MetLife 2001 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2001 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

chairman’s letter

To MetLife Shareholders:

The year 2001 was a true test of the qualities that define MetLife. Our core values, brought to life in

what we do every day, were no more evident than in our response to the tragic events that shook our

nation on September 11. Our purpose, to build financial freedom for everyone, resonated with meaning

as we served our customers, communities and employees during this difficult time. And, our investment

of $1 billion in a broad array of publicly traded stocks was a testament to the confidence we have in our

country and our economy. As I reflect on the year and what we accomplished, I have never been more

proud to be a part of MetLife. While financial results are clearly important, it’s the impact we have on our

customers’ lives that has been, and always will be, MetLife’s legacy.

During the year, we continued to sharpen our strategic focus and review our operating platforms, shaping MetLife for heightened

market leadership in the years ahead and increased shareholder value. At the same time, we are investing for growth, recognizing the

importance of technology and scale as continued consolidation, convergence and competition characterize the financial services

industry.

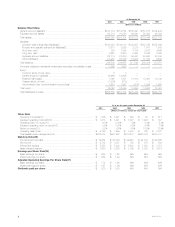

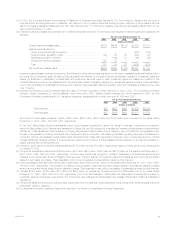

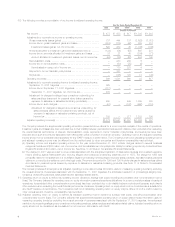

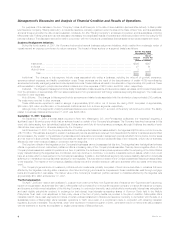

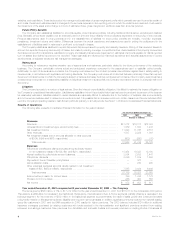

In an environment of volatile markets and an economic slowdown, we continued to deliver solid financial results for our shareholders.

For the year 2001, net income was $473 million, or $0.62 per diluted share. Net income for 2001 includes a $159 million litigation

charge associated with the anticipated resolution of certain class action lawsuits and a related regulatory inquiry pending against

Metropolitan Life Insurance Company, $330 million of charges related to business realignment initiatives, establishment of a $74 million

policyholder liability with respect to certain group annuity contracts at New England Financial, $208 million of losses associated with the

September 11th tragedies and net realized investment losses of $433 million, all of which are net of income taxes.

For 2000, net income was $953 million, or $1.21 per share on a pro forma diluted basis. For 2000, net income included a one-time

payout to transferred Canadian policyholders of $327 million associated with MetLife’s demutualization, net realized investment losses of

$236 million and demutualization expenses of $170 million, all of which were net of income taxes, as well as a net surplus tax benefit of

$145 million.

Excluding the items discussed in the preceding paragraphs, the results for 2001 were $1.68 billion, up 9% from $1.54 billion for the

prior year. On a per share diluted basis, the 2001 results were $2.19, up 12% from $1.96, on a pro forma basis, for the prior year.

Although some of the actions taken this year have been difficult, they were necessary steps in our transformation as we continue to

streamline our organization to speed up decision-making, boost productivity and re-allocate capital for investment in growth opportuni-

ties. I am confident that we will deliver on our three-year plan to produce 15% growth in operating earnings per share annually through

2004, and increase our operating return on equity annually by 75 basis points through 2004.

HBuilding Shareholder Value

We have instilled a rigorous financial management discipline to support our business performance. Expense management remains

one of our highest priorities. In the Individual segment, we’ve continued to consolidate sales offices to enhance productivity. We have

also moved aggressively to integrate our Customer Response Centers and develop common platforms in such areas as life administra-

tion, annuities administration and our broker-dealer operations. Consolidating shared services into ‘‘centers of excellence’’ has enabled

our company to better leverage resources and create efficiencies. Other initiatives include a company-wide effort to reduce costs,

enhance quality and improve productivity.

We also made the decision last year to lease a significant amount of space at our headquarters to Credit Suisse First Boston. Given

the value of New York City real estate, it was a business decision that will benefit our bottom line over the long term. In considering

options for affected employees, we consulted a number of managers in each of our businesses. As a result, we leased three new

workspaces in the New York City area—in Long Island City, New York; Jersey City, New Jersey and White Plains, New York. Our move to

the Long Island City location has been applauded as a major commitment to the borough of Queens and its continued development.

Continuing to streamline management decision-making, we announced in the third quarter of last year the elimination of 10% of

officer- and director-level positions. While difficult, these steps were necessary to position us for greater profitability and competitiveness

in the years ahead.

HInformation Technology

We continued to build our eBusiness platform in 2001 to heighten service quality and operational efficiency. MetLife’s eBusiness

applications continued to evolve as we rolled out: MyBenefits, the Institutional segment’s employee portal; MetDental.com, a dental

provider portal to help dentists manage administrative functions; MetLife eService, an Individual segment functionality that allows life and

annuity clients to view their life insurance policies and annuity contract values and perform select self-service transactions electronically;

and the MetLife Auto & Home Agent Resource Site, a Web portal designed to provide agents with the most up-to-date sales and

marketing information. In addition, as we gear up for the full-scale launch of MetLife Bank, we are preparing to offer customers the ability

to transact business online.

Internally, we are using Web-based technologies for communicating with and providing service to our employees, while at the same

time improving the operational efficiency and functionality of internal processes.