MetLife 2001 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2001 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

variables, such as inflation. These factors enter into management’s estimates of gross margins and profits which generally are used to amortize certain of

such costs. Revisions to estimates result in changes to the amounts expensed in the reporting period in which the revisions are made and could result in

the impairment of the asset and a charge to income if estimated future gross margins and profits are less than amounts deferred.

Future Policy Benefits

The Company also establishes liabilities for amounts payable under insurance policies, including traditional life insurance, annuities and disabled

lives. Generally, amounts are payable over an extended period of time and the profitability of the products is dependent on the pricing of the products.

Principal assumptions used in pricing policies and in the establishment of liabilities for future policy benefits are mortality, morbidity, expenses,

persistency, investment returns and inflation. Differences between the actual experience and assumptions used in pricing the policies and in the

establishment of liabilities result in variances in profit and could result in losses.

The Company establishes liabilities for unpaid claims and claims expenses for property and casualty insurance. Pricing of this insurance takes into

account the expected frequency and severity of losses, the costs of providing coverage, competitive factors, characteristics of the property covered and

the insured, and profit considerations. Liabilities for property and casualty insurance are dependent on estimates of amounts payable for claims reported

but not settled and claims incurred but not reported. These estimates are influenced by historical experience and actuarial assumptions of current

developments, anticipated trends and risk management strategies.

Reinsurance

Accounting for reinsurance requires extensive use of assumptions and estimates, particularly related to the future performance of the underlying

business. The Company periodically reviews actual and anticipated experience compared to the assumptions used to establish policy benefits.

Additionally, for each of its reinsurance contracts, the Company must determine if the contract provides indemnification against loss or liability relating to

insurance risk, in accordance with applicable accounting standards. The Company must review all contractual features, particularly those that may limit

the amount of insurance risk to which the Company is subject or features that delay the timely reimbursement of claims. If the Company determines that a

contract does not expose it to a reasonable possibility of a significant loss from insurance risk, the Company records the contract on a deposit method of

accounting.

Litigation

The Company is a party to a number of legal actions. Given the inherent unpredictability of litigation, it is difficult to estimate the impact of litigation on

the Company’s consolidated financial position. Liabilities are established when it is probable that a loss has been incurred and the amount of the loss can

be reasonably estimated. Liabilities related to certain lawsuits are especially difficult to estimate due to the limitation of available data and uncertainty

around numerous variables used to determine amounts recorded. It is possible that an adverse outcome in certain cases could have an adverse effect

upon the Company’s operating results or cash flows in particular quarterly or annual periods. See Note 11 of Notes to Consolidated Financial Statements.

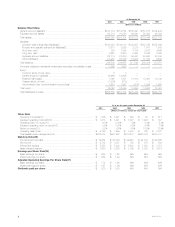

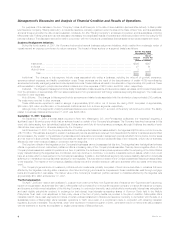

Results of Operations

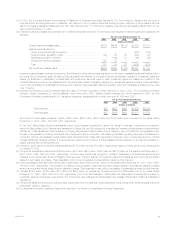

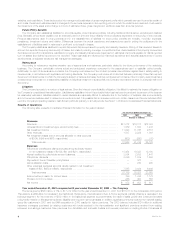

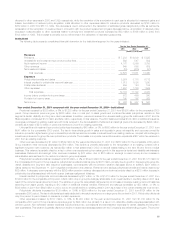

The following table presents consolidated financial information for the years indicated:

For the Year Ended December 31,

2001 2000 1999

(Dollars in millions)

Revenues

Premiums*********************************************************************** $17,212 $16,317 $12,088

Universal life and investment-type product policy fees ********************************** 1,889 1,820 1,433

Net investment income *********************************************************** 11,923 11,768 9,816

Other revenues ****************************************************************** 1,507 2,229 1,861

Net investment losses (net of amounts allocable to other accounts

of $(134), $(54) and $(67), respectively) ******************************************* (603) (390) (70)

Total revenues *************************************************************** 31,928 31,744 25,128

Expenses

Policyholder benefits and claims (excludes amounts directly related

to net investment losses of $(159), $41 and $(21), respectively) *********************** 18,454 16,893 13,100

Interest credited to policyholder account balances ************************************* 3,084 2,935 2,441

Policyholder dividends ************************************************************ 2,086 1,919 1,690

Payments to former Canadian policyholders ****************************************** — 327 —

Demutualization costs************************************************************* — 230 260

Other expenses (excludes amounts directly related to net investment

losses of $25, $(95) and $(46), respectively) *************************************** 7,565 8,024 6,462

Total expenses ************************************************************** 31,189 30,328 23,953

Income before provision for income taxes ******************************************** 739 1,416 1,175

Provision for income taxes********************************************************* 266 463 558

Net income ********************************************************************* $ 473 $ 953 $ 617

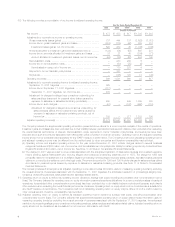

Year ended December 31, 2001 compared with year ended December 31, 2000 — The Company

Premiums grew by $895 million, or 5%, to $17,212 million for the year ended December 31, 2001 from $16,317 for the comparable 2000 period.

This variance is attributable to increases in the Institutional, Reinsurance, International and Auto & Home segments, partially offset by a decrease in the

Individual segment. An improvement of $388 million in the Institutional segment is predominately the result of sales growth and continued favorable

policyholder retention in this segment’s dental, disability and long-term care businesses. In addition, significant premiums received from several existing

group life customers in 2001 and the BMA acquisition in 2000 resulted in higher premiums. The 2000 balance includes $124 million in additional

insurance coverages purchased by existing customers with funds received in the demutualization and significant premiums received from existing

retirement and savings customers. New premiums from facultative and automatic treaties and renewal premiums on existing blocks of business all

MetLife, Inc.

8