MetLife 2001 Annual Report Download - page 17

Download and view the complete annual report

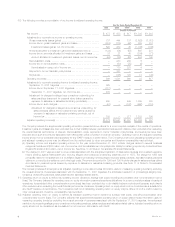

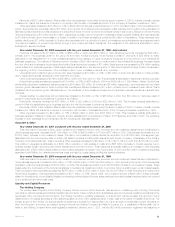

Please find page 17 of the 2001 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Capitalization of deferred policy acquisition costs increased by $54 million, or 6%, to $926 million for the year ended December 31, 2001 from

$872 million for the comparable 2000 period. This increase is primarily due to higher sales of variable and universal life insurance policies and annuity and

investment-type products, resulting in higher commissions and other deferrable expenses. Total amortization of deferred policy acquisition costs

increased by $26 million, or 4%, to $654 million in 2001 from $628 million in 2000. Amortization of deferred policy acquisition costs of $633 million and

$723 million is allocated to other expenses in 2001 and 2000, respectively, while the remainder of the amortization in each year is allocated to investment

gains and losses. Amortization of deferred policy acquisition costs allocated to other expenses related to insurance products declined by $48 million due

to refinements in the calculation of estimated gross margins and profits. Amortization of deferred policy acquisition costs allocated to other expenses

related to annuity and investment products declined by $42 million due to refinements in the calculation of estimated gross profits. Contributing to this

variance are modifications made in the third quarter of 2001 relating to the manner in which estimates of future market performance are developed. These

estimates are used in determining unamortized deferred policy acquisition costs balances and the amount of related amortization. The modification

reflects an expected impact of past market performance on future market performance, and improves the ability to estimate deferred policy acquisition

costs balances and related amortization.

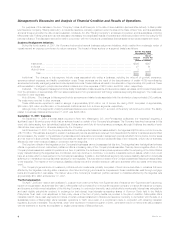

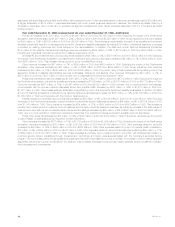

Year ended December 31, 2000 compared with the year ended December 31, 1999—Individual

Premiums increased by $384 million, or 9%, to $4,673 million in 2000 from $4,289 million in 1999. Excluding the impact of the GenAmerica

acquisition, premiums decreased by $72 million, or 2%. Premiums from insurance products decreased by $82 million, or 2%, to $4,133 million in 2000

from $4,215 million in 1999. This decrease is primarily due to a decline in sales of traditional life insurance policies, which reflects a continued shift in

policyholders’ preferences from those policies to variable life products. Premiums from annuity and investment products increased by $10 million, or

14%, to $84 million in 2000 from $74 million in 1999. This increase is largely attributable to increased sales of supplementary contracts with life

contingencies and immediate annuity products.

Universal life and investment-type product policy fees increased by $333 million, or 38%, to $1,221 million in 2000 from $888 million in 1999.

Excluding the impact of the GenAmerica acquisition, universal life and investment-type fees increased by $130 million, or 15%. Policy fees from

insurance products increased by $48 million, or 8%, to $619 million in 2000 from $571 million in 1999, primarily due to increased sales of variable life

products and continued growth in separate accounts, reflecting a continued shift in customer preferences from traditional life products. This increase also

reflects the acceleration of the recognition of unearned fees in connection with a product replacement program related to universal life policies. Policy

fees from annuity and investment products increased by $82 million, or 26%, to $399 million in 2000 from $317 million in 1999, primarily due to

continued growth in separate account assets.

Other revenues increased by $269 million, or 71%, to $650 million in 2000 from $381 million in 1999. Excluding the impact of the GenAmerica

acquisition, other revenues increased by $96 million, or 25%. Other revenues for insurance products increased by $98 million, or 28%, to $445 million in

2000 from $347 million in 1999. This increase is principally attributable to higher commission and fee income associated with increased sales in the

broker/dealer and other subsidiaries. Other revenues for annuity products remained essentially unchanged at $32 million in 2000 compared with

$34 million in 1999.

