MetLife 2001 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2001 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Problem and Potential Problem Equity Securities and Other Limited Partnership Interests

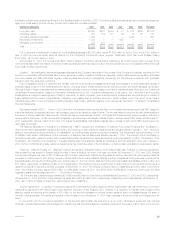

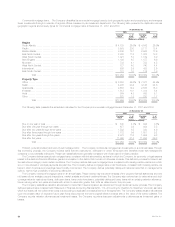

The Company monitors its equity securities and other limited partnership interests on a continual basis. Through this monitoring process, the

Company identifies investments that management considers to be problems or potential problems.

Problem equity securities and other limited partnership interests are defined as securities (i) in which significant declines in revenues and/or margins

threaten the ability of the issuer to continue operating, or (ii) where the issuer has subsequently entered bankruptcy.

Potential problem equity securities and other limited partnership interests are defined as securities issued by a company that is experiencing

significant operating problems or difficult industry conditions. Criteria generally indicative of these problems or conditions are (i) cash flows falling below

varying thresholds established for the industry and other relevant factors, (ii) significant declines in revenues and/or margins, (iii) public securities trading at

a substantial discount compared to original cost as a result of specific credit concerns, and (iv) other information that becomes available.

Equity securities or other limited partnership interests which are deemed to be other than temporarily impaired are written down to fair value. Write-

downs are recorded as investment losses and the cost basis of the equity securities and other limited partnership interests are adjusted accordingly. The

Company does not change the revised cost basis for subsequent recoveries in value. For the years ended December 31, 2001 and 2000, such write-

downs were $142 million and $18 million, respectively.

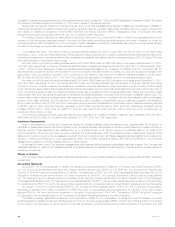

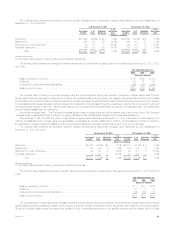

Other Invested Assets

The Company’s other invested assets consist principally of leveraged leases and funds withheld at interest of $2.7 billion and $2.3 billion at

December 31, 2001 and 2000, respectively. The leveraged leases are recorded net of non-recourse debt. The Company participates in lease

transactions which are diversified by geographic area. The Company regularly reviews residual values and writes down residuals to expected values as

needed. Funds withheld represent amounts contractually withheld by ceding companies in accordance with reinsurance agreements. For agreements

written on a modified coinsurance basis and certain agreements written on a coinsurance basis, assets equal to the net statutory reserves are withheld

and legally owned by the ceding company. Interest accrues to these funds withheld at rates defined by the treaty terms. The Company’s other invested

assets represented 1.9% and 1.8% of cash and invested assets at December 31, 2001 and 2000, respectively.

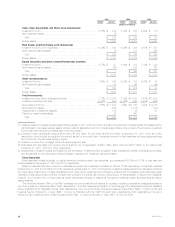

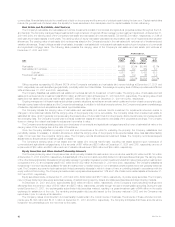

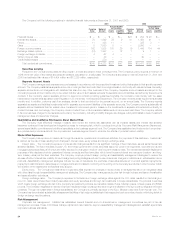

Derivative Financial Instruments

The Company uses derivative instruments to manage market risk through one of four principal risk management strategies: the hedging of invested

assets, liabilities, portfolios of assets or liabilities and anticipated transactions. Additionally, Metropolitan Life enters into income generation and replication

derivative transactions as permitted by its derivatives use plan that was approved by the Department. The Company’s derivative hedging strategy

employs a variety of instruments including financial futures, financial forwards, interest rate and foreign currency swaps, foreign exchange contracts, and

options, including caps and floors.

The Company designates and accounts for the following as cash flow hedges, when they have met the effectiveness requirements of SFAS 133:

(i) various types of interest rate swaps to convert floating rate investments to fixed rate investments, (ii) receive fixed foreign currency swaps to hedge the

foreign currency cash flow exposure of foreign currency denominated investments, (iii) foreign currency forwards to hedge the exposure of future

payments in foreign currencies, and (iv) other instruments to hedge the cash flows of various other anticipated transactions. For all qualifying and highly

effective cash flow hedges, the effective portion of changes in fair value of the derivative instrument is reported in other comprehensive income. The

ineffective portion of changes in fair value of the derivative instrument are reported in net investment gains or losses. Hedged forecasted transactions,

other than the receipt or payment of variable interest payments, are not expected to occur more than 12 months after hedge inception.

The Company designates and accounts for the following as fair value hedges, when they have met the effectiveness requirements of SFAS 133:

(i) various types of interest rate swaps to convert fixed rate investments to floating rate investments, (ii) receive floating foreign currency swaps to hedge

the foreign currency fair value exposure of foreign currency denominated investments, and (iii) other instruments to hedge various other fair value

exposures of investments. For all qualifying and highly effective fair value hedges, the changes in fair value of the derivative instrument are reported as net

investment gains or losses. In addition, changes in fair value attributable to the hedged portion of the underlying instrument are reported in net investment

gains and losses.

For the year ended December 31, 2001, the amount related to fair value and cash flow hedge ineffectiveness was insignificant and there were no

discontinued fair value or cash flow hedges.

For the years ended December 31, 2001, 2000 and 1999, the Company recognized net investment income of $32 million, $13 million and

$0.3 million, respectively, from the periodic settlement of interest rate and foreign currency swaps.

For the year ended December 31, 2001, the Company recognized other comprehensive income of $39 million relating to the effective portion of

cash flow hedges. At December 31, 2001, the accumulated amount in other comprehensive income relating to cash flow hedges was $71 million.

During the year ended December 31, 2001, $19 million of other comprehensive income was reclassified into net investment income primarily due to the

SFAS 133 transition adjustment. During the next year, other comprehensive income of $17 million related to cash flow hedges is expected to be

reclassified into net investment income. The reclassifications are recognized over the life of the hedged item.

For the year ended December 31, 2001, the Company recognized net investment income of $24 million and net investment gains of $100 million

from derivatives not designated as accounting hedges. The use of these non-speculative derivatives is permitted by the Department.

MetLife, Inc. 33