MetLife 2001 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2001 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

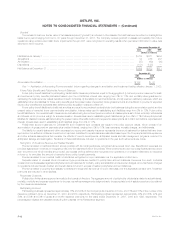

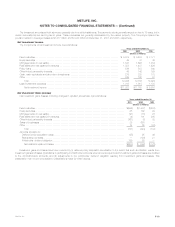

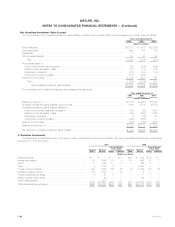

Structured Investment Transactions

The Company securitizes high yield debt securities, investment grade bonds and structured finance securities. The Company has sponsored four

securitizations with a total of approximately $1.5 billion in financial assets as of December 31, 2001. Two of these transactions included the transfer of

assets totaling approximately $289 million from which investment gains, recognized by the Company, were insignificant. The Company’s beneficial

interests in these SPEs and the related investment income were insignificant as of and for the year ended December 31, 2001.

The Company invests in structured notes and similar type instruments which generally provide equity-based returns on debt securities. The carrying

value of such investments was approximately $1.6 billion and $1.3 billion at December 31, 2001 and 2000, respectively. The related income recognized

was $44 million and $62 million for the years ended December 31, 2001 and 2000, respectively.

Assets on Deposit and Held in Trust

The Company had investment assets on deposit with regulatory agencies with a fair market value of $845 million and $932 million at December 31,

2001 and 2000, respectively. Company securities held in trust to satisfy collateral requirements had an amortized cost of $1,218 million and $1,234

million at December 31, 2001 and 2000, respectively.

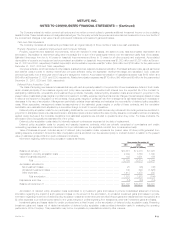

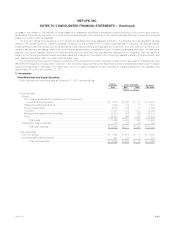

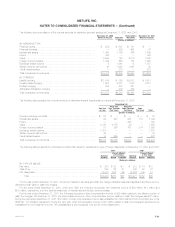

Mortgage Loans on Real Estate

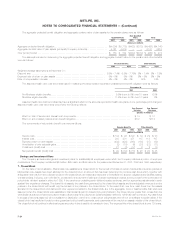

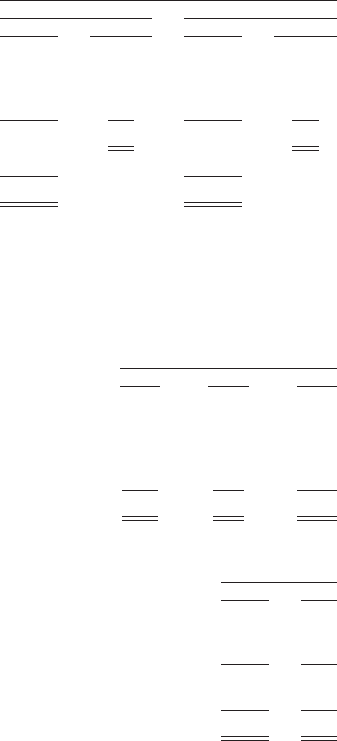

Mortgage loans on real estate were categorized as follows:

December 31,

2001 2000

Amount Percent Amount Percent

(Dollars in millions)

Commercial mortgage loans************************************************** $18,093 76% $16,944 77%

Agricultural mortgage loans*************************************************** 5,277 22% 4,980 22%

Residential mortgage loans*************************************************** 395 2% 110 1%

Total****************************************************************** 23,765 100% 22,034 100%

Less: Valuation allowances 144 83

Mortgage loans $23,621 $21,951

Mortgage loans on real estate are collateralized by properties primarily located throughout the United States. At December 31, 2001, approximately

17%, 8% and 8% of the properties were located in California, New York and Florida, respectively. Generally, the Company (as the lender) requires that a

minimum of one-fourth of the purchase price of the underlying real estate be paid by the borrower.

Certain of the Company’s real estate joint ventures have mortgage loans with the Company. The carrying values of such mortgages were $644

million and $540 million at December 31, 2001 and 2000, respectively.

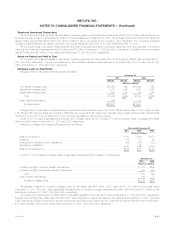

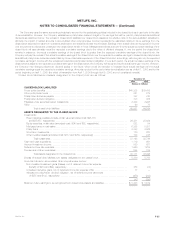

Changes in mortgage loan valuation allowances were as follows:

Years ended December 31,

2001 2000 1999

(Dollars in millions)

Balance at January 1 ********************************************************************** $ 83 $ 90 $ 173

Additions********************************************************************************* 106 38 40

Deductions for writedowns and dispositions**************************************************** (45) (74) (123)

Acquisitions of affiliates ********************************************************************* —29 —

Balance at December 31 ******************************************************************* $144 $ 83 $ 90

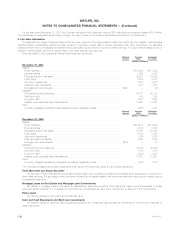

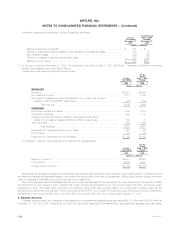

A portion of the Company’s mortgage loans on real estate was impaired and consisted of the following:

December 31,

2001 2000

(Dollars in millions)

Impaired mortgage loans with valuation allowances ********************************************************** $ 816 $592

Impaired mortgage loans without valuation allowances******************************************************** 324 330

Total ********************************************************************************************* 1,140 922

Less: Valuation allowances ****************************************************************************** 140 77

Impaired mortgage loans **************************************************************************** $1,000 $845

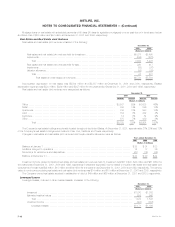

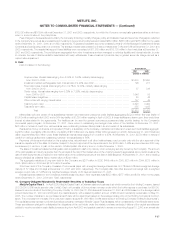

The average investment in impaired mortgage loans on real estate was $947 million, $912 million and $1,134 million for the years ended

December 31, 2001, 2000 and 1999, respectively. Interest income on impaired mortgage loans was $92 million, $76 million and $101 million for the

years ended December 31, 2001, 2000 and 1999, respectively.

The investment in restructured mortgage loans on real estate was $685 million and $784 million at December 31, 2001 and 2000, respectively.

Interest income of $52 million, $62 million and $80 million was recognized on restructured loans for the years ended December 31, 2001, 2000 and

1999, respectively. Gross interest income that would have been recorded in accordance with the original terms of such loans amounted to $60 million,

$74 million and $92 million for the years ended December 31, 2001, 2000 and 1999, respectively.

MetLife, Inc. F-17