MetLife Capital Trust I. The

primary uses of cash in financing activities include cash payments to eligible policyholders in connection with the demutualization, stock repurchases,

common stock cash dividends, and the pay-down of short-term debt. Deposits to policyholders’ account balances exceeded withdrawals by

$3,674 million and $386 million in 2001 and 2000, respectively, as compared with withdrawals from policyholder account balances exceeding deposits

of $2,222 million in 1999. Short-term financing decreased by $730 million and $3,095 million in 2001 and 2000, respectively, compared with an

increase of $608 million in 1999, while net additions to long-term debt were $1,228 million and $83 million in 2001 and 2000 compared with net

reductions of $392 million in 1999.

The operating, investing and financing activities described above resulted in an increase (decrease) in cash and cash equivalents of $4,039 million,

$645 million and $(512) million for the years ended December 31, 2001, 2000 and 1999, respectively.

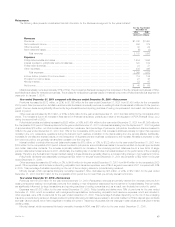

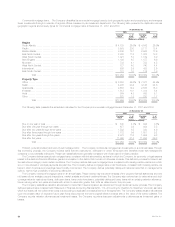

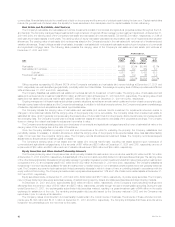

Insolvency Assessments

Most of the jurisdictions in which the Company is admitted to transact business require life insurers doing business within the jurisdiction to

participate in guaranty associations, which are organized to pay contractual benefits owed pursuant to insurance policies issued by impaired, insolvent or

failed life insurers. These associations levy assessments, up to prescribed limits, on all member insurers in a particular state on the basis of the

proportionate share of the premiums written by member insurers in the lines of business in which the impaired, insolvent or failed insurer engaged. Some

states permit member insurers to recover assessments paid through full or partial premium tax offsets. Assessments levied against the Company from

January 1, 1999 through December 31, 2001 aggregated $2 million. The Company maintained a liability of $61 million at December 31, 2001 for future

assessments in respect of currently impaired, insolvent or failed insurers.

In the past five years, none of the aggregate assessments levied against MetLife’s insurance subsidiaries has been material. The Company has

established liabilities for guaranty fund assessments that it considers adequate for assessments with respect to insurers that are currently subject to

insolvency proceedings.

Effects of Inflation

The Company does not believe that inflation has had a material effect on its consolidated results of operations, except insofar as inflation may affect

interest rates.

Accounting Standards

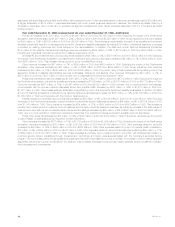

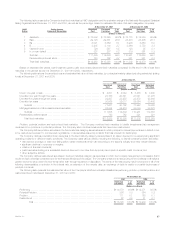

During 2001, the Company adopted or applied the following accounting standards: (i) Statement of Financial Accounting Standards (‘‘SFAS’’)

No. 133, Accounting for Derivative Instruments and Hedging Activities, as amended (‘‘SFAS 133’’), (ii) SFAS No. 140, Accounting for Transfers and

Servicing of Financial Assets and Extinguishment of Liabilities — a replacement of FASB No. 125, (iii) Emerging Issues Task Force Issue No. 99-20,

Recognition of Interest Income and Impairment on Certain Investments, (iv) SFAS No. 141, Business Combinations, and (v) Staff Accounting Bulletin

No. 102, Selected Loan Loss Allowance and Documentation Issues. Adoption of these standards did not have a material impact on the Company’s

consolidated financial statements. The Financial Accounting Standards Board (‘‘FASB’’) continues to issue additional guidance relating to the accounting

for derivatives under SFAS 133, which may result in further adjustments to the Company’s treatment of derivatives in subsequent accounting periods.

On January 1, 2002, the Company adopted SFAS No. 142, Goodwill and Other Intangible Assets (‘‘SFAS 142’’). The Company is in the process of

developing an estimate of the impact of the adoption of SFAS 142, if any, on its consolidated financial statements. On January 1, 2002, the Company

adopted SFAS No. 144, Accounting for the Impairment or Disposal of Long-Lived Assets (‘‘SFAS 144’’). The adoption of SFAS 144 by the Company is

not expected to have a material impact on the Company’s consolidated financial statements at the date of adoption.

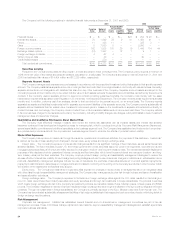

The FASB is currently deliberating the issuance of an interpretation of SFAS No. 94, Consolidation of All Majority-Owned Subsidiaries, to provide

additional guidance to assist companies in identifying and accounting for special purpose entities (‘‘SPEs’’), including when SPEs should be consolidated

by the investor. The interpretation would introduce a concept that consolidation would be required by the primary beneficiary of the activities of an SPE

MetLife, Inc.

24