MetLife 2001 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2001 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

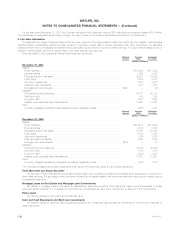

processed. Any revision to the estimate of gross losses and reinsurance recoveries in subsequent periods will affect net income in such periods.

Reinsurance recoveries are dependent on the continued creditworthiness of the reinsurers, which may be adversely affected by their other reinsured

losses in connection with the tragedies.

The long-term effects of the tragedies on the Company’s businesses cannot be assessed at this time. The tragedies have had significant adverse

effects on the general economic, market and political conditions, increasing many of the Company’s business risks. In particular, the declines in share

prices experienced after the reopening of the United States equity markets following the tragedies have contributed, and may continue to contribute, to a

decline in separate account assets, which in turn could have an adverse effect on fees earned in the Company’s businesses. In addition, the Institutional

segment may receive disability claims from individuals suffering from mental and nervous disorders resulting from the tragedies. This may lead to a

revision in the Company’s estimated insurance losses related to the tragedies. The majority of the Company’s disability policies include the provision that

such claims be submitted within two years of the traumatic event.

The Company’s general account investment portfolios include investments, primarily comprised of fixed income securities, in industries that were

affected by the tragedies, including airline, insurance, other travel and lodging and insurance. Exposures to these industries also exist through mortgage

loans and investments in real estate. The market value of the Company’s investment portfolio exposed to industries affected by the tragedies was

approximately $3.0 billion at December 31, 2001.

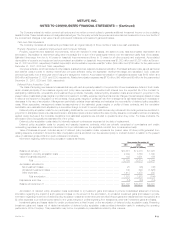

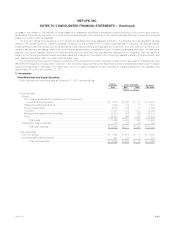

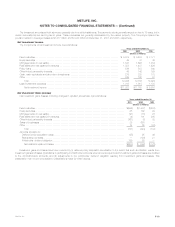

3. Investments

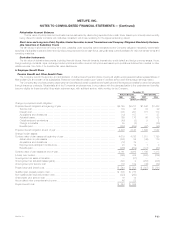

Fixed Maturities and Equity Securities

Fixed maturities and equity securities at December 31, 2001 were as follows:

Cost or Gross Unrealized

Amortized Estimated

Cost Gain Loss Fair Value

(Dollars in millions)

Fixed Maturities:

Bonds:

U.S. Treasury securities and obligations of U.S. government

corporations and agencies ********************************************** $ 8,230 $1,026 $ 43 $ 9,213

States and political subdivisions ******************************************** 1,492 49 10 1,531

Foreign governments ***************************************************** 4,512 419 41 4,890

Corporate ************************************************************** 47,217 1,703 1,031 47,889

Mortgage- and asset-backed securities ************************************* 33,834 906 266 34,474

Other ****************************************************************** 16,220 956 537 16,639

Total bonds ********************************************************* 111,505 5,059 1,928 114,636

Redeemable preferred stocks************************************************ 783 12 33 762

Total fixed maturities************************************************** $112,288 $5,071 $1,961 $115,398

Equity Securities:

Common stocks*********************************************************** $ 1,968 $ 657 $ 78 $ 2,547

Nonredeemable preferred stocks ********************************************* 491 28 3 516

Total equity securities************************************************* $ 2,459 $ 685 $ 81 $ 3,063

MetLife, Inc. F-15