MetLife 2001 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2001 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

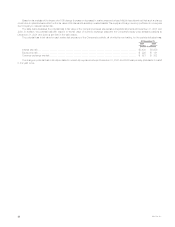

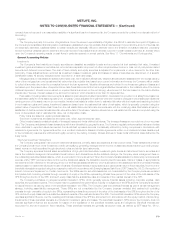

Based on its analysis of the impact of a 10% change (increase or decrease) in market rates and prices, MetLife has determined that such a change

could have a material adverse effect on the fair value of its interest rate sensitive invested assets. The equity and foreign currency portfolios do not expose

the Company to material market risk.

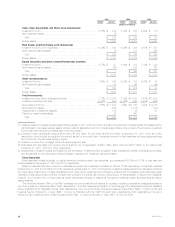

The table below illustrates the potential loss in fair value of the Company’s interest rate sensitive financial instruments at December 31, 2001 and

2000. In addition, the potential loss with respect to the fair value of currency exchange rates and the Company’s equity price sensitive positions at

December 31, 2001 and 2000 is set forth in the table below.

The potential loss in fair value for each market risk exposure of the Company’s portfolio, all of which is non-trading, for the periods indicated was:

At December 31,

2001 2000

(Dollars in millions)

Interest rate risk ************************************************************************************** $3,430 $3,959

Equity price risk ************************************************************************************** $ 228 $ 181

Currency exchange rate risk**************************************************************************** $ 521 $ 302

The change in potential loss in fair value related to market risk exposure between December 31, 2001 and 2000 was primarily attributable to a shift

in the yield curve.

MetLife, Inc.

36