MetLife 2001 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2001 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

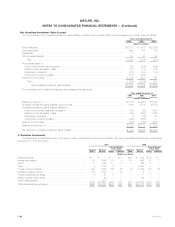

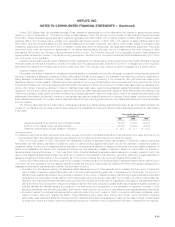

$13,802 million and $16,594 million at December 31, 2001 and 2000, respectively, for which the Company contractually guarantees either a minimum

return or account value to the policyholder.

Fees charged to the separate accounts by the Company (including mortality charges, policy administration fees and surrender charges) are reflected

in the Company’s revenues as universal life and investment-type product policy fees and totaled $564 million, $667 million and $485 million for the years

ended December 31, 2001, 2000 and 1999, respectively. Guaranteed separate accounts consisted primarily of Met Managed Guaranteed Interest

Contracts and participating close out contracts. The average interest rates credited on these contracts were 7.0% and 6.9% at December 31, 2001 and

2000, respectively. The assets that support these liabilities were comprised of $11,888 million and $15,708 million in fixed maturities at December 31,

2001 and 2000, respectively. The portfolios are segregated from other investments and are managed to minimize liquidity and interest rate risk. In order

to minimize the risk of disintermediation associated with early withdrawals, these investment products carry a graded surrender charge as well as a

market value adjustment.

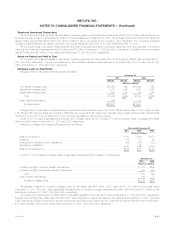

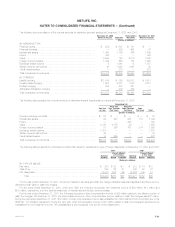

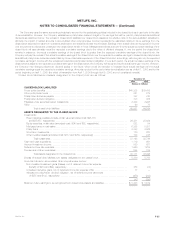

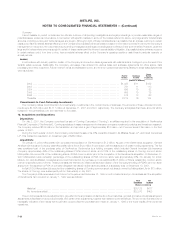

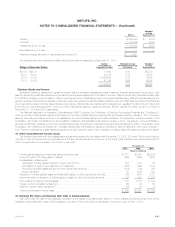

9. Debt

Debt consisted of the following:

December 31,

2001 2000

(Dollars in millions)

Surplus notes, interest rates ranging from 6.30% to 7.80%, maturity dates ranging

from 2003 to 2025 ************************************************************************* $1,630 $1,630

Investment-related exchangeable debt, interest rate of 4.90% due 2002******************************* 195 271

Fixed rate notes, interest rates ranging from 3.47% to 12.00%, maturity dates ranging

from 2002 to 2019 ************************************************************************* 87 316

Senior notes, interest rates ranging from 5.25% to 7.25%, maturity dates ranging

from 2006 to 2011 ************************************************************************* 1,546 98

Capital lease obligations *********************************************************************** 23 42

Other notes with varying interest rates *********************************************************** 147 43

Total long-term debt ************************************************************************** 3,628 2,400

Total short-term debt ************************************************************************** 355 1,085

Total $3,983 $3,485

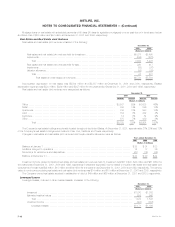

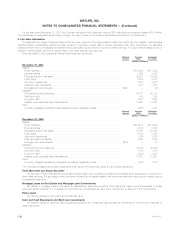

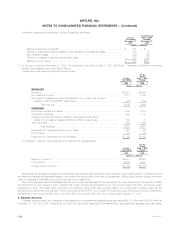

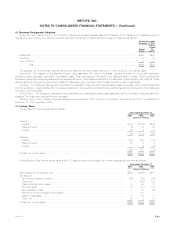

Metropolitan Life and certain of its subsidiaries maintain committed and unsecured credit facilities aggregating $2,250 million (five-year facility of

$1,000 million expiring in April 2003 and a 364-day facility of $1,250 million expiring in April of 2002). If these facilities are drawn upon, they would bear

interest at rates stated in the agreements. The facilities can be used for general corporate purposes and also provide backup for the Company’s

commercial paper program. At December 31, 2001, there were no outstanding borrowings under either of the facilities. At December 31, 2001,

$97 million in letters of credit from various banks were outstanding between Metropolitan Life and certain of its subsidiaries.

Reinsurance Group of America, Incorporated (‘‘RGA’’), a subsidiary of the Company, maintains committed and unsecured credit facilities aggregat-

ing $180 million (one facility of $140 million, one facility of $18 million and one facility of $22 million all expiring in 2005). At December 31, 2001 RGA had

drawn approximately $24 million under these facilities at interest rates ranging from 4.40% to 4.97%. At December 31, 2001, $376 million in letters of

credit from various banks were outstanding between the subsidiaries of RGA.

Payments of interest and principal on the surplus notes, subordinated to all other indebtedness, may be made only with the prior approval of the

insurance department of the state of domicile. Subject to the prior approval of the Superintendent, the $300 million 7.45% surplus notes due 2023 may

be redeemed, in whole or in part, at the election of Metropolitan Life at any time on or after November 1, 2003.

The issue of investment-related exchangeable debt is payable in cash or by delivery of an underlying security owned by the Company. The amount

of the debt payable at maturity is greater than the principal of the debt if the market value of the underlying security appreciates above certain levels at the

date of debt repayment as compared to the market value of the underlying security at the date of debt issuance. At December 31, 2001, the underlying

security pledged as collateral had a market value of $240 million.

The aggregate maturities of long-term debt for the Company are $207 million in 2002, $439 million in 2003, $27 million in 2004, $272 million in

2005, $609 million in 2006 and $2,074 million thereafter.

Short-term debt of the Company consisted of commercial paper with a weighted average interest rate of 2.1% and 6.6% and a weighted average

maturity of 87 days and 44 days at December 31, 2001 and 2000, respectively. The Company also has other secured borrowings with a weighted

average coupon rate of 7.25% and a weighted average maturity of 30 days at December 31, 2001.

Interest expense related to the Company’s indebtedness included in other expenses was $252 million, $377 million and $384 million for the years

ended December 31, 2001, 2000 and 1999, respectively.

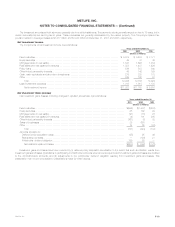

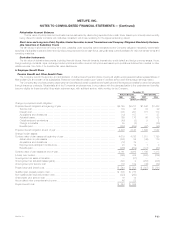

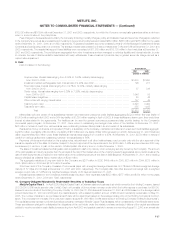

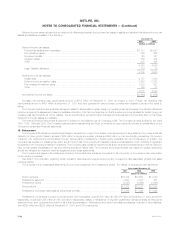

10. Company-Obligated Mandatorily Redeemable Securities of Subsidiary Trusts

MetLife Capital Trust I. In April 2000, MetLife Capital Trust I, a Delaware statutory business trust wholly-owned by the Holding Company, issued

20,125,000 8.00% equity security units (‘‘units’’). Each unit consists of (i) a purchase contract under which the holder agrees to purchase, for $50.00,

shares of common stock of the Holding Company on May 15, 2003 (59,771,250 shares at December 31, 2001 and 2000 based on the average market

price at December 31, 2001 and 2000) and (ii) a capital security, with a stated liquidation amount of $50.00 and mandatorily redeemable on May 15,

2005. The number of shares to be purchased at such date will be determined based on the average trading price of the Holding Company’s common

stock. The proceeds from the sale of the units were used to acquire $1,006 million 8.00% debentures of the Holding Company (‘‘MetLife debentures’’).

The capital securities represent undivided beneficial ownership interests in MetLife Capital Trust I’s assets, which consist solely of the MetLife debentures.

These securities are pledged to collateralize the obligations of the unit holder under the related purchase contracts. Holders of the capital securities are

entitled to receive cumulative cash distributions accruing from April 2000 and payable quarterly in arrears commencing August 15, 2000 at an annual rate

MetLife, Inc. F-27