MetLife 2001 Annual Report Download - page 15

Download and view the complete annual report

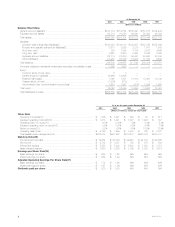

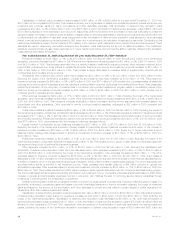

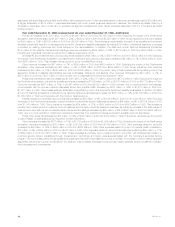

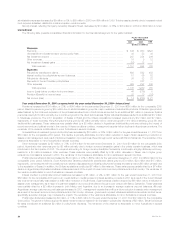

Please find page 15 of the 2001 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Policyholder benefits and claims increased by $3,793 million, or 29%, to $16,893 million in 2000 from $13,100 million in 1999. This increase

reflects total gross policyholder benefits and claims of $16,934 million, an increase of $3,855 million from $13,079 million in 1999, before the offsets for

additions to or (reductions in) participating contractholder accounts of $126 million in 2000 and $(21) million in 1999 and changes in the policyholder

dividend obligation of $(85) million in 2000 directly related to net investment losses. Excluding the impact of the GenAmerica acquisition, policyholder

benefits and claims increased $2,044 million, or 16%. This rise is primarily due to increases of $1,366 million, or 20%, in Institutional, $704 million, or

54%, in Auto & Home, and $104 million, or 23%, in International. These increases are partially offset by a decrease of $103 million, or 2%, in Individual.

The Institutional increase is largely due to overall growth within the segment’s group dental and disability businesses, as well as the BMA and Lincoln

National acquisitions. In addition, policyholder benefits and claims related to the group life and retirement and savings businesses increased commensu-

rate with the premium variance noted above. The increase in Auto & Home is due, in most part, to the St. Paul acquisition, which represents $580 million

of the increase. The remainder of the increase is largely attributable to a 9% increase in the number of auto policies in force and increased costs resulting

from an increase in the use of original equipment manufacturer parts and higher labor rates. The increase in International is primarily due to overall growth

in Mexico, Taiwan, South Korea, Spain and Brazil, commensurate with the increase in International’s premiums. The decrease in Individual is

predominately the result of improved mortality and morbidity experience.

Interest credited to policyholder account balances increased by $494 million, or 20%, to $2,935 million in 2000 from $2,441 million in 1999.

Excluding the impact of the GenAmerica acquisition, interest credited to policyholder account balances increased by $95 million, or 4%. This is primarily

attributable to increases of $54 million, or 5%, in Institutional and $36 million, or 3%, in Individual. The higher expense in Institutional is largely due to an

increase in group insurance of $84 million, which resulted from asset growth in customer account balances, growth in the bank-owned life insurance

business and increases in the cash values of executive and corporate-owned universal life plans. These increases are partially offset by a decrease in

retirement and savings products of $30 million, due to a continued shift in customers’ investment preferences from guaranteed interest products to

separate account alternatives. The increase in Individual is predominately due to higher policyholder account balances and increases in crediting rates on

annuity and investment products.

Policyholder dividends increased by $229 million, or 14%, to $1,919 million in 2000 from $1,690 million in 1999. Excluding the acquisition of

GenAmerica, policyholder dividends increased by $20 million, or 1%. Policyholder dividends vary from period to period based on participating group and

traditional individual life insurance contract experience.

Payments of $327 million were made during the second quarter of 2000, as part of Metropolitan Life’s demutualization, to holders of certain policies

transferred to Clarica Life Insurance Company in connection with the sale of a substantial portion of the Canadian operations in 1998.

Demutualization costs decreased by $30 million, or 12%, to $230 million in 2000 from $260 million in 1999. These costs are related to Metropolitan

Life’s demutualization on April 7, 2000.

