MetLife 2001 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2001 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

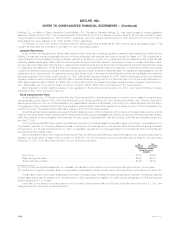

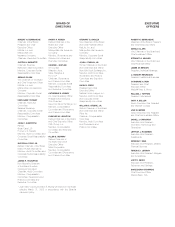

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

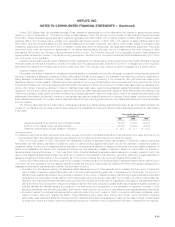

effectively manage its capital. The Company evaluates the performance of each operating segment based upon income or loss from operations before

provision for income taxes and non-recurring items (e.g. items of unusual or infrequent nature). The Company allocates non-recurring items (primarily

consisting of expenses associated with the anticipated resolution of proceedings alleging race-conscious underwriting practices, sales practices claims

and claims for personal injuries caused by exposure to asbestos or asbestos-containing products and demutualization costs) to Corporate & Other.

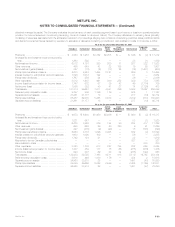

At or for the year ended December 31, 2001

Auto & Asset Corporate

Individual Institutional Reinsurance Home Management International & Other Total

(Dollars in millions)

Premiums *********************************** $ 4,563 $ 7,288 $1,762 $2,755 $ — $ 846 $ (2) $ 17,212

Universal life and investment-type product policy

fees ************************************** 1,260 592 — — — 38 (1) 1,889

Net investment income ************************ 6,512 4,161 390 200 71 267 322 11,923

Other revenues******************************* 495 649 42 22 198 16 85 1,507

Net investment gains (losses) ******************* 827 (15) (6) (17) 25 (16) (1,401) (603)

Policyholder benefits and claims***************** 5,233 8,924 1,484 2,121 — 689 3 18,454

Interest credited to policyholder account balances** 1,898 1,013 122 — — 51 — 3,084

Policyholder dividends ************************* 1,767 259 24 — — 36 — 2,086

Other expenses ****************************** 3,012 1,907 491 800 252 329 774 7,565

Income (loss) before provision for income taxes**** 1,747 572 67 39 42 46 (1,774) 739

Net income (loss) ***************************** 1,095 382 40 41 27 14 (1,126) 473

Total assets********************************** 131,314 89,661 7,911 4,581 256 5,308 17,867 256,898

Deferred policy acquisition costs **************** 8,757 509 1,196 179 — 525 1 11,167

Separate account assets ********************** 31,261 31,177 13 — — 277 (14) 62,714

Policyholder liabilities ************************** 88,287 52,075 5,355 2,610 — 3,419 (813) 150,933

Separate account liabilities ********************* 31,261 31,177 13 — — 277 (14) 62,714

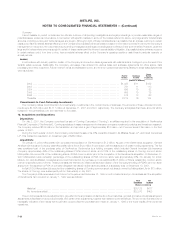

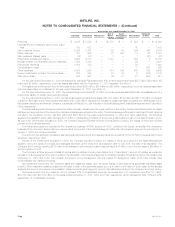

At or for the year ended December 31, 2000

Auto & Asset Corporate

Individual Institutional Reinsurance Home Management International & Other Total

(Dollars in millions)

Premiums *********************************** $ 4,673 $ 6,900 $1,450 $2,636 $ — $ 660 $ (2) $ 16,317

Universal life and investment-type product policy

fees ************************************** 1,221 547 — — — 53 (1) 1,820

Net investment income ************************ 6,475 3,959 379 194 90 254 417 11,768

Other revenues******************************* 650 650 29 40 760 9 91 2,229

Net investment gains (losses) ******************* 227 (475) (2) (20) — 18 (138) (390)

Policyholder benefits and claims***************** 5,054 8,178 1,096 2,005 — 562 (2) 16,893

Interest credited to policyholder account balances** 1,680 1,090 109 — — 56 — 2,935

Policyholder dividends ************************* 1,742 124 21 — — 32 — 1,919

Payments to former Canadian policyholders ******* — — — — — 327 — 327

Demutualization costs ************************* — — — — — — 230 230

Other expenses ****************************** 3,323 1,730 513 827 784 292 555 8,024

Income (loss) before provision for income taxes**** 1,447 459 117 18 66 (275) (416) 1,416

Net income (loss) ***************************** 920 307 69 30 34 (285) (122) 953

Total assets********************************** 132,433 89,725 7,163 4,511 418 5,119 14,765 254,134

Deferred policy acquisition costs **************** 8,610 446 1,030 176 — 354 2 10,618

Separate account assets ********************** 34,860 33,918 28 — — 1,491 (47) 70,250

Policyholder liabilities ************************** 84,049 49,669 5,028 2,559 — 2,435 (1,169) 142,571

Separate account liabilities ********************* 34,860 33,918 28 — — 1,491 (47) 70,250

MetLife, Inc. F-39