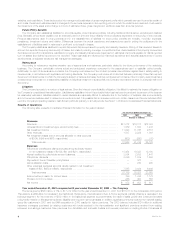

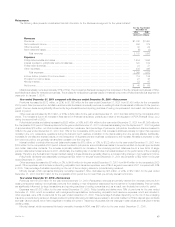

Policyholder benefits and claims increased by $429 million, or 9%, to $5,054 million in 2000 from $4,625 million in 1999. Excluding the impact of

the GenAmerica acquisition, policyholder benefits and claims decreased by $103 million, or 2%. Policyholder benefits and claims for insurance products

decreased by $111 million, or 2%, to $4,339 million in 2000 from $4,450 million in 1999. This decrease is predominately a result of improved mortality

and morbidity experience. Policyholder benefits and claims for annuity and investment products increased by $8 million, or 5%, to $183 million in 2000

from $175 million in 1999, commensurate with the increase in premiums discussed above.

Interest credited to policyholder account balances increased by $321 million, or 24%, to $1,680 million in 2000 from $1,359 million in 1999.

Excluding the impact of the GenAmerica acquisition, interest credited to policyholder account balances increased by $36 million, or 3%. Interest on

insurance products increased by $26 million, or 6%, to $445 million in 2000 from $419 million in 1999, largely due to higher policyholder account

balances. Higher crediting rates caused interest on annuity and investment products to increase by $10 million, or 1%, to $950 million in 2000 from

$940 million in 1999.

Policyholder dividends increased by $233 million, or 15%, to $1,742 million in 2000 from $1,509 million in 1999. Excluding the impact of the

GenAmerica acquisition, policyholder dividends increased by $33 million, or 2%. This increase is due to growth in cash values of policies associated with

this segment’s large block of traditional life insurance business.

Other expenses increased by $781 million, or 31%, to $3,323 million in 2000 from $2,542 million in 1999. Excluding the capitalization and

amortization of deferred policy acquisition costs, which are discussed below, other expenses increased by $773 million, or 29%, to $3,472 million in

2000 from $2,699 million in 1999. Excluding the impact of the GenAmerica acquisition, other expenses increased by $298 million, or 11%. Other

expenses related to insurance products increased by $189 million, or 9%, to $2,252 million in 2000 from $2,063 million in 1999. This increase is

attributable to a $111 million increase from the broker/dealer and other subsidiaries commensurate with the increase in other revenues discussed above.

In addition, increased volume in the securities lending program resulted in a $122 million increase in related rebate expense. The income associated with

securities lending activity is included in net investment income. These increases were partially offset by a $44 million reduction in general and

administrative expenses. Other expenses related to annuity and investment products increased by $109 million, or 17%, to $745 million in 2000 from

$636 million in 1999. This increase resulted from a $54 million increase in rebate expense associated with the Company’s securities lending program.

The income associated with securities lending activity is included in net investment income. The remaining increase is largely attributable to a $55 million

increase in general and administrative expenses incurred in connection with initiatives focused on improving service delivery capabilities through

investments in technology and the consolidation of operations.

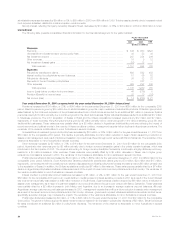

Deferred policy acquisition costs are principally amortized in proportion to gross margins or gross profits, including investment gains or losses. The

amortization is allocated to investment gains and losses to provide consolidated statement of income information regarding the impact of investment

gains and losses on the amount of the amortization, and other expenses to provide amounts related to gross margins or profits originating from

transactions other than investment gains and losses.

Capitalization of deferred policy acquisition costs increased by $90 million to $872 million in 2000 from $782 million in 1999, while total amortization

of deferred policy acquisition costs, charged to operations, increased by $49 million to $628 million in 2000 from $579 million in 1999. Excluding the

impact of the GenAmerica acquisition, capitalization of deferred policy acquisition costs decreased by $6 million, or 1%, while total amortization of

deferred policy acquisition costs decreased by $117 million, or 20%. Amortization of deferred policy acquisition costs of $723 million and $625 million are

allocated to other expenses in 2000 and 1999, respectively, while the remainder of the amortization in each year is allocated to investment gains and

losses. Excluding the impact of the GenAmerica acquisition, amortization of deferred policy acquisition costs of $585 million and $625 million are

MetLife, Inc.

14