MetLife 2001 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2001 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

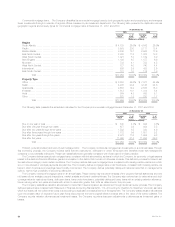

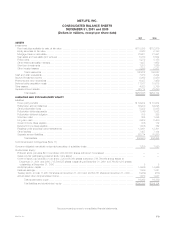

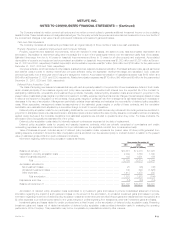

METLIFE, INC.

CONSOLIDATED BALANCE SHEETS

DECEMBER 31, 2001 and 2000

(Dollars in millions, except per share data)

2001 2000

ASSETS

Investments:

Fixed maturities available-for-sale, at fair value ************************************************************** $115,398 $112,979

Equity securities, at fair value **************************************************************************** 3,063 2,193

Mortgage loans on real estate**************************************************************************** 23,621 21,951

Real estate and real estate joint ventures ****************************************************************** 5,730 5,504

Policy loans ******************************************************************************************* 8,272 8,158

Other limited partnership interests************************************************************************* 1,637 1,652

Short-term investments ********************************************************************************* 1,203 1,269

Other invested assets ********************************************************************************** 3,298 2,821

Total investments ******************************************************************************** 162,222 156,527

Cash and cash equivalents ******************************************************************************** 7,473 3,434

Accrued investment income ******************************************************************************* 2,062 2,050

Premiums and other receivables**************************************************************************** 6,437 7,459

Deferred policy acquisition costs *************************************************************************** 11,167 10,618

Other assets ******************************************************************************************** 4,823 3,796

Separate account assets********************************************************************************** 62,714 70,250

Total assets ************************************************************************************* $256,898 $254,134

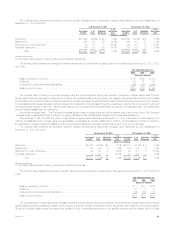

LIABILITIES AND STOCKHOLDERS’ EQUITY

Liabilities:

Future policy benefits *********************************************************************************** $ 84,924 $ 81,974

Policyholder account balances *************************************************************************** 58,923 54,095

Other policyholder funds ******************************************************************************** 5,332 5,035

Policyholder dividends payable *************************************************************************** 1,046 1,082

Policyholder dividend obligation*************************************************************************** 708 385

Short-term debt *************************************************************************************** 355 1,085

Long-term debt **************************************************************************************** 3,628 2,400

Current income taxes payable**************************************************************************** 306 112

Deferred income taxes payable*************************************************************************** 1,526 752

Payables under securities loaned transactions ************************************************************** 12,661 12,301

Other liabilities ***************************************************************************************** 7,457 7,184

Separate account liabilities******************************************************************************* 62,714 70,250

Total liabilities************************************************************************************ 239,580 236,655

Commitments and contingencies (Note 11)

Company-obligated mandatorily redeemable securities of subsidiary trusts***************************************** 1,256 1,090

Stockholders’ Equity:

Preferred stock, par value $0.01 per share; 200,000,000 shares authorized; none issued ************************* ——

Series A junior participating preferred stock; none issued ***************************************************** ——

Common stock, par value $0.01 per share; 3,000,000,000 shares authorized; 786,766,664 shares issued at

December 31, 2001 and 2000; 715,506,525 shares outstanding at December 31, 2001 and 760,681,913 shares

outstanding at December 31, 2000 ********************************************************************* 88

Additional paid-in capital ******************************************************************************** 14,966 14,926

Retained earnings************************************************************************************** 1,349 1,021

Treasury stock, at cost; 71,260,139 shares at December 31, 2001 and 26,084,751 shares at December 31, 2000*** (1,934) (613)

Accumulated other comprehensive income***************************************************************** 1,673 1,047

Total stockholders’ equity************************************************************************** 16,062 16,389

Total liabilities and stockholders’ equity ************************************************************** $256,898 $254,134

See accompanying notes to consolidated financial statements.

MetLife, Inc. F-3