MetLife 2001 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2001 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Holdings, S.L., an affiliate of Banco Santander Central Hispano, S.A. The sale by Santusa Holdings, S.L. was made pursuant to a shelf registration

statement, effective June 29, 2001. The Company acquired 45,242,966 and 26,108,315 shares of common stock for $1,322 million and $613 million

during the years ended December 31, 2001 and 2000, respectively. During the years ended December 31, 2001 and 2000, 67,578 and 23,564 of

these shares have been reissued for $1 million and $0.4 million, respectively.

On February 19, 2002, the Holding Company’s Board of Directors authorized an additional $1 billion common stock repurchase program. This

program will begin after the completion of the March 28, 2001 repurchase program.

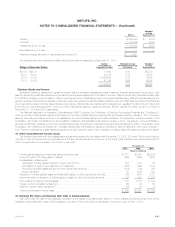

Dividend Restrictions

Under the New York Insurance Law, Metropolitan Life is permitted without prior insurance regulatory clearance to pay a stockholder dividend to the

Holding Company as long as the aggregate amount of all such dividends in any calendar year does not exceed the lesser of (i) 10% of its surplus to

policyholders as of the immediately preceding calendar year and (ii) its statutory net gain from operations for the immediately preceding calendar year

(excluding realized capital gains). Metropolitan Life will be permitted to pay a stockholder dividend to the Holding Company in excess of the lesser of such

two amounts only if it files notice of its intention to declare such a dividend and the amount thereof with the Superintendent and the Superintendent does

not disapprove the distribution. Under the New York Insurance Law, the Superintendent has broad discretion in determining whether the financial

condition of a stock life insurance company would support the payment of such dividends to its stockholders. The Department has established informal

guidelines for such determinations. The guidelines, among other things, focus on the insurer’s overall financial condition and profitability under statutory

accounting practices. For the year ended December 31, 2001, Metropolitan Life paid to MetLife, Inc. $721 million in dividends for which prior insurance

regulatory clearance was not required and $3,064 million in special dividends, as approved by the Superintendent. For the year ended December 31,

2000, Metropolitan Life paid to MetLife, Inc. $763 million in dividends for which prior insurance regulatory clearance was not required. At December 31,

2001, Metropolitan Life could pay the Holding Company a dividend of $546 million without prior approval of the Superintendent.

MIAC is subject to similar restrictions based on the regulations of its domicile, and at December 31, 2001, could pay the Holding Company

dividends of $104 million without prior approval.

Stock Compensation Plans

Under the MetLife, Inc. 2000 Stock Incentive Plan (the ‘‘Stock Incentive Plan’’), awards granted may be in the form of non-qualified or incentive stock

options qualifying under Section 422A of the Internal Revenue Code. Under the MetLife, Inc. 2000 Directors Stock Plan, (the ‘‘Directors Stock Plan’’)

awards granted may be in the form of stock awards or non-qualified stock options or a combination of the foregoing to outside Directors of the Company.

The aggregate number of shares of stock that may be awarded under the Stock Incentive Plan is subject to a maximum limit of 37,823,333 shares for the

duration of the plan. The Directors Stock Plan has a maximum limit of 500,000 share awards.

All options granted have an exercise price equal to the fair market value price of the Company’s common stock on the date of grant, and an option’s

maximum term is ten years. Certain options under the Stock Incentive Plan become exercisable over a three-year period commencing with date of grant,

while other options become exercisable three years after the date of grant. Options issued under the Directors Stock Plan are exercisable at any time

after April 7, 2002.

The Company applies APB 25 and related interpretations in accounting for its stock-based compensation plans. Accordingly, in the measurement of

compensation expense, the Company utilizes the excess of market price over exercise price on the first date that both the number of shares and award

price are known. For the year ended December 31, 2001, compensation expense for non-employees related to the Company’s Stock Incentive Plan and

Directors Stock Plan was $1 million.

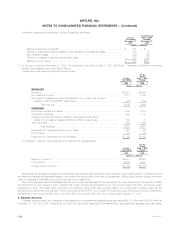

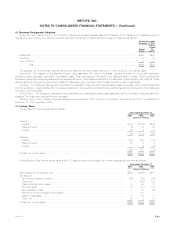

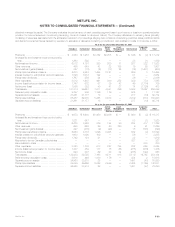

Had compensation cost for the Company’s Stock Incentive Plan and Directors Stock Plan been determined based on fair value at the grant date for

awards under those plans consistent with the method of SFAS No. 123, the Company’s net income and earnings per share for the year ended

December 31, 2001 would have been reduced to the pro forma amounts below:

As Pro

Reported forma(1)(2)

(Dollars in millions,

except per share

amounts)

Net income ************************************************************************************** $ 473 $ 454

Basic earnings per share *************************************************************************** $0.64 $0.61

Diluted earnings per share ************************************************************************** $0.62 $0.59

(1) The pro forma earnings disclosures are not necessarily representative of the effects on net income and earnings per share in future years.

(2) Includes the Company’s ownership share of compensation costs related to RGA’s incentive stock plan determined in accordance with SFAS 123.

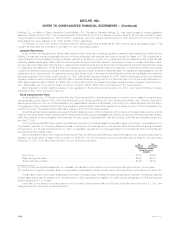

The fair value of each option grant is estimated on the date of the grant using the Black-Scholes options-pricing model with the following weighted

average assumptions used for grants in 2001: dividend yield of 0.68%, expected price variability of 31.60%, risk-free interest rate of 5.72% and expected

duration ranging from 4 to 6 years.

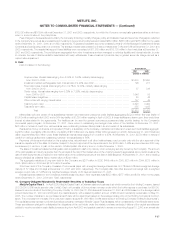

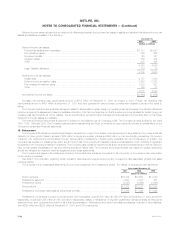

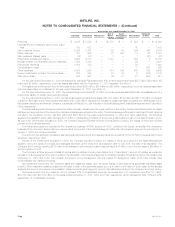

A summary of the status of options included in the Company’s Stock Incentive Plan and Directors Stock Plan as of December 31, 2001 and

changes during the year ended is presented below:

MetLife, Inc.

F-36