MetLife 2001 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2001 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

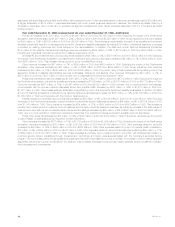

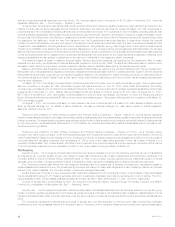

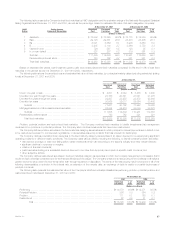

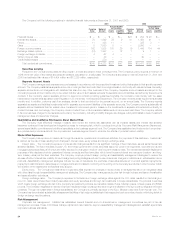

2001 2000 1999

Yield(1) Amount Yield(1) Amount Yield(1) Amount

(Dollars in millions)

Cash, Cash Equivalents and Short-term Investments:

Investment income ************************************************ 5.54% $ 279 5.72% $ 288 4.22% $ 173

Net investment losses ********************************************* (5) — —

Total ********************************************************** $ 274 $ 288 $ 173

Ending assets **************************************************** $ 8,676 $ 4,703 $ 5,844

Real Estate and Real Estate Joint Ventures:(4)

Investment income, net of expenses ********************************* 10.58% $ 584 11.09% $ 629 9.67% $ 581

Net investment gains (losses) *************************************** (4) 101 265

Total ********************************************************** $ 580 $ 730 $ 846

Ending assets **************************************************** $ 5,730 $ 5,504 $ 5,649

Equity Securities and Other Limited Partnership Interests:

Investment income ************************************************ 2.37% $ 97 4.98% $ 183 7.12% $ 239

Net investment gains (losses) *************************************** (96) 185 132

Total ********************************************************** $ 1 $ 368 $ 371

Ending assets **************************************************** $ 4,700 $ 3,845 $ 3,337

Other Invested Assets:

Investment income ************************************************ 7.60% $ 249 6.30% $ 162 6.01% $ 91

Net investment gains (losses) *************************************** 79 65 (24)

Total ********************************************************** $ 328 $ 227 $ 67

Ending assets **************************************************** $ 3,298 $ 2,821 $ 1,501

Total Investments:

Investment income before expenses and fees ************************* 7.72% $ 12,167 7.70% $12,008 7.47% $10,079

Investment expenses and fees ************************************** (0.16%) (244) (0.16%) (240) (0.20%) (263)

Net investment income********************************************* 7.56% $ 11,923 7.54% $11,768 7.27% $ 9,816

Net investment losses ********************************************* (762) (1,104) (137)

Adjustments to investment losses(5)********************************** 134 54 67

Gains from sales of subsidiaries ************************************* 25 660 —

Total ********************************************************** $ 11,320 $11,378 $ 9,746

(1) Yields are based on quarterly average asset carrying values for 2001, 2000 and 1999, excluding recognized and unrealized gains and losses, and for

yield calculation purposes, average assets exclude collateral associated with the Company’s securities lending program. Fixed maturity investment

income has been reduced by rebates paid under the program.

(2) Included in fixed maturities are equity-linked notes of $1,004 million, $1,232 million and $1,079 million at December 31, 2001, 2000 and 1999,

respectively, which include an equity-like component as part of the notes’ return. Investment income for fixed maturities includes prepayment fees

and income from the securities lending program.

(3) Investment income from mortgage loans includes prepayment fees.

(4) Real estate and real estate joint venture income is shown net of depreciation of $220 million, $224 million and $247 million for the years ended

December 31, 2001, 2000 and 1999, respectively.

(5) Adjustments to investment gains and losses include amortization of deferred policy acquisition costs, charges and credits to participating contracts,

and adjustments to the policyholder dividend obligation resulting from investment gains and losses.

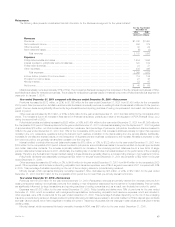

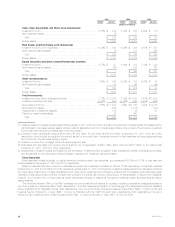

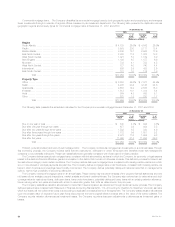

Fixed Maturities

Fixed maturities consist principally of publicly traded and privately placed debt securities, and represented 68.0% and 70.7% of total cash and

invested assets at December 31, 2001 and 2000, respectively.

Based on estimated fair value, public fixed maturities and private fixed maturities comprised 83.7% and 16.3%, respectively, of total fixed maturities

at December 31, 2001 and 83.6% and 16.4%, respectively, at December 31, 2000. The Company invests in privately placed fixed maturities to enhance

the overall value of its portfolio, increase diversification and obtain higher yields than can ordinarily be obtained with comparable public market securities.

Generally, private placements provide the Company with protective covenants, call protection features and, where applicable, a higher level of collateral.

However, the Company may not freely trade its private placements because of restrictions imposed by federal and state securities laws and illiquid

trading markets.

The Securities Valuation Office of the NAIC evaluates the bond investments of insurers for regulatory reporting purposes and assigns securities to

one of six investment categories called ‘‘NAIC designations.’’ The NAIC designations parallel the credit ratings of the Nationally Recognized Statistical

Rating Organizations for marketable bonds. NAIC designations 1 and 2 include bonds considered investment grade (rated ‘‘Baa3’’ or higher by Moody’s

Investors Service (‘‘Moody’s’’), or rated ‘‘BBB–’’ or higher by Standard & Poor’s (‘‘S&P’’)) by such rating organizations. NAIC designations 3 through 6

include bonds considered below investment grade (rated ‘‘Ba1’’ or lower by Moody’s, or rated ‘‘BB+’’ or lower by S&P).

MetLife, Inc.

26