MetLife 2001 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2001 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

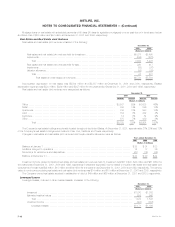

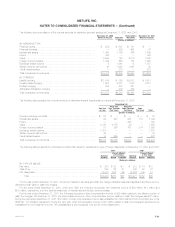

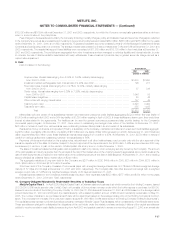

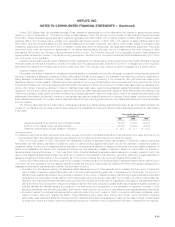

Policyholder Account Balances

The fair value of policyholder account balances are estimated by discounting expected future cash flows, based upon interest rates currently

being offered for similar contracts with maturities consistent with those remaining for the agreements being valued.

Short-term and Long-term Debt, Payables Under Securities Loaned Transactions and Company-Obligated Mandatorily Redeem-

able Securities of Subsidiary Trusts

The fair values of short-term and long-term debt, payables under securities loaned transactions and Company-obligated mandatorily redeemable

securities of subsidiary trusts are determined by discounting expected future cash flows, using risk rates currently available for debt with similar terms and

remaining maturities.

Derivative Instruments

The fair value of derivative instruments, including financial futures, financial forwards, interest rate, credit default and foreign currency swaps, floors,

foreign exchange contracts, caps, exchange-traded options and written covered call options are based upon quotations obtained from dealers or other

reliable sources. See Note 4 for derivative fair value disclosures.

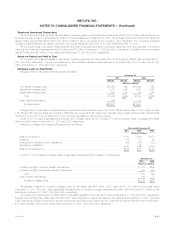

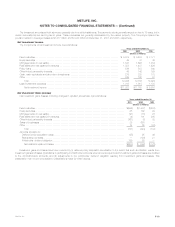

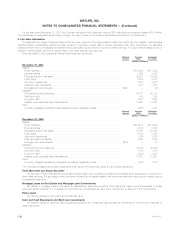

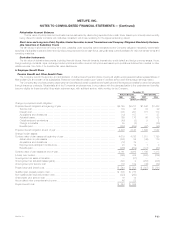

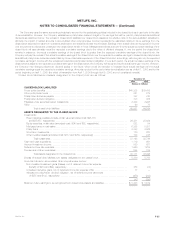

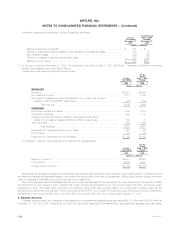

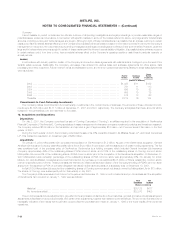

6. Employee Benefit Plans

Pension Benefit and Other Benefit Plans

The Company is both the sponsor and administrator of defined benefit pension plans covering all eligible employees and sales representatives of

Metropolitan Life and certain of its subsidiaries. Retirement benefits are based upon years of credited service and final average earnings history.

The Company also provides certain postemployment benefits and certain postretirement health care and life insurance benefits for retired employees

through insurance contracts. Substantially all of the Company’s employees may, in accordance with the plans applicable to the postretirement benefits,

become eligible for these benefits if they attain retirement age, with sufficient service, while working for the Company.

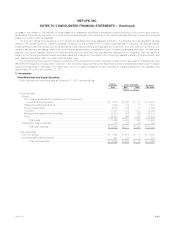

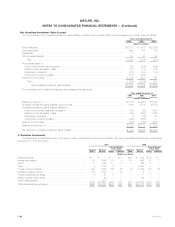

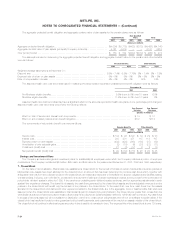

December 31,

Pension Benefits Other Benefits

2001 2000 2001 2000

(Dollars in millions)

Change in projected benefit obligation:

Projected benefit obligation at beginning of year *********************************************** $4,145 $3,737 $1,542 $1,483

Service cost************************************************************************* 104 98 34 29

Interest cost************************************************************************* 308 291 115 113

Acquisitions and divestitures *********************************************************** (12) 107 — 37

Actuarial losses ********************************************************************** 169 176 66 59

Curtailments and terminations ********************************************************** (49) (3) 9 2

Change in benefits ******************************************************************* 29 (2) — (86)

Benefits paid ************************************************************************ (268) (259) (97) (95)

Projected benefit obligation at end of year **************************************************** 4,426 4,145 1,669 1,542

Change in plan assets:

Contract value of plan assets at beginning of year ********************************************* 4,619 4,726 1,318 1,199

Actual return on plan assets *********************************************************** (201) 54 (49) 179

Acquisitions and divestitures *********************************************************** (12) 79 — —

Employer and participant contributions *************************************************** 23 19 1 3

Benefits paid ************************************************************************ (268) (259) (101) (63)

Contract value of plan assets at end of year ************************************************** 4,161 4,619 1,169 1,318

(Under) over funded ********************************************************************** (265) 474 (500) (224)

Unrecognized net asset at transition********************************************************* — (31) — —

Unrecognized net actuarial losses (gains)***************************************************** 693 2 (258) (478)

Unrecognized prior service cost 116 109 (49) (89)

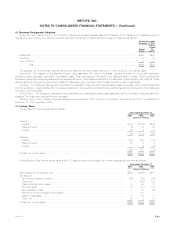

Prepaid (accrued) benefit cost************************************************************** $ 544 $ 554 $ (807) $ (791)

Qualified plan prepaid pension cost ********************************************************* $ 805 $ 775

Non-qualified plan accrued pension cost ***************************************************** (323) (263)

Unamortized prior service cost ************************************************************* 16 14

Accumulated other comprehensive income *************************************************** 46 28

Prepaid benefit cost $ 544 $ 554

MetLife, Inc. F-23