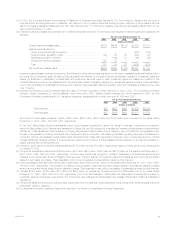

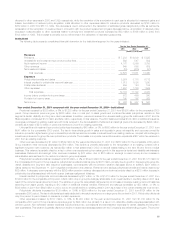

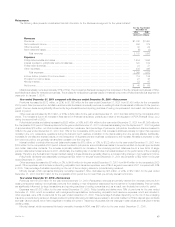

Other expenses increased by $1,562 million, or 24%, to $8,024 million in 2000 from $6,462 million in 1999. Excluding the capitalization and

amortization of deferred policy acquisition costs, which are discussed below, other expenses increased by $1,717 million, or 26%, to $8,409 million in

2000 from $6,692 million in 1999. Excluding the impact of the GenAmerica acquisition, other expenses increased by $405 million, or 6%. This increase

is primarily attributable to increases in Auto & Home, Individual, Institutional and International. These increases are partially offset by a $354 million, or

45%, decrease in Corporate & Other and a $101 million, or 13%, decrease in Asset Management. The increase in Auto & Home of $311 million, or 59%,

is largely due to the St. Paul acquisition. The increase in Individual of $298 million, or 11%, is partially attributable to a $111 million increase from the

broker/dealer and other subsidiaries commensurate with the increase in other revenues and increased securities lending volume. The income associated

with securities lending activity is included in net investment income. The increase in Institutional of $141 million, or 9%, is primarily due to costs incurred in

connection with initiatives focused on improving service delivery capabilities through investments in technology and an increase in volume-related

expenses associated with premium growth. Volume-related expenses include premium taxes, separate account investment management expenses and

commissions. The increase in International of $45 million, or 14%, is primarily attributable to expenses incurred in connection with business expansion

efforts in several countries. The decrease in Corporate & Other is primarily due to a $499 million charge in 1999 principally related to the settlement of a

multidistrict litigation proceeding involving alleged improper sales practices, accruals for sales practices claims not covered by the settlement and other

legal costs. The most significant factor contributing to the decline in Asset Management is the sale of Nvest, which occurred on October 30, 2000.

Deferred policy acquisition costs are principally amortized in proportion to gross margins or profits, including investment gains or losses. The

amortization is allocated to investment gains and losses to provide consolidated statement of income information regarding the impact of investment

gains and losses on the amount of the amortization, and other expenses to provide amounts related to gross margins or profits originating from

transactions other than investment gains and losses.

Capitalization of deferred policy acquisition costs increased to $1,863 million in 2000 from $1,160 million in 1999 while total amortization of deferred

policy acquisition costs, charged to operations, increased to $1,383 million in 2000 from $884 million in 1999. Excluding the impact of the GenAmerica

acquisition, capitalization of deferred policy acquisition costs increased to $1,413 million in 2000 from $1,160 in 1999 while total amortization of deferred

policy acquisition costs increased to $1,012 million in 2000 from $884 million in 1999. Amortization of deferred policy acquisition costs of $1,478 million

and $930 million are allocated to other expenses in 2000 and 1999, respectively, while the remainder of the amortization in each year is allocated to

investment losses. Excluding the impact of the GenAmerica acquisition, amortization of deferred policy acquisition costs of $1,136 million and

$930 million are allocated to other expenses in 2000 and 1999, respectively, while the remainder of the amortization in each year is allocated to

investment losses. The increase in amortization of deferred policy acquisition costs allocated to other expenses was predominately attributable to Auto &

Home’s acquisition of St. Paul.

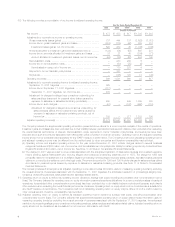

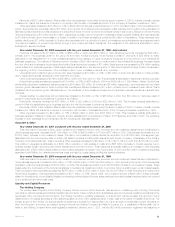

Income tax expense for the year ended December 31, 2000 was $463 million, or 33% of income before provision for income taxes, compared with

$558 million, or 47%, in 1999. The 2000 effective tax rate differs from the corporate tax rate of 35% due to non-deductible payments made in the second

quarter of 2000 to former Canadian policyholders in connection with the demutualization, a surplus tax benefit of $145 million and a reduction in prior year

taxes on capital gains associated with the sale of businesses recorded in the third quarter of 2000. The 1999 effective rate differs from the corporate tax

rate of 35% primarily due to the impact of surplus tax. Prior to its demutualization, Metropolitan Life was subject to surplus tax imposed on mutual life

insurance companies under Section 809 of the Internal Revenue Code. The surplus tax results from the disallowance of a portion of a mutual life

insurance company’s policyholder dividends as a deduction from taxable income.

MetLife, Inc.

12