MetLife 2001 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2001 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.METLIFE, INC.

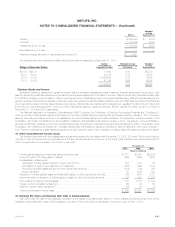

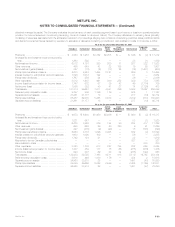

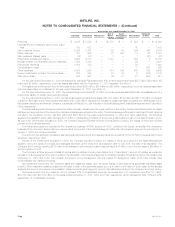

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

The plaintiffs in these actions, which have been consolidated, claim that the Policyholder Information Booklets relating to the plan failed to disclose certain

material facts and seek rescission and compensatory damages. Metropolitan Life’s motion to dismiss these three cases was denied on July 23, 2001. A

purported class action also was filed in the United States District Court for the Southern District of New York seeking damages from Metropolitan Life and

the Holding Company for alleged violations of various provisions of the Constitution of the United States in connection with the plan of reorganization. On

July 9, 2001, pursuant to a motion to dismiss filed by Metropolitan Life, this case was dismissed by the District Court. Plaintiffs have appealed to the

United States Court of Appeals for the Second Circuit. Metropolitan Life, the Holding Company and the individual defendants believe they have

meritorious defenses to the plaintiffs’ claims and are contesting vigorously all of the plaintiffs’ claims in these actions.

In 2001, a lawsuit was filed in the Superior Court of Justice, Ontario, Canada on behalf of a proposed class of certain former Canadian policyholders

against the Holding Company, Metropolitan Life, and Metropolitan Life Insurance Company of Canada. Plaintiffs’ allegations concern the way that their

policies were treated in connection with the demutualization of Metropolitan Life; they seek damages, declarations, and other non-pecuniary relief. The

defendants believe they have meritorious defenses to the plaintiffs’ claims and will contest vigorously all of plaintiffs’ claims in this matter.

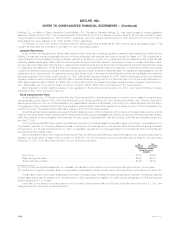

Race-Conscious Underwriting Claims

Insurance Departments in a number of states initiated inquiries in 2000 about possible race-conscious underwriting of life insurance. These inquiries

generally have been directed to all life insurers licensed in their respective states, including Metropolitan Life and certain of its subsidiaries. The New York

Insurance Department has commenced examinations of certain domestic life insurance companies, including Metropolitan Life, concerning possible past

race-conscious underwriting practices. Metropolitan Life is cooperating fully with that inquiry, which is ongoing. Four purported class action lawsuits filed

against Metropolitan Life in 2000 and 2001 alleging racial discrimination in the marketing, sale, and administration of life insurance policies have been

consolidated in the United States District Court for the Southern District of New York. The plaintiffs seek unspecified monetary damages, punitive

damages, reformation, imposition of a constructive trust, a declaration that the alleged practices are discriminatory and illegal, injunctive relief requiring

Metropolitan Life to discontinue the alleged discriminatory practices and adjust policy values, and other relief. At the outset of discovery, Metropolitan Life

moved for summary judgment on statute of limitations grounds. On June 27, 2001, the District Court denied that motion, citing, among other things,

ongoing discovery on relevant subjects. The ruling does not prevent Metropolitan Life from continuing to pursue a statute of limitations defense. Plaintiffs

have moved for certification of a class consisting of all non-Caucasian policyholders purportedly harmed by the practices alleged in the complaint.

Metropolitan Life has opposed the class certification motion. Metropolitan Life has been involved in settlement discussions to resolve the regulatory

examinations and the actions pending in the United States District Court for the Southern District of New York. In that connection, Metropolitan Life has

recorded a $250 million pre-tax charge in the fourth quarter of 2001 as probable and estimable costs associated with the anticipated resolution of these

matters.

In the fall of 2001, 12 lawsuits were filed against Metropolitan Life on behalf of approximately 109 non-Caucasian plaintiffs in their individual

capacities in state court in Tennessee. The complaints allege under state common law theories that Metropolitan Life discriminated against

non-Caucasians in the sale, formation and administration of life insurance policies. The plaintiffs have stipulated that they do not seek and will not accept

more than $74,000 per person if they prevail on their claims. Early in 2002, two individual actions were filed against Metropolitan Life in federal court in

Alabama alleging both federal and state law claims of racial discrimination in connection with the sale of life insurance policies issued. Metropolitan Life is

contesting vigorously plaintiffs’ claims in the Tennessee and Alabama actions.

Other

In March 2001, a putative class action was filed against Metropolitan Life in the United States District Court for the Southern District of New York

alleging gender discrimination and retaliation in the MetLife Financial Services unit of the Individual segment. The plaintiffs seek unspecified compensatory

damages, punitive damages, a declaration that the alleged practices are discriminatory and illegal, injunctive relief requiring Metropolitan Life to

discontinue the alleged discriminatory practices, an order restoring class members to their rightful positions (or appropriate compensation in lieu thereof),

and other relief. Metropolitan Life is vigorously defending itself against these allegations.

A lawsuit has been filed against Metropolitan Life in Ontario, Canada by Clarica Life Insurance Company regarding the sale of the majority of

Metropolitan Life’s Canadian operation to Clarica in 1998. Clarica alleges that Metropolitan Life breached certain representations and warranties

contained in the sale agreement, that Metropolitan Life made misrepresentations upon which Clarica relied during the negotiations and that Metropolitan

Life was negligent in the performance of certain of its obligations and duties under the sale agreement. Metropolitan Life is vigorously defending itself

against this lawsuit.

General American has received and responded to subpoenas for documents and other information from the office of the U.S. Attorney for the

Eastern District of Missouri with respect to certain administrative services provided by its former Medicare Unit during the period January 1, 1988 through

December 31, 1998, which services ended and which unit was disbanded prior to MetLife’s acquisition of General American. The subpoenas were

issued as part of the Government’s criminal investigation alleging that General American’s former Medicare Unit engaged in improper billing and claims

payment practices. The Government is also conducting a civil investigation under the federal False Claims Act. General American is cooperating fully with

the Government’s investigations.

Various litigation, claims and assessments against the Company, in addition to those discussed above and those otherwise provided for in the

Company’s consolidated financial statements, have arisen in the course of the Company’s business, including, but not limited to, in connection with its

activities as an insurer, employer, investor, investment advisor and taxpayer. Further, state insurance regulatory authorities and other federal and state

authorities regularly make inquiries and conduct investigations concerning the Company’s compliance with applicable insurance and other laws and

regulations.

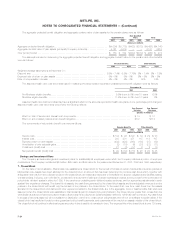

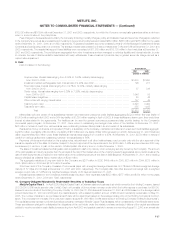

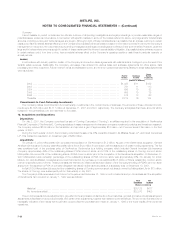

The Company has recorded, in other expenses, charges of $250 million, $15 million and $499 million for the years ended December 31, 2001,

2000 and 1999, respectively. The charge in 2001 relates to race-conscious underwriting and the charges in 2000 and 1999 relate to sales practice

claims. The charge in 1999 was principally related to the settlement of the multi-district litigation proceeding involving alleged improper sales practices,

accruals for sales practices claims not covered by the settlement and other legal costs.

MetLife, Inc. F